Litecoin (LTC) has come under the spotlight once again after posting a 10% rally last week, only to now face renewed selling pressure. The coin is currently hovering around the $115 level, a key support zone that could determine its next major move. Analysts warn that failure to hold this level could spell serious trouble for the altcoin.

Popular crypto strategist Ali Martinez shared his latest outlook on the LTC/USD pair, highlighting that Litecoin has been repeatedly rejected at its upper resistance near $135 since 2023. This ceiling, he said, continues to cap every bullish attempt.

According to Martinez, if Litecoin fails to break through this barrier, the price could collapse towards the $50 region, revisiting historical accumulation levels between $48 and $51, zones last tested during major market corrections.

For October, analysts forecast Litecoin’s price to fluctuate around $133, provided it sustains its current support and manages to reclaim momentum. However, the risk of a deep retracement remains significant if market sentiment weakens further.

Litecoin ETF Reaches Final Approval Stage

In what could be a defining moment for Litecoin, the long-awaited Litecoin ETF is nearing launch. Bloomberg’s senior ETF analyst Eric Balchunas confirmed that Canary Capital has filed an S-1 amendment for its proposed Litecoin (LTCC) and Hedera Hashgraph (HBAR) spot ETFs.

The latest filing includes crucial details such as management fees set at 95 basis points (0.95%) and the official ticker symbols LTCC for Litecoin and HBR for Hedera. According to Balchunas, these are typically the final updates made before an ETF goes live, signalling that regulatory approval could be imminent.

However, the timing remains uncertain due to delays caused by the U.S. government shutdown, which has affected several SEC review processes. Despite this, optimism remains strong in the crypto community. On Polymarket, traders currently assign a 98% probability that the Litecoin ETF will be approved by the end of 2025, indicating near-universal market confidence.

Balchunas noted that while the ETF’s fee structure appears higher than that of existing Bitcoin ETFs, it’s standard for newer or niche products. He added that if inflows are strong, “other issuers will no doubt come and threaten that with cheaper products,” hinting at potential competition once the ETF launches.

Institutional Optimism Meets Technical Uncertainty

While ETF approval could be a historic milestone for Litecoin, analysts remain divided about its short-term trajectory. The coin’s price has struggled to sustain momentum despite growing institutional interest.

BeInCrypto data shows that LTC recently touched a six-week high before pulling back, erasing some of its gains but retaining moderate support near $115. As of press time, LTC trades at $115.7, down 2.55% in the past 24 hours.

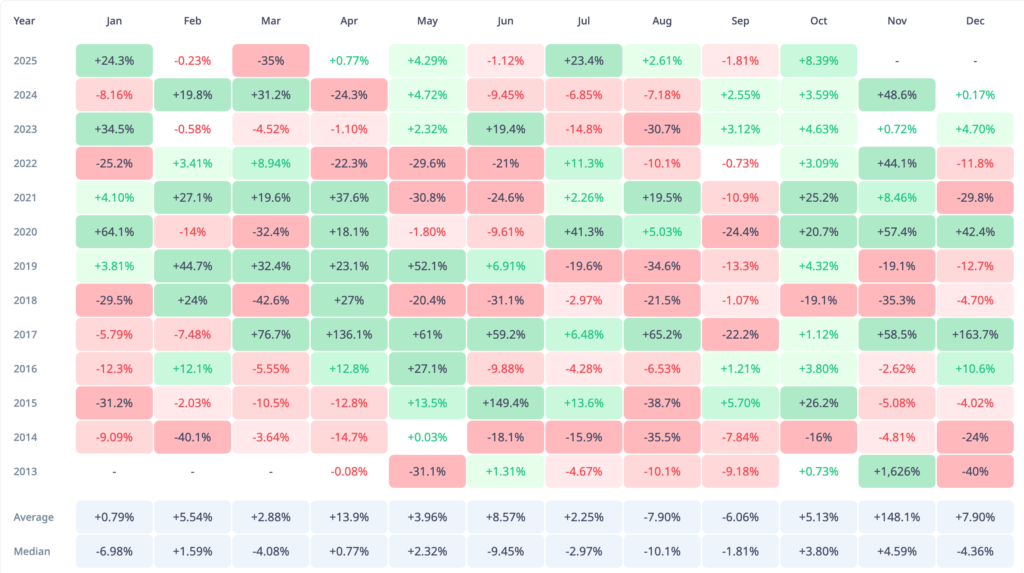

Still, the broader outlook for Q4 2025 remains cautiously bullish. Historical data reveals that November has been Litecoin’s best-performing month, with an average return of 148.1% over the past 12 years. Analysts also point to an inverse head-and-shoulders pattern forming on Litecoin’s chart, a bullish reversal indicator suggesting potential recovery if confirmed.

This sets up a possible tug-of-war between bearish technical pressure and bullish fundamental catalysts such as the ETF approval.

Q4 Outlook: Crash or Comeback?

The coming weeks could prove decisive for Litecoin’s trajectory. If the ETF receives the regulatory green light, it may act as a powerful catalyst, unlocking institutional inflows and renewed market demand. On the other hand, a rejection at the $135 resistance or a breakdown below $115 could trigger a swift move towards $50, a scenario that would erase months of gains.

With ETF optimism soaring and seasonal trends favouring late-year rallies, Litecoin’s next move will likely depend on whether bullish traders can defend key support levels amid market turbulence.

For now, Litecoin stands at a critical crossroads, one that could either propel it toward a new bullish cycle or send it tumbling back to its 2022 lows.

Leave a Reply