Kanye West, now legally known as Ye, has officially stepped into the crypto spotlight with the launch of his YZY token. Built on the Solana blockchain, the token exploded onto the scene on 21 August, reaching a staggering $3 billion market capitalisation within hours.

Backed by Ye’s celebrity power and branded as the “official Yeezy coin,” YZY promises to blend fashion, music, and Web3. But beneath the glamour and hype, red flags are already flashing. With heavy insider concentration, doubts about timing, and Ye’s own history of criticising such ventures, the launch is fuelling scepticism across the crypto community.

A Fan Currency or Just Another Memecoin?

According to the project’s website, YZY isn’t just another meme-inspired token. It is positioned as the native currency of the Yeezy ecosystem, with plans to allow holders to purchase Yeezy products and access new digital services.

Alongside the token, two additional products were unveiled:

- YE Pay – a payment processor designed to handle crypto transactions.

- YZY Card – a debit card aimed at onboarding West’s fanbase into the crypto economy.

In theory, this ecosystem could connect West’s cultural empire, spanning fashion, music, and lifestyle directly to blockchain rails.

But critics argue the playbook looks familiar: celebrity-backed coins that promise real-world utility but rely heavily on hype and branding to attract retail investors.

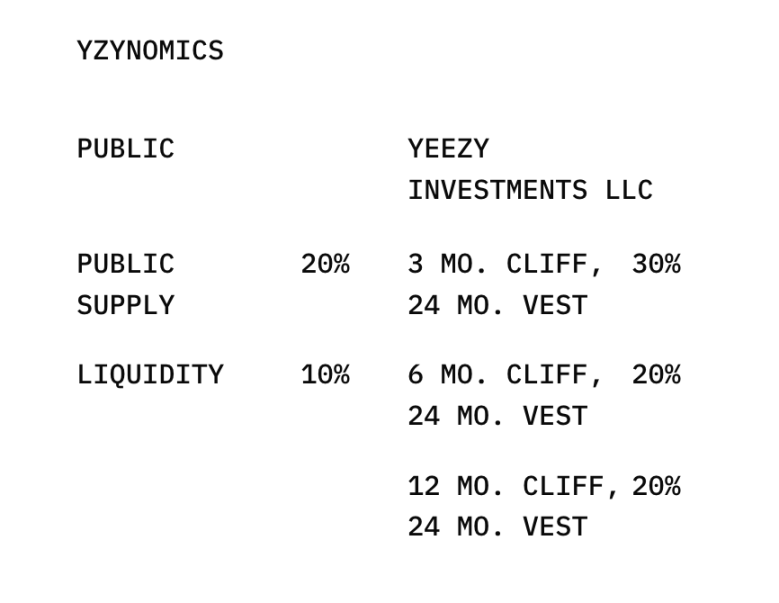

The Tokenomics Problem

The most glaring issue is YZY’s token distribution. On-chain data reveals an alarming concentration of power:

- The top six wallets control more than 90% of the entire supply.

- Ye himself reportedly holds 70% of all tokens, giving him near-total control over price movements.

- Another 20% is reserved for investors, leaving just 10% for liquidity pools where public trading occurs.

This means ordinary traders are playing in a market dominated by insiders. Any large sell-off by Ye or his investors could instantly crash the price. Rather than a decentralised fan-first currency, YZY appears more like a centralised gamble on West’s personal brand.

Ye’s U-Turn on Celebrity Coins

What makes YZY’s arrival even more controversial is Ye’s past stance. Just last year, he publicly rejected a $2 million offer to launch a crypto token, calling such projects “predatory” and damaging to fans.

Fast forward a few months, and he has not only launched his own coin but done so on a grand scale. The sudden U-turn has raised questions about credibility. Why embrace the very scheme he once condemned? Was it financial opportunity, market timing, or a shift in strategy?

The contradiction has not gone unnoticed by traders, who already view celebrity tokens with suspicion after multiple failed projects and rug pulls in recent years.

Questionable Timing and Insider Moves

Beyond Ye’s reversal, the timing of YZY’s launch is puzzling. The memecoin boom that peaked earlier in 2025 has largely fizzled out. Most leading tokens are down 70% or more from their highs, and retail investors have become more cautious.

Launching a hype-driven token into a cooling market looks risky. Yet some insiders seemed prepared. On-chain data revealed wallets selling huge amounts of YZY almost immediately, despite having no record of purchasing tokens beforehand. This suggests early allocations were quietly handed out, enabling insiders to take instant profits.

One wallet reportedly flipped $50 into $40,000 within hours, highlighting how quickly opportunists capitalised on the frenzy, often at the expense of latecomers.

The Market’s Verdict

The mixed response to YZY’s debut mirrors earlier celebrity crypto experiments. While some traders enjoyed rapid profits, many others warned that the spectacle was a “top signal” a cultural hype moment marking the end of bullish momentum rather than the start.

Sceptics point to the classic warning signs:

- Heavy insider control.

- Lack of transparency.

- Promises of future utility that may never materialise.

Whether YZY evolves into a genuine ecosystem coin or becomes another cautionary tale remains to be seen. But for now, the launch underlines a key lesson in crypto: celebrity hype may drive short-term gains, but long-term value depends on transparency, fair distribution, and real utility.

Leave a Reply