Linea, the Consensys-developed Ethereum layer-2 network, has revealed new details about its upcoming token generation event and airdrop, along with fresh staking and burning mechanisms designed to enhance its alignment with the Ethereum mainnet. These updates reflect a broader strategy to position Linea as the go-to destination for ETH capital.

85 Percent of Token Supply Reserved for Users and Builders

The token generation event is expected to take place later this year, though a specific date has not yet been announced. Declan Fox, global product lead at Linea, confirmed that the criteria for the airdrop will be shared approximately a week before the event.

Of the total token supply, 85 percent will be allocated to the ecosystem, including users and builders. The remaining 15 percent will be reserved for the Consensys treasury, subject to a five-year lock-up period.

Ethereum-Compatible Staking Launching in October

In an effort to make Ether more productive within its ecosystem, Linea will launch a new staking mechanism in October. This feature will allow users to earn staking rewards even when they bridge their Ether to Linea. By integrating staking with DeFi opportunities, Linea aims to enhance the utility and yield of ETH on its network.

Joseph Lubin, founder and CEO of Consensys, stated that the staking rewards will be redistributed within Linea to DeFi protocols, creating higher returns for liquidity providers. He described the mechanism as a sustainable incentive loop that increases transaction volume and liquidity, ultimately drawing more users to the platform.

Commitment to ETH Burning and Deflationary Tokenomics

Linea is also introducing a dual burn mechanism that further aligns it with Ethereum’s long-term economic model. The network will burn 20 percent of all transaction fees in ETH, becoming the first layer-2 network to implement this feature. The remaining 80 percent of transaction fees will go toward burning LINEA tokens, establishing a deflationary model for the ecosystem.

Lubin emphasised that Linea is “the only L2 with total Ethereum compatibility,” and said its economic design is intended to support Ethereum as much as its technology does.

Market Position and Growth Strategy

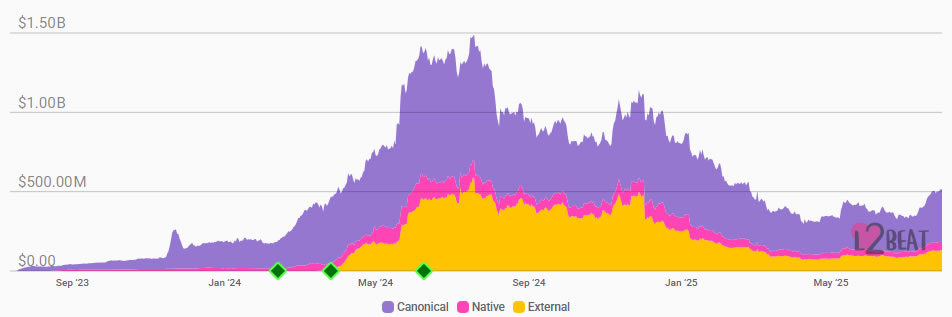

Currently, Linea holds a 1.23 percent share of the rollup-based L2 market, with around $513 million in on-chain value according to L2Beat. Fox highlighted the ambition to significantly grow this share by making Linea the most attractive destination for ETH liquidity.

He added that liquidity providers would find favourable risk-adjusted returns by bridging their ETH to Linea, supported by the distribution network of MetaMask and the broader Consensys ecosystem.

Consortium for Ethereum Ecosystem Fund

In a further move to demonstrate its Ethereum-centric strategy, Linea will form an Ethereum-aligned consortium to manage the Ethereum ecosystem fund. Alongside Consensys, the consortium will include Eigen Labs, ENS Labs, Status, and SharpLink, the ETH treasury gaming firm co-led by Joseph Chalom.

Chalom noted that Linea’s strong alignment with Ethereum makes it an essential player in Ethereum’s future. “Linea’s commitment to Ethereum couldn’t be clearer,” he said, adding that its unique positioning will be key to attracting new users and builders to its digital infrastructure.

Leave a Reply