JPMorgan has raised eyebrows in the crypto industry by calling recent $2 trillion stablecoin forecasts “hard to believe.” In a client note dated July 23, the bank’s strategists pushed back against bold claims made by US Treasury Secretary Scott Bessent and other bullish voices suggesting that the stablecoin market could explode in size within the next three years.

The bank’s note cautioned that, while adoption is indeed expected to grow, the current infrastructure surrounding stablecoins is too underdeveloped to support such rapid expansion. “The infrastructure/ecosystem that supports stablecoins is far from developed and will take time to build out,” the report stated.

Instead of an eightfold rise, JPMorgan sees a more realistic scenario where the stablecoin market doubles or triples from its current estimated size of $250 billion.

Current Use Still Crypto-Centric

JPMorgan’s analysts argue that stablecoin usage remains largely confined to the crypto ecosystem, used mainly for trading and decentralised finance (DeFi) applications rather than for day-to-day transactions.

In earlier commentary, the bank noted, “So far, stablecoin usage remains heavily concentrated within the crypto ecosystem, rather than as a tool for everyday payments.” This limited real-world use, they suggest, makes a multi-trillion-dollar market far less likely in the near future.

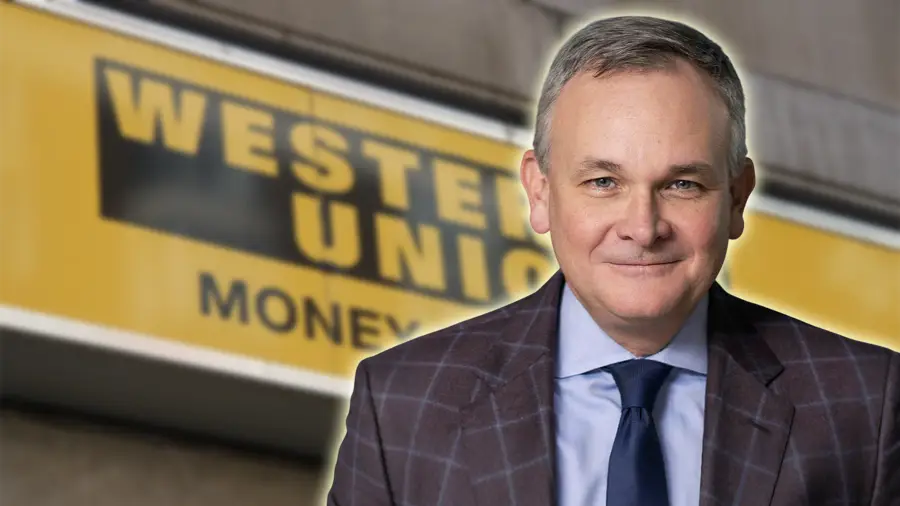

Western Union CEO Devin McGranahan echoed similar sentiments during a recent Bloomberg TV interview. “Last I checked, you couldn’t spend stablecoin if you wanted to buy a Coca-Cola,” he said, highlighting the lack of mainstream merchant adoption. McGranahan pointed out that this gap gives firms like Western Union an opportunity to provide services that convert stablecoins into fiat currencies for practical use.

Industry Bullish Despite Concerns

Despite JPMorgan’s scepticism, several industry leaders remain confident in the market’s potential. Ripple CEO Brad Garlinghouse, speaking on CNBC’s Squawk Box, described the stablecoin sector as one with “profound” growth prospects. He estimated that the current $250 billion market could swell to as much as $2 trillion in the coming years.

Wealth management firm Bernstein has issued even more ambitious projections, predicting that stablecoin issuance could skyrocket by over 2,000% to reach $2.8 trillion by 2028. Standard Chartered has also backed a strong growth narrative, forecasting a $2 trillion market by the end of 2028.

This optimism is rooted in the belief that stablecoins can eventually replace slower and more expensive cross-border payment methods and find wider usage in e-commerce, remittances, and digital banking.

JPMorgan Still Making Quiet Moves

Interestingly, despite its conservative view on the sector’s growth, JPMorgan appears to be building its own presence in the stablecoin ecosystem. On June 15, the bank filed its second trademark application for “JPMD.”

Although the filing doesn’t explicitly mention stablecoins, it references a range of blockchain-based financial services, including digital asset clearing, virtual currency exchanges, and payment processing powered by distributed ledger technology.

Reports have also surfaced that JPMorgan and other major financial institutions are exploring the development of a joint stablecoin initiative, though details remain under wraps.

This dual approach, public caution paired with quiet investment suggests that while JPMorgan may not believe in explosive short-term growth, it is still positioning itself to capitalise on the long-term evolution of stablecoin technology.

Growth Likely, But Not Overnight

The debate over the stablecoin market’s future reflects a broader divide between traditional finance and crypto-native optimism. While banks like JPMorgan are cautious, they aren’t ignoring the trend. On the other hand, crypto advocates remain firm in their belief that mainstream stablecoin adoption is inevitable.

For now, the growth path may be more gradual than explosive, but the foundations being laid today could eventually support a much larger, more widely used stablecoin economy in the years ahead.

Leave a Reply