Meteora (MET), Solana’s largest decentralised exchange (DEX), officially launched its much-awaited token and airdrop on 23 October 2025, marking one of the most significant events in Solana’s DeFi calendar. Known for its liquidity depth and innovation, Meteora processes over $1 billion in daily trading volume and boasts a total value locked (TVL) of $854 million, placing it at the forefront of Solana’s DeFi ecosystem.

The Token Generation Event (TGE) and airdrop concluded successfully without technical hiccups, a feat that bolstered confidence in Meteora’s infrastructure. However, the optimism was short-lived. Within hours of listing, the MET token’s price collapsed sharply from its pre-listing futures valuation of $1.70 to as low as $0.51, signalling a severe mismatch between market expectations and actual demand.

Strong Fundamentals, Weak Market Reaction

According to Artemis data, Meteora’s on-chain performance remains impressive: daily trading volume sits around $633 million, generating $4.5 million in fees and $580,000 in daily revenue. These figures cement Meteora’s role as the liquidity backbone of Solana’s DeFi environment.

Yet, despite these strong fundamentals, the MET token’s post-launch performance paints a different picture. Analysts attribute the slump to two key factors, excessive pre-listing speculation and structural concerns about Solana’s DeFi valuation model.

Interestingly, on-chain data revealed that three wallets linked to individuals associated with Donald Trump’s team received a combined $4.2 million worth of MET in the airdrop and immediately deposited the tokens on OKX, adding to the selling pressure.

This development stirred mild controversy in the community, though no irregularities were confirmed. Still, it underlined the challenge of ensuring fair token distribution in high-profile airdrops.

Tokenomics and Supply Pressure

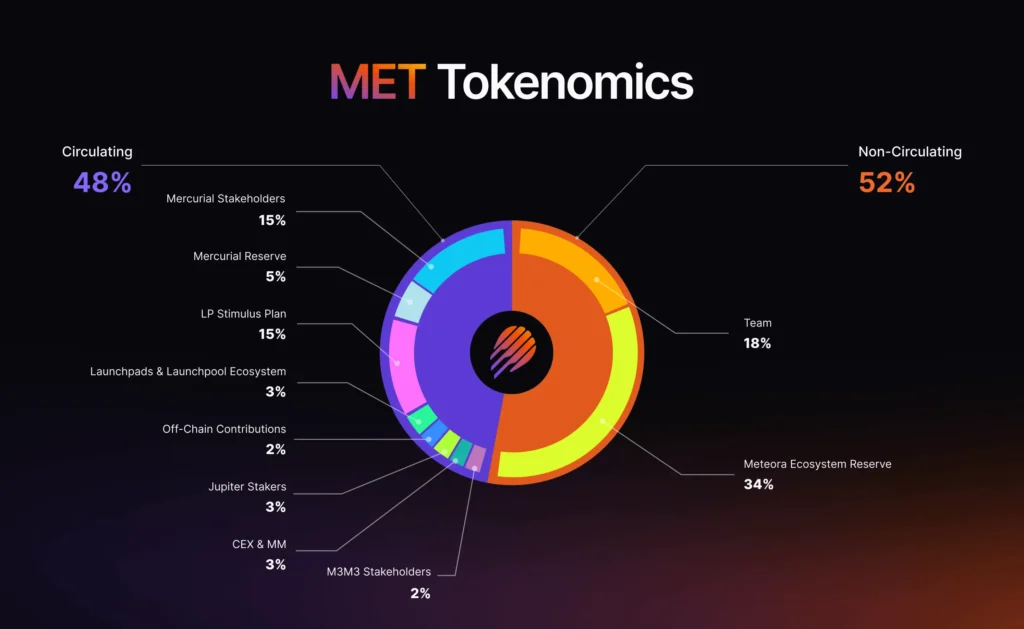

Meteora’s tokenomics provide partial insight into the downward price momentum. Only 48% of the total MET supply is currently in circulation, leaving a substantial portion locked or vested.

The largest allocations are tied to Mercurial Stakeholders and a Liquidity Provider (LP) stimulus plan, designed to encourage long-term participation and trading activity. Of the remaining non-circulating supply, 34% is reserved for the Meteora Ecosystem Reserve, while 18% is allocated to the team, a standard setup for most major DeFi launches but one that adds medium-term supply risk.

As circulating supply gradually unlocks, traders anticipate further selling pressure unless new demand sources, such as staking, governance incentives, or integrations, emerge to absorb the liquidity.

This cautious sentiment is echoed across the Solana DeFi sector, where even strong performers like Jupiter and Drift Protocol trade at significantly lower Fully Diluted Valuations (FDVs) than Ethereum giants like Aave (AAVE) and Uniswap (UNI).

Price Outlook: No Clear Signs of Recovery

Technically, MET’s chart remains under strain. The token has been in a consistent downtrend since peaking at $1.71 on 11 October. After finding temporary support at the $0.50 level on 22 October, the price rebounded slightly, but still trades in the lower section of its descending channel, a zone typically associated with weak momentum.

Indicators offer little relief. The Relative Strength Index (RSI) remains below 30, signalling oversold conditions, while the Moving Average Convergence/Divergence (MACD) continues to print negative readings, suggesting that a bullish reversal is not imminent.

While a short-term bounce toward the channel’s midline, around the $0.70–$0.80 range is possible, technical and sentiment factors both indicate that sustained recovery will require renewed market confidence.

Final Thoughts: A Lesson in Market Maturity

Meteora’s airdrop and TGE execution showcased Solana’s growing technical sophistication and network efficiency. However, the market’s harsh response underscores a deeper issue: valuation confidence.

Despite stellar DEX metrics, Solana’s DeFi ecosystem continues to face scepticism from investors who appear more attracted to memecoins and speculative assets than to sustainable DeFi protocols. Until that narrative shifts, projects like Meteora may struggle to achieve the kind of premium valuations enjoyed by their Ethereum-based counterparts.

For now, MET’s fundamentals remain solid, but investor sentiment will dictate its near-term trajectory. If the team successfully drives ecosystem expansion and liquidity incentives, Meteora could yet reclaim its place as a cornerstone of Solana’s DeFi revival.

Leave a Reply