Japanese investment firm Metaplanet has acquired an additional 780 Bitcoin, further cementing its position as the top non-US corporate Bitcoin holder. This latest acquisition brings the company’s total Bitcoin holdings to 17,132 BTC, now valued at over $2 billion.

Largest Non-US Bitcoin Treasury

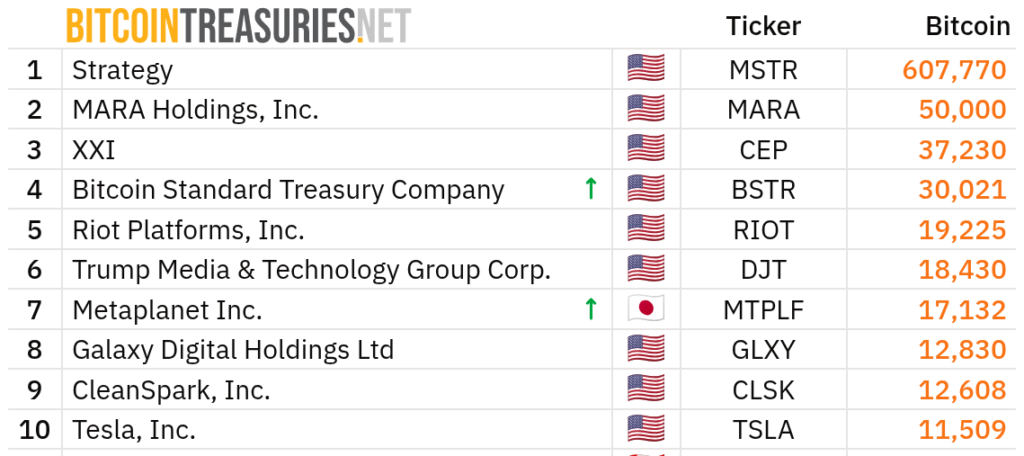

Following the purchase, Metaplanet remains the only non-US company among the top ten global Bitcoin treasuries. The company disclosed the acquisition on Monday, revealing that it spent approximately ¥13.67 billion (around $92 million) for the 780 BTC, with an average price of ¥17,520,454 per coin (approximately $118,145). This purchase reinforces Metaplanet’s position as the seventh-largest Bitcoin-holding company globally, sitting above Galaxy Digital Holdings (12,830 BTC) and just behind Trump Media & Technology Group (18,430 BTC).

Long-Term Strategy and Vision

Metaplanet’s total Bitcoin investment to date has reached $1.7 billion, averaging $99,640 per BTC. According to recent reports, the company plans to use its Bitcoin reserves strategically in the future, potentially to acquire cash-generating businesses, including a digital bank in Japan. This approach reflects a shift towards integrating Bitcoin into long-term corporate growth strategies.

Bitcoin Market and Purchase Timing

At the time of the announcement, Bitcoin was trading at approximately $118,171, slightly above the price at which Metaplanet made its most recent acquisition. Over the past 24 hours, Bitcoin’s price has risen by 0.75 per cent, according to Nansen data. The acquisition was timed at a moment of relative market stability, further showcasing Metaplanet’s calculated and consistent buying strategy.

Surging Share Price and CEO’s Vision

Metaplanet’s aggressive Bitcoin investment strategy has significantly boosted its market performance. The company’s shares have soared 517 per cent over the past year and are up 246 per cent since the beginning of 2025. On Monday, the share price reached $8.36, marking a 5 per cent increase in a single day.

Speaking to Forbes Japan, Metaplanet’s President and CEO Simon Gerovich expressed surprise at the rapid growth. “In just a year, we became the country’s top-performing stock, with record trading volume and a ¥1 trillion market cap,” he said. Gerovich emphasised that Metaplanet is not simply following in the footsteps of US-based Strategy (formerly MicroStrategy), but rather building a Japan-specific model that aligns with local regulation, taxation, and financial structures.

Tailored Approach for Japanese Market

Gerovich noted that Metaplanet’s Bitcoin strategy is tailored for compliance with Japan’s financial laws and systems, including its tax-free savings accounts. This localised approach sets the company apart from other major players and highlights its commitment to sustainable, regulation-aligned innovation in the crypto space.

Conclusion

Metaplanet’s latest Bitcoin acquisition not only strengthens its position in the global corporate crypto landscape but also underscores the growing trend of companies using digital assets as a long-term treasury and growth strategy. With a strong foothold in the Japanese market and a clear strategic vision, Metaplanet continues to stand out as a leader in the global Bitcoin economy.

Leave a Reply