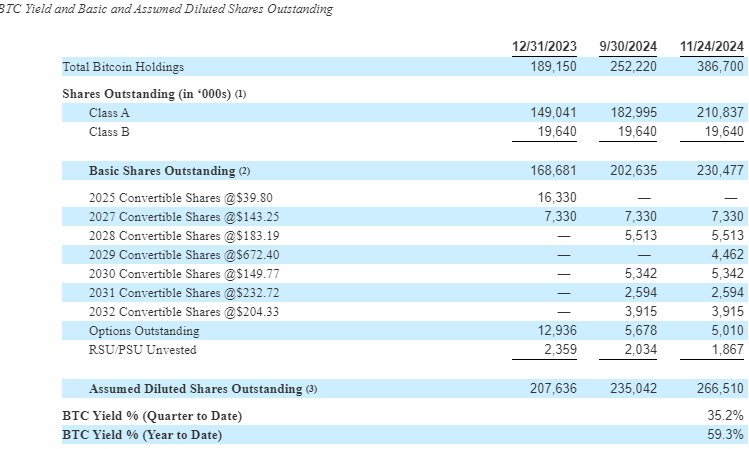

MicroStrategy, a business intelligence powerhouse, has made waves with its latest Bitcoin acquisition. Between 18 and 24 November, the company purchased 55,000 BTC for $5.4 billion, paying an average price of $97,862 per coin. This move brings its total holdings to an unprecedented 386,700 BTC, acquired at an average cost of $56,761 per Bitcoin.

Funding the Bitcoin Buying Spree

The purchase was funded through proceeds from a 0% convertible senior notes offering and MicroStrategy’s at-the-market (ATM) equity program. The notes offering generated $2.97 billion, while 5.6 million shares sold under the ATM program raised $2.46 billion. With $12.8 billion in liquidity still available under the ATM program, the firm shows no signs of slowing its BTC strategy.

BTC Yield: A New Metric for Shareholder Value

MicroStrategy has introduced “Bitcoin Yield,” a proprietary metric that tracks the percentage change in BTC holdings relative to diluted shares. The metric rose to 59.3% on 24 November from 35.2% in Q3, underscoring Bitcoin’s role as a driver of shareholder value.

Institutional Adoption Picks Up Pace

MicroStrategy isn’t alone in the Bitcoin rush. Semler Scientific, a US healthcare firm, acquired 297 BTC for $29.1 million, increasing its holdings to 1,570 BTC. With a year-to-date Bitcoin Yield of 58.4% and an expanded $100 million ATM program, the firm mirrors MicroStrategy’s bullish stance on Bitcoin as a treasury asset.

MicroStrategy’s continued acquisitions near Bitcoin’s all-time highs reflect growing institutional confidence in the asset’s long-term potential, buoyed by optimism over pro-crypto policies under the incoming US administration. With its aggressive BTC strategy, the firm aims to solidify its position as a leader in institutional Bitcoin adoption.

Leave a Reply