Kenya’s first comprehensive cryptocurrency law has barely taken effect, yet Bitcoin ATMs have already appeared across major Nairobi malls. This sudden rise in visible crypto infrastructure has created an immediate challenge for regulators who insist that no virtual asset provider is currently authorised to operate under the new framework.

Bitcoin ATMs Appear Despite Lack of Licensing

Local outlet Capital News reported that several popular malls in Nairobi recently installed new machines branded “Bankless Bitcoin.” These ATMs sit beside traditional banking kiosks and offer residents a cash-to-crypto service. Their arrival comes even though Kenya’s Virtual Assets Service Providers (VASP) Act of 2025 only began implementation on 4 November and the licensing process has not officially opened.

Bitcoin ATMs are not new to Kenya. In 2018, The East African reported that BitClub placed similar machines in Nairobi, although adoption remained extremely low and most devices never reached mainstream locations. Current CoinATMradar data still lists only two operational Bitcoin ATMs in the country.

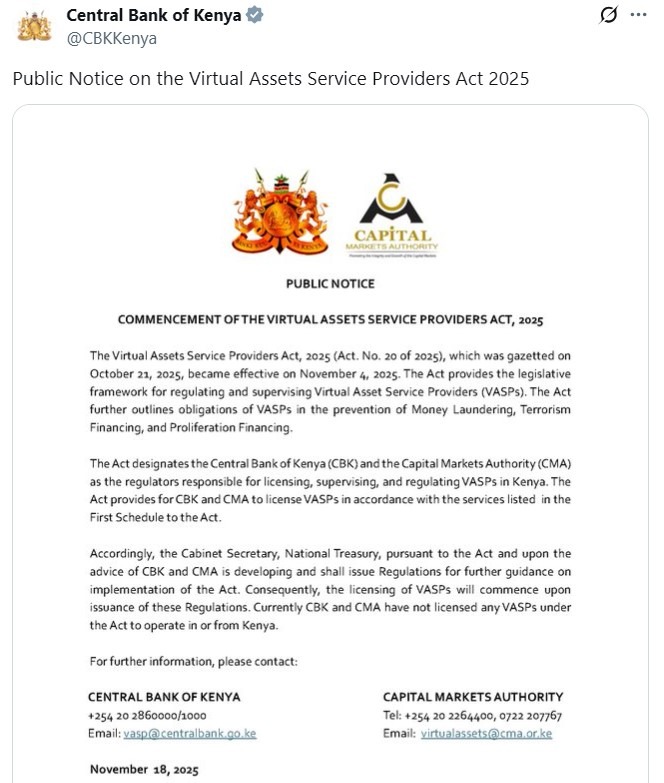

Regulators Warn: No VASP Is Licensed Yet

The Central Bank of Kenya and the Capital Markets Authority issued a joint notice stating that no firm has been licensed to provide crypto services under the new Act. They cautioned that any company claiming to hold approval is acting illegally.

The CBK stressed that the National Treasury is still preparing the regulations that will determine when licensing applications can begin. Until then, all operators remain unregulated.

This gap between legislation and licensing has created an unusual situation. Bitcoin ATMs are entering highly visible commercial areas while regulators are publicly reminding Kenyans that no provider currently meets the legal requirements to operate.

Questions Rise Over Enforcement

The presence of these machines has raised concerns about compliance and enforcement. Although the VASP Act outlines clear oversight responsibilities, the lack of accompanying regulations leaves a temporary vacuum.

Under the new law, the CBK will supervise payment and custody services, while the CMA will oversee investment and trading activities. However, without complete regulatory guidelines, authorities face difficulties stopping operators who proceed without approval.

Bitcoin Use Moves From Informal Settlements to Upscale Malls

The expansion of Bitcoin ATMs into prominent malls also reflects a broader shift within Kenya’s long-running informal crypto economy. Capital News reported that Bitcoin adoption has been thriving in low-income areas such as Kibera where residents use digital currency as an alternative to traditional banking.

AfriBit Africa co-founder Ronnie Mdawida said many people in Kibera lack access to formal savings tools due to documentation requirements. He added that Bitcoin offers them a simple way to store value and described this access as a type of financial freedom for individuals earning around a dollar per day.

As Bitcoin moves from backstreets into premium commercial zones, Kenya’s regulators now face mounting pressure to accelerate the rollout of licensing rules. The country’s evolving digital asset sector is already expanding, even before the official framework has fully taken shape.

Leave a Reply