Kraken, one of the largest US-based cryptocurrency exchanges, is reportedly looking to raise $500 million in new funding at a valuation of $15 billion, according to a report by The Information. The move comes amid growing regulatory clarity in the United States and increased investor appetite for crypto-related stocks.

This fresh funding round would mark a significant jump from Kraken’s last known valuation of $11 billion in 2022. The exchange is said to be preparing for a public listing as early as the first quarter of 2026, riding a wave of IPO enthusiasm and a friendlier regulatory landscape.

Regulatory Tailwinds Boost Crypto Market Confidence

The crypto sector in the United States has been undergoing a notable shift in regulatory tone. Since President Donald Trump’s return to the White House, the Securities and Exchange Commission (SEC) has softened its stance on crypto-related enforcement. In March 2025, the SEC dropped a long-standing securities lawsuit against Kraken, paving the way for the company to move forward with its expansion and funding plans.

This regulatory shift is not unique to Kraken. Several other crypto and fintech firms, including Ripple, Gemini, Galaxy Digital, and Grayscale, have either gone public or signalled intentions to do so. A more defined and supportive regulatory environment has helped attract institutional capital, which is now seeking exposure to the fast-growing digital asset space.

Kraken Expands Globally While Scaling Trading Volumes

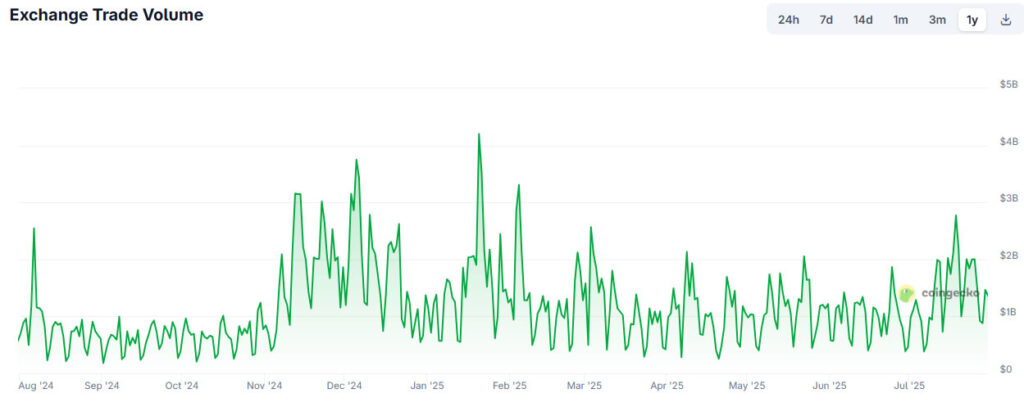

Kraken currently facilitates about $1.37 billion in daily trading volume, according to data from CoinGecko. It offers more than 1,100 trading pairs significantly more than Coinbase, its main US competitor, which has 448. However, Coinbase handles more than double Kraken’s volume, with $2.77 billion traded daily.

In a move to boost its global reach, Kraken launched a peer-to-peer payments app named Krak in June. The app enables users to send both fiat and cryptocurrency internationally with ease. The company also received regulatory approval under the EU’s Markets in Crypto-Assets (MiCA) framework, allowing it to expand its services across European Union countries.

IPO Market Heats Up with Crypto and Fintech Firms

Kraken is not alone in seizing the opportunity presented by a surging IPO market. Several crypto companies have recently gone public or seen significant stock market gains:

- Circle, the issuer of the USDC stablecoin, completed a $1 billion IPO in June and listed on the New York Stock Exchange at $31. Its share price has since climbed by 484%, closing above $181.

- eToro, a social trading platform offering crypto and stock trading, listed on Nasdaq in May at $52 and is currently trading over $60, up by more than 16.5%.

- Coinbase, which went public in 2021, has seen its stock rise by 50% since the beginning of 2025.

- Robinhood, the popular stock and crypto trading platform, has soared by 162% so far this year.

These strong performances suggest that public markets are warming up to crypto-focused companies, especially those with solid fundamentals and clear regulatory standing.

Kraken’s Path Forward

Kraken’s decision to seek $500 million in funding could help fuel its growth in the lead-up to its IPO. With improved access to capital, regulatory clearance in key markets, and a growing global presence, Kraken is positioning itself as a serious contender in the next wave of publicly traded crypto firms.

Its expansion into the EU through MiCA licensing and the launch of its peer-to-peer app mark strategic moves to increase user engagement and transaction volume. If the IPO market remains favourable and investor confidence continues to grow, Kraken could be one of the next big names to make its debut on a public exchange by early 2026.

Leave a Reply