Terraform administrator files major claim

The administrator of bankrupt crypto firm Terraform Labs has filed a lawsuit seeking $4 billion in damages from trading firm Jump Trading and several senior executives. The legal action was reported by The Wall Street Journal and relates to the collapse of the Terra blockchain ecosystem in 2022 which wiped out an estimated $50 billion in value.

The lawsuit was filed by Todd Snyder who is overseeing Terraform Labs bankruptcy process. It accuses Jump Trading of unlawfully profiting from the Terra crash and of playing an active role in destabilising the ecosystem. Jump Trading has denied the allegations and did not immediately comment on the case.

Background to the Terra collapse

Terraform Labs operated the Terra blockchain and its algorithmic stablecoin TerraUSD known as UST. The token was designed to maintain a one dollar peg through an automated mechanism linked to the issuance of the LUNA token.

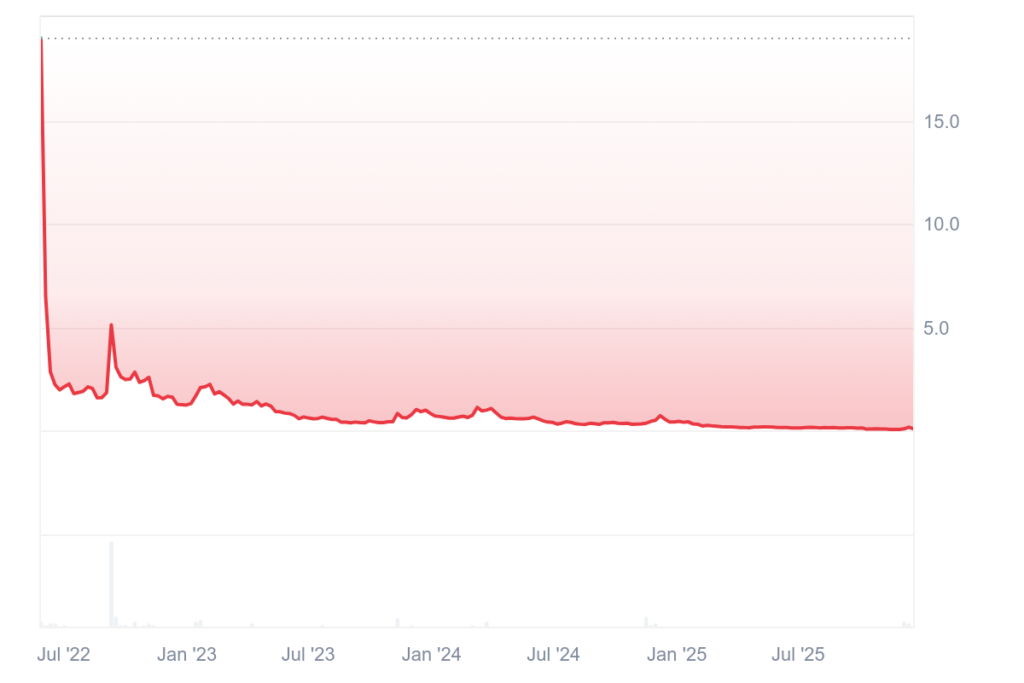

In 2022 UST lost its peg to the US dollar. This triggered a sharp increase in the supply of LUNA which then collapsed in value. The chain reaction caused severe losses across the crypto market with investors losing around $50 billion.

The failure of the algorithmic model became one of the most damaging events in crypto history and led to multiple investigations and lawsuits across several jurisdictions.

Allegations of manipulation and secret deals

According to the lawsuit Jump Trading actively exploited the Terra ecosystem through manipulation and self dealing. Snyder claims the firm entered into secret agreements with Terraform Labs that allowed Jump to purchase large quantities of LUNA at heavily discounted prices.

The filing alleges Jump was permitted to acquire millions of LUNA tokens at around $0.40 while the market price exceeded $110. In return Jump was allegedly expected to support the UST peg through trading activity. This support would have masked weaknesses in the stablecoin design and misled the wider market.

The lawsuit claims these arrangements were informal and kept secret to avoid regulatory scrutiny. It also alleges that after an earlier depegging event Jump helped restore the peg but publicly attributed the recovery to the Terra algorithm rather than its own intervention.

Bitcoin reserves and executive involvement

The legal action also raises questions about the handling of Bitcoin reserves held by the Luna Foundation Guard. This organisation was created to defend the UST peg using Bitcoin as a backstop.

According to the filing nearly 50,000 Bitcoin were transferred from the foundation to Jump Trading without a written agreement detailing how the funds would be used. The lawsuit claims the transfers were directed by Terraform co founder and former chief executive Do Kwon together with Kanav Kariya who previously led Jump crypto operations.

Do Kwon pleaded guilty in the United States in August and was sentenced to 15 years in prison earlier this month. Prosecutors in South Korea had sought a much longer sentence. Kwon has been a central figure in multiple legal actions arising from the Terra collapse.

Previous cases and regulatory scrutiny

This is not the first time Jump Trading has faced legal action over its role in Terra. A separate lawsuit filed in May 2023 accused the firm of manipulating the price of UST in violation of US commodities law. That case remains ongoing.

In that lawsuit plaintiffs alleged Terraform Labs and Kwon secretly coordinated with Jump to prop up the UST peg rather than admitting the algorithm could not function as promised. Shortly after the case was filed Kariya stepped down from his role amid reports of an investigation by the US Commodities and Futures Trading Commission.

Jump involvement with Terra also drew attention from the US Securities and Exchange Commission. In late 2024 Jump subsidiary Tai Mo Shan agreed to pay $123 million to settle charges that it misled investors about the stability of TerraUSD.

Leave a Reply