Metaplanet has announced plans to raise $135 million through the issuance of new Class B perpetual preferred shares as part of a restructuring effort aimed at expanding its Bitcoin-centred treasury strategy. The proposal, disclosed in filings to the Tokyo Stock Exchange, forms a key element of the company’s long term bet on the cryptocurrency despite recent losses.

Major Capital Raise Planned Through New Share Class

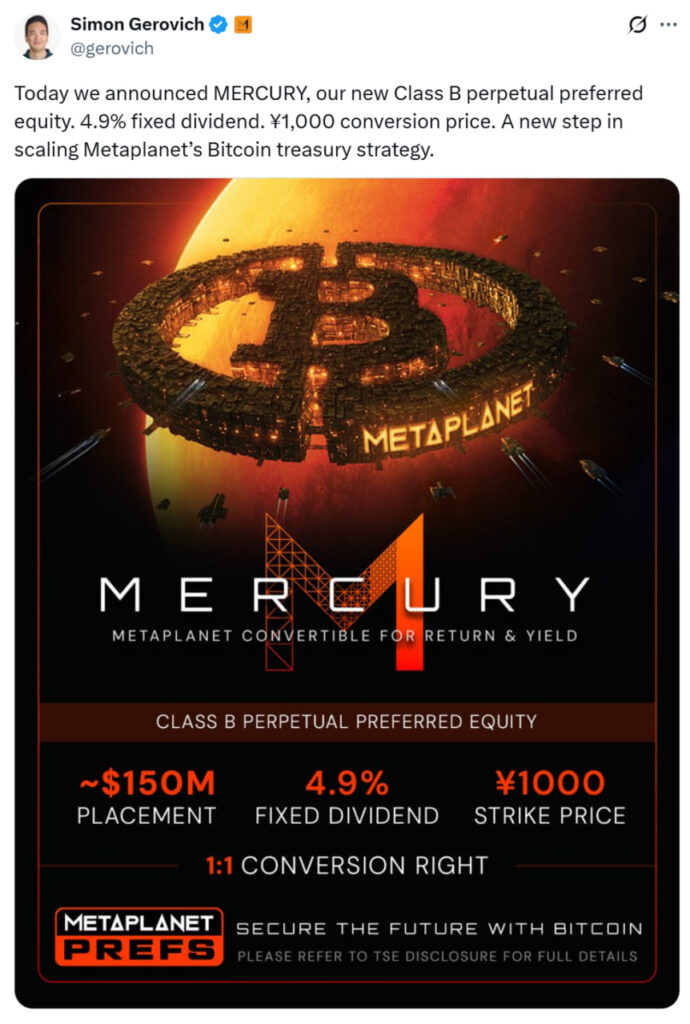

According to the filing, Metaplanet intends to issue 23.6 million Class B perpetual preferred shares priced at 900 yen each, equal to roughly $5.71. The total raise is expected to reach 21.2 billion yen, approximately $135 million.

The shares will be allotted to overseas investors subject to approval at an extraordinary shareholder meeting scheduled for 22 December 2025.

The new Class B shares include a fixed annual dividend of 4.9 percent on a notional value of $6.34. Investors will receive around $0.078 per quarter when distributions begin. Holders will also be allowed to convert the preferred shares into common stock at a $6.34 conversion price.

Metaplanet has retained a market-price call option that can be triggered if the share price trades above 130 percent of the liquidation preference for 20 consecutive sessions. The shares do not carry voting rights although they include redemption rights under certain circumstances.

Existing Warrants to Be Cancelled

This capital raise aligns with a wider restructuring of Metaplanet’s financing tools. The company intends to cancel its twentieth, twenty first and twenty second series of stock acquisition rights. It will then issue new twenty third and twenty fourth series rights to Evo Fund, a Cayman Islands based investment firm, pending regulatory clearance.

In a post on X, chief executive Simon Gerovich said the Class B perpetual preferred equity programme is internally referred to as Mercury. He described the instrument as a new step in scaling the firm’s Bitcoin treasury strategy.

Share Price Shows Mild Recovery Despite Steep Decline

Metaplanet’s shares closed the latest trading session with a 3.20 percent rise, gaining 12 points. The uptick offers a modest improvement after a difficult period. The stock remains more than 60 percent lower compared with six months earlier, according to market data from Google Finance.

Bitcoin Holdings Deep in Unrealised Loss

Metaplanet is currently the fourth largest public company worldwide by Bitcoin holdings. The firm now controls 30,823 BTC worth approximately $2.82 billion based on figures from BitcoinTreasuries.NET.

The company purchased its Bitcoin reserves at an average price of $108,036 per coin. With Bitcoin trading significantly below that level, Metaplanet faces an unrealised loss of 15.17 percent. This marks a sharp reversal from gains recorded in October when market conditions were more favourable.

The company’s latest fundraising and restructuring plans suggest a continued commitment to its long term Bitcoin accumulation strategy despite the downturn. Investors will now watch the December meeting closely as approval for the new share issuance could determine how aggressively Metaplanet expands its crypto-focused approach in the months ahead.

Leave a Reply