Mirae Asset Group is reportedly exploring the acquisition of South Korea based cryptocurrency exchange Korbit, a move that could mark another major financial institution stepping deeper into the digital asset space. According to local media reports, discussions are underway for a deal valued between 100 billion and 140 billion Korean won, translating to roughly $70 million to $100 million.

If completed, the transaction would place one of the country’s longest operating crypto exchanges under the umbrella of a leading financial group, highlighting renewed institutional interest in regulated digital asset platforms.

Mirae Asset Consulting Leading the Discussions

The potential acquisition is being spearheaded by Mirae Asset Consulting, a non financial affiliate within the Mirae Asset Group. Reports indicate that the firm has already signed a memorandum of understanding with Korbit’s major shareholders, signaling serious intent rather than early stage talks.

The discussions were first reported by The Chosun Daily on Sunday, citing industry sources familiar with the matter. While neither Mirae Asset nor Korbit has officially confirmed the negotiations, the presence of an MOU suggests that both sides are actively evaluating deal terms, valuation, and regulatory considerations.

For Mirae Asset, acquiring an existing exchange with operational approvals in place could offer a faster and more compliant entry into the crypto sector than building a platform from scratch.

Korbit’s Ownership Structure and Strategic Appeal

Korbit is currently majority owned by NXC and its subsidiary Simple Capital Futures, which together control approximately 60.5 percent of the exchange. SK Square holds an additional 31.5 percent stake, making it another key party in any acquisition talks.

Founded in 2013, Korbit was South Korea’s first cryptocurrency exchange and remains fully licensed under the country’s strict regulatory framework. Its compliance systems, reporting standards, and banking partnerships are seen as valuable assets, especially as regulators continue to tighten oversight of digital asset platforms.

Despite its smaller market share today, Korbit’s regulatory readiness makes it an attractive acquisition target for traditional financial groups looking for exposure to crypto without the legal uncertainty that surrounds unlicensed operators.

Trading Volume Lags Behind Domestic Rivals

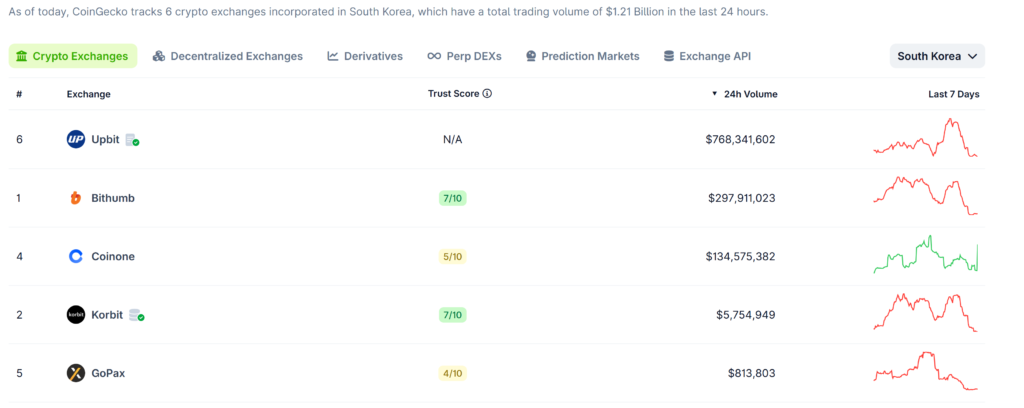

While Korbit’s regulatory standing is solid, its trading activity has fallen behind its domestic competitors. Data from CoinGecko shows that Korbit accounted for just $5.75 million in 24 hour trading volume out of approximately $1.21 billion across six Korean exchanges. This places its market share well below 1 percent.

By comparison, Upbit dominates the market with daily volumes exceeding $768 million. Bithumb follows with close to $298 million, while Coinone records around $135 million in daily trading.

The sharp contrast in volumes suggests that any new owner would face the challenge of reviving Korbit’s competitiveness. However, industry observers note that with the backing of a major financial group, Korbit could potentially expand its offerings, improve liquidity, and attract a broader user base.

Growing Institutional Interest in Korean Crypto Market

The reported Korbit talks come amid broader consolidation and strategic moves in South Korea’s crypto sector. In a separate development, Naver Financial has announced plans to acquire Dunamu, the operator of Upbit, through a large scale stock swap deal.

That transaction is valued at approximately 15.1 trillion won, or about $10.3 billion, and would see Naver Financial issue 87.56 million new shares to Dunamu shareholders. If approved, Dunamu would become a wholly owned subsidiary of Naver Financial.

Shareholders from both companies are scheduled to vote on the proposal on May 22, 2026, with the share exchange planned for June 30. Regulatory approvals will also be required before the deal can be finalized.

Reports suggest that following the acquisition, Naver Financial plans to launch a Korean won backed stablecoin and expand its digital finance services, further blurring the line between traditional finance and crypto assets.

What a Korbit Deal Could Mean

If Mirae Asset proceeds with the Korbit acquisition, it would reinforce a growing trend of established financial institutions seeking regulated exposure to digital assets rather than speculative trading plays. For Korbit, the backing of a large financial group could provide the capital and credibility needed to regain relevance in a highly competitive market.

As South Korea continues to position itself as a tightly regulated but innovation friendly crypto hub, deals such as these may reshape the industry landscape, favoring platforms that combine compliance, scale, and institutional support.

Leave a Reply