Metaplanet Surges Ahead in Corporate Bitcoin Race

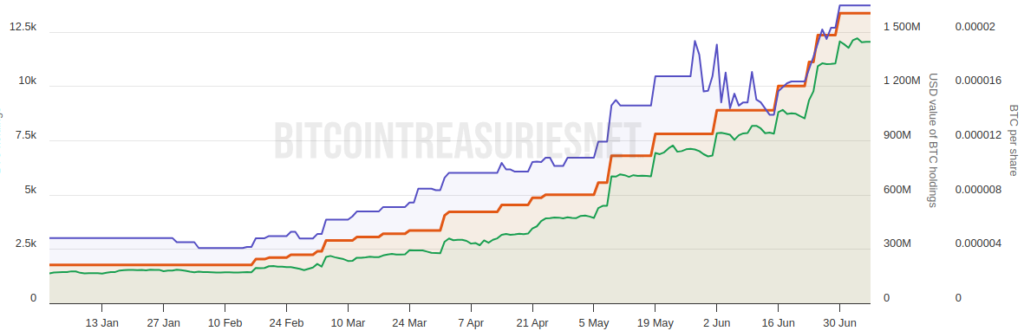

Japan’s leading corporate Bitcoin treasury, Metaplanet, has made headlines once again with a massive addition to its cryptocurrency holdings. The company has acquired 2,204 more Bitcoin at a cost of $237 million, taking its total holdings to 15,555 BTC. With this purchase, Metaplanet has become the fifth-largest corporate holder of Bitcoin globally, surpassing industry giants such as Tesla and CleanSpark.

According to a regulatory filing released on Monday, Metaplanet bought the new batch of Bitcoin at an average price of 15,640,253 Japanese yen per coin, which translates to approximately $107,700. The company’s overall Bitcoin investment now stands at an average purchase price of about $99,985 per coin, indicating a strategic and consistent accumulation approach.

Tesla and CleanSpark Overtaken in June

Metaplanet’s recent acquisition follows a series of significant purchases throughout June. In late June, the company overtook Tesla by acquiring 1,234 BTC, raising its holdings to 12,345 BTC at the time. Tesla currently holds 11,509 BTC, positioning Metaplanet ahead of the electric vehicle manufacturer in the corporate crypto space.

Shortly afterwards, Metaplanet surpassed Bitcoin mining firm CleanSpark by acquiring an additional 1,005 BTC for $108 million. CleanSpark’s current holdings stand at 12,502 BTC, placing it just behind the Japanese firm.

Data from BitcoinTreasuries.NET confirms Metaplanet’s new standing among the world’s top corporate Bitcoin holders, further highlighting the intensifying competition among companies adopting Bitcoin as part of their treasury strategies.

Corporate Bitcoin Treasuries Continue Expanding

Metaplanet’s announcement comes amidst a broader trend of aggressive Bitcoin accumulation by corporations around the world. MicroStrategy, the world’s largest corporate Bitcoin holder, made headlines on June 30 by purchasing 4,980 BTC for $531.1 million. This latest acquisition brought the firm’s total holdings to 597,325 BTC, acquired at an average price of $70,982 per coin, with the total investment nearing $42.4 billion.

Other companies have also joined the race. Crypto entrepreneur Anthony Pompliano’s investment firm, ProCap, entered the Bitcoin market in late June with its first major buy: 3,724 BTC for $386 million. Meanwhile, healthcare technology company Semler Scientific announced its intention to raise its Bitcoin holdings from 3,808 BTC to a staggering 105,000 BTC in the near future.

These developments reflect a growing trend among corporations to treat Bitcoin as a long-term asset class, aiming to strengthen their balance sheets and hedge against inflationary pressures.

Not All Analysts Are Convinced

Despite the growing interest in Bitcoin among corporates, not everyone is convinced this trend is sustainable. James Check, lead analyst at Glassnode, expressed scepticism over the long-term viability of corporate Bitcoin treasury strategies. In comments made on Saturday, he suggested that the “easy upside” may already be behind for new entrants.

“For many new entrants, it could already be over,” Check said, pointing out that the market tends to reward early adopters while later entrants may struggle to stand out. He noted that investors often prefer companies that take pioneering steps rather than those who follow the herd.

Check also questioned whether many of these companies have a strong enough core business to support sustained Bitcoin accumulation, warning that the market may be reaching a saturation point for corporate treasuries.

Concerns of a Bitcoin Treasury Bubble

A recent report by venture capital firm Breed echoed similar concerns, suggesting that only a few of these treasury-driven companies are likely to avoid what it called a “death spiral.” The report warned that unless companies build solid strategies around their Bitcoin holdings and ensure alignment with their broader business goals, many may face financial instability.

The increasing number of companies adding Bitcoin to their treasuries may not guarantee long-term value unless accompanied by operational strength, technological innovation and a forward-looking strategy.

Metaplanet’s Bold Bet in Context

Despite these concerns, Metaplanet continues to double down on Bitcoin, positioning itself as a leading player in the corporate crypto space. The company’s strategy appears to be paying off in the short term, at least in terms of visibility and market positioning.

Whether Metaplanet’s aggressive accumulation of Bitcoin proves to be a visionary move or a risky gamble will depend on how the cryptocurrency market evolves in the coming years. For now, the firm has firmly cemented its place among the top-tier corporate holders of Bitcoin, drawing global attention to Japan’s growing influence in the digital asset landscape.

Leave a Reply