Bitcoin Hits $123,000 as Strategy Strengthens Its Holdings

Michael Saylor’s firm Strategy has made yet another major move in the cryptocurrency space, investing $472.5 million in Bitcoin as the digital asset climbed to historic highs. The fresh purchase brought Strategy’s total Bitcoin holdings to more than 600,000 BTC, cementing its position as the largest publicly held Bitcoin portfolio in the world.

Over 4,200 Bitcoins Added at Record Prices

In a filing submitted to the US Securities and Exchange Commission (SEC) on Monday, Strategy confirmed it had acquired 4,225 Bitcoins last week. The average purchase price was $111,827 per coin. This move came as Bitcoin prices surged from around $108,000 on July 7 to $118,000 by week’s end, according to data from CoinGecko. At the time of writing, Bitcoin has risen even further, hitting $123,000 on Monday.

With this acquisition, Strategy’s total Bitcoin holdings now stand at 601,550 BTC, purchased for an overall amount of $42.87 billion. The average cost per coin across all of Strategy’s holdings now sits at $71,268.

First July Purchase Follows Strategic Pause

This marks Strategy’s first reported Bitcoin acquisition for July, following a brief pause in buying activity during the first week of the month. During this time, the company announced a $4.2 billion stock offering and revealed it had $14 billion in unrealised gains for Q2 2025. A similar pause occurred in April, seemingly aligned with preparations for quarterly financial reporting.

So far in 2025, Strategy has added 88,062 BTC to its holdings, representing a gain of $10.9 billion. This comes close to the 140,538 BTC gain recorded throughout the entire year of 2024, which brought in $13 billion.

Executive Share Sale Draws Attention

While Strategy was making headlines with its Bitcoin purchase, internal activity also caught attention. The company’s senior executive vice president, Wei-Ming Shao, sold 62,500 MSTR shares during the same week. According to three separate SEC filings, these sales amounted to approximately $25.7 million.

The breakdown of the transactions includes a 32,500-share sale on Wednesday, followed by 20,000 on Thursday, and another 10,000 on Friday. The timing of these sales, closely aligned with Bitcoin’s new highs and Strategy’s fresh purchase, has led to speculation in the financial community.

Saylor’s Optimism Remains Unshaken

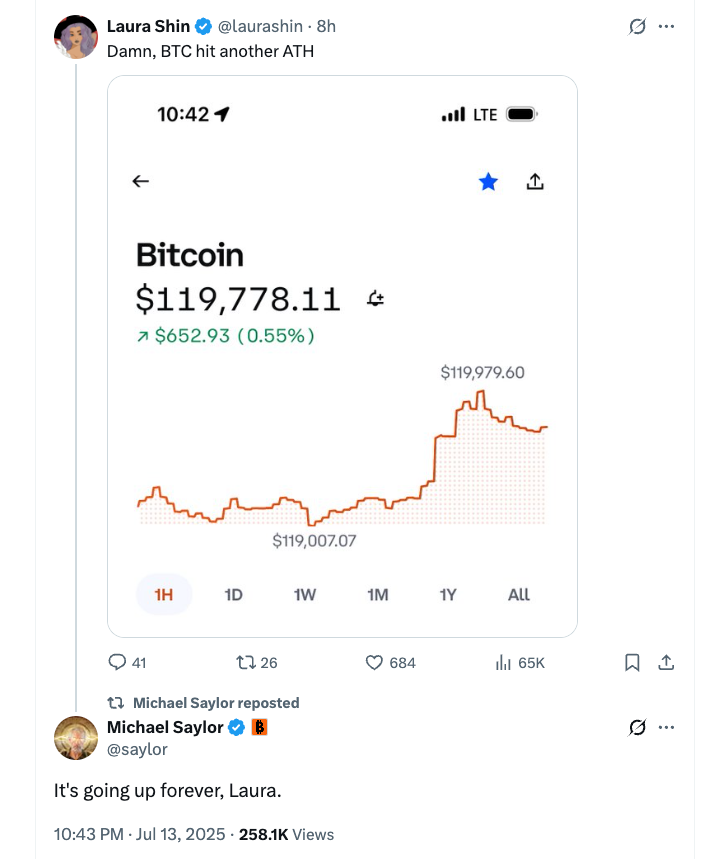

As Bitcoin continues to scale new heights, Strategy’s co-founder Michael Saylor has remained outspoken about his bullish stance. Responding to crypto journalist Laura Shin on X (formerly Twitter), who posted about Bitcoin crossing $119,000, Saylor replied, “It’s going up forever, Laura.”

The phrase is a reference to Saylor’s 2021 appearance on Shin’s Unchained podcast, where he famously said, “It’s the technically superior asset class compared to the dollar, the euro, compared to a stock index, compared to gold, compared to silver, compared to everything you can conceivably buy. If you have the superior asset, it’s going up forever, Laura.”

This renewed confidence aligns with his company’s actions, as Strategy continues to increase its exposure to Bitcoin amid growing investor interest and a strong upward trend in prices.

Looking Ahead

With Bitcoin now trading well above $120,000 and Strategy doubling down on its long-term bullish outlook, market watchers are closely following both the cryptocurrency and the company’s financial strategies. The firm’s aggressive accumulation of Bitcoin, coupled with its substantial unrealised gains and continued stock activities, reflects a high-stakes bet on the future of decentralised digital assets.

As more institutional players enter the space, Strategy’s moves could further influence the broader market. Investors and analysts alike will be watching to see whether Bitcoin can maintain its momentum and if Saylor’s prediction that it’s “going up forever” will stand the test of time.

Leave a Reply