Strategy Adds Nearly 2,000 Bitcoin

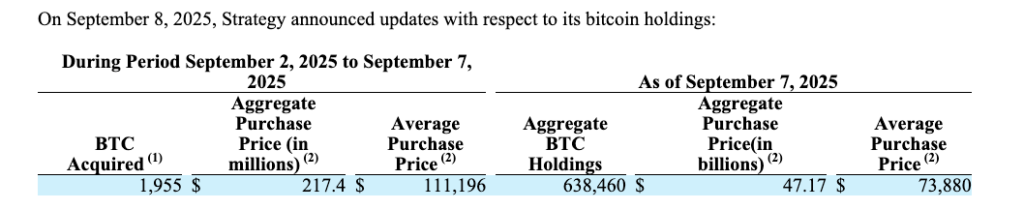

Michael Saylor’s Strategy, the world’s largest holder of Bitcoin, has added 1,955 BTC to its portfolio between 2 and 7 September, according to a US Securities and Exchange Commission filing. The acquisition, valued at $217.4 million, was made at an average price of $111,196 per coin as the cryptocurrency briefly surged past $113,000 before settling around $110,000, according to CoinGecko.

Total Holdings Now Over 638,000 BTC

With the latest purchase, Strategy’s total Bitcoin holdings now stand at 638,460 BTC. The company has spent approximately $47.2 billion on these coins at an average price of $73,880 per BTC. This solidifies Strategy’s position as the leading institutional holder of the cryptocurrency globally.

Recent Buying Trends

The September purchase follows a series of acquisitions in August, when Strategy added roughly 7,714 BTC. This was significantly smaller than earlier purchases, including 31,466 BTC in July and 17,075 BTC in June, suggesting a measured approach amid recent price movements.

Funding the Purchases

Strategy used proceeds from three of its at-the-market equity offerings to fund the latest Bitcoin purchase. These included the Series A Perpetual Strife Preferred Stock, the Series A Perpetual Strike Preferred Stock, and its own Common A stock MSTR.

Market Implications

The continued accumulation of Bitcoin by Strategy reflects confidence in the cryptocurrency despite volatility in global markets. Analysts note that institutional buying remains a key driver of market sentiment and may influence Bitcoin price stability in the coming weeks.

Leave a Reply