Global cryptocurrency exchange KuCoin has officially entered the Thai market by launching a fully regulated local subsidiary, KuCoin Thailand. This expansion follows the successful acquisition of ERX, Thailand’s first SEC-supervised digital token exchange. The move positions KuCoin to strengthen its foothold in Southeast Asia and offer secure, compliant crypto services tailored to local needs.

Strategic Move into Thailand’s Regulated Market

KuCoin’s entry into Thailand marks a major step in its global expansion strategy. With this launch, KuCoin Thailand becomes the company’s first fully licensed and regulated local digital asset exchange. The new platform operates under licenses granted by Thailand’s Securities and Exchange Commission (SEC) and is also registered with the Ministry of Commerce.

Speaking to Cointelegraph, KuCoin CEO BC Wong said Thailand was chosen because of its “regulatory clarity, strong market potential, and government support.” The country’s proactive stance on crypto regulation made it an ideal location for KuCoin’s next phase of growth.

Acquisition of ERX: A Gateway to Local Operations

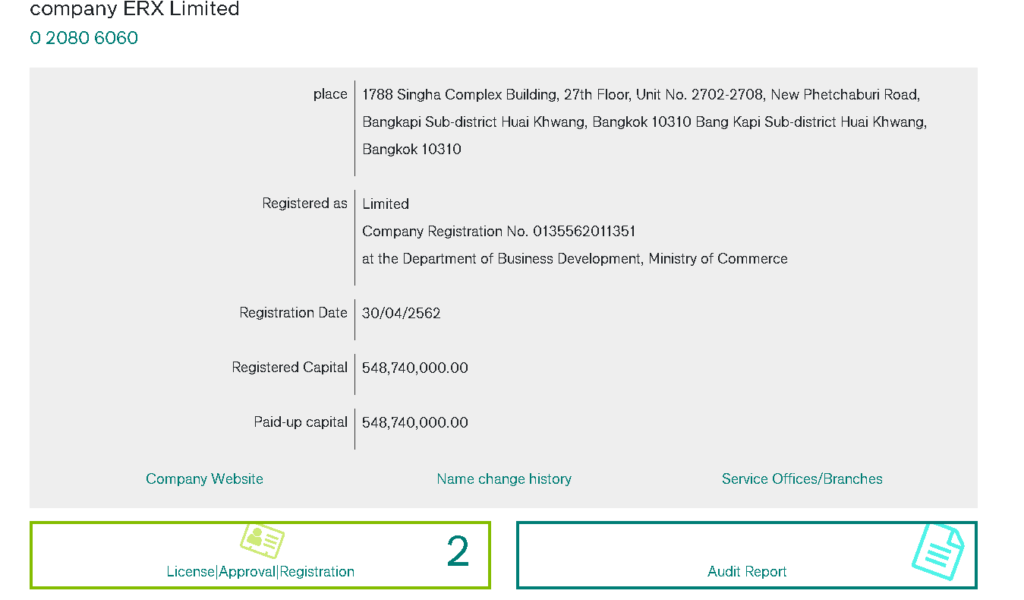

To enter the Thai market, KuCoin acquired ERX Company, which was Thailand’s first SEC-supervised digital asset exchange. The acquisition allowed KuCoin to inherit a compliant infrastructure and a user base already familiar with regulated crypto services.

ERX has been rebranded as KuCoin Thailand since April 22, 2025, and all existing users of ERX have been successfully migrated to the new platform. This seamless transition ensures continued service for Thai users under a more global brand with expanded resources.

Features and Services: What KuCoin Thailand Offers

KuCoin Thailand currently supports spot trading and provides fiat on/off-ramp services using the Thai baht (THB). This means users can directly buy or sell crypto using local currency, making it easier for everyday investors to access digital assets.

While the global KuCoin platform offers a broad suite of products such as futures, staking, and lending, KuCoin Thailand will tailor its offerings to meet local regulatory standards and market demand. Wong also stated that more services would be added in the future as regulations evolve.

Competing in a Growing Thai Crypto Market

Thailand is already home to eight other licensed crypto exchanges, including major names like Bitkub Online, Upbit Exchange, Gulf Binance, and InnovestX Securities. Despite the competition, KuCoin sees a strong opportunity, especially as the Thai government continues to show support for digital innovation.

One key area of focus is the government’s plan to allow crypto payments for tourists, potentially integrated with credit cards. This could create a significant new use case for digital assets in the country and position KuCoin as a key player in supporting that infrastructure.

KuCoin’s launch in Thailand is more than just market expansion, it’s a clear signal of its commitment to regulatory compliance, user security, and regional growth. By acquiring ERX and transforming it into KuCoin Thailand, the exchange has gained an early-mover advantage in a promising and well-regulated Southeast Asian market.

As crypto adoption rises and government initiatives favour innovation, KuCoin Thailand is well-placed to play a leading role in shaping the future of digital assets in the region.

Leave a Reply