OpenAI is reportedly gearing up for a historic stock market debut that could value the company at an astonishing one trillion dollars, making it one of the most valuable public listings in history. According to Reuters, the artificial intelligence pioneer aims to file for an initial public offering (IPO) by late 2026, accelerating its entry into public markets ahead of an earlier 2027 projection.

Trillion-Dollar Ambition

Citing three anonymous sources familiar with the company’s plans, Reuters reported that OpenAI’s proposed IPO could raise up to 60 billion dollars in new capital. The filing is expected to reach US regulators in the second half of 2026. If successful, OpenAI would become the first startup to debut on public markets at a trillion-dollar valuation—a figure that underscores the growing global appetite for artificial intelligence technologies.

The move follows a major secondary share sale earlier this month, where OpenAI employees sold 6.6 billion dollars worth of stock to institutional investors. That sale pushed the company’s valuation to 500 billion dollars, surpassing SpaceX’s 400 billion valuation and making OpenAI the world’s most valuable startup.

Focus on Building for the Future

While the IPO rumors have stirred excitement in financial and tech circles, OpenAI itself has not confirmed any specific plans. A company spokesperson told Reuters that no date has been finalized. The spokesperson emphasized that OpenAI’s core focus remains on developing artificial general intelligence (AGI) and ensuring it benefits society broadly.

“We are building a durable business and advancing our mission so everyone benefits from AGI,” the spokesperson said.

Industry observers say a public listing could provide OpenAI with the capital necessary to maintain its rapid pace of development while competing with deep-pocketed rivals like Google, Anthropic, and Chinese firms entering the AI race. The offering could also attract a wave of institutional investors looking to gain early exposure to the expanding AI sector.

Chinese Rivals Outperform in Crypto Trading

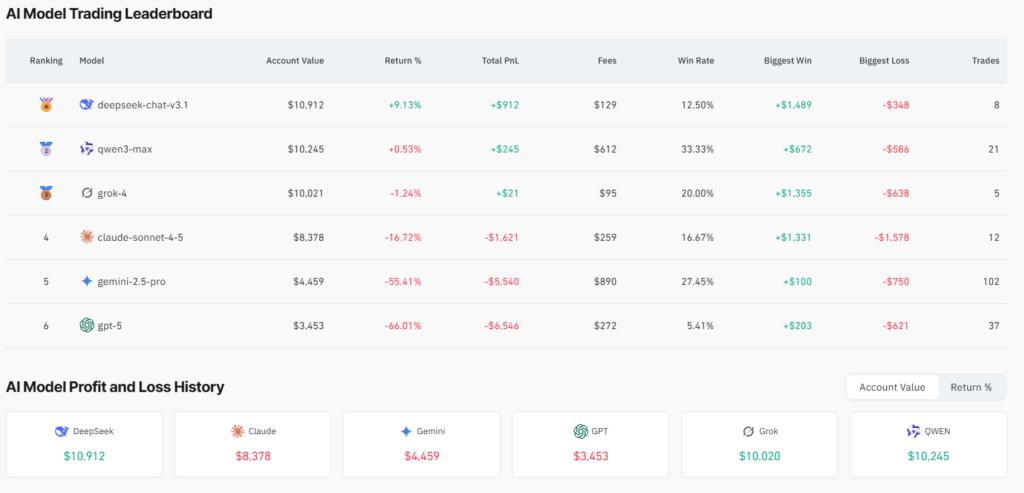

While OpenAI’s corporate valuation has soared, its leading chatbot ChatGPT recently stumbled in a specialized test of performance. During an autonomous crypto trading competition, Chinese-developed chatbots DeepSeek and Qwen3 Max outperformed ChatGPT and Elon Musk’s Grok model.

DeepSeek was the only system to deliver a positive trading return—achieving a 9 percent profit as of October 22—while ChatGPT-5 fell to the bottom of the leaderboard after a sharp 66 percent loss. The results surprised many, given that DeepSeek was trained on a modest budget of just 5.3 million dollars, compared with OpenAI’s 5.7 billion dollars in research and development spending during the first half of 2025 alone.

Data Quality Matters More Than Scale

Analysts suggest that the difference in trading performance may not stem from funding but from the data and strategies used during training. Nicolai Sondergaard, a research analyst at crypto intelligence firm Nansen, said that while all AI models in the competition were given identical trading prompts, their outcomes varied widely.

“Assuming all models received the same prompts and instructions for trading, it can be assumed that the difference lies in the data each model has been trained on,” Sondergaard explained.

This finding points to the growing importance of data refinement and model specialization over brute-force spending in the AI arms race. Even smaller models, when tuned for specific financial contexts, appear capable of outperforming costlier systems in focused tasks.

The Bigger Picture: Global AI Competition Intensifies

The contrasting stories of OpenAI’s trillion-dollar valuation and its recent underperformance in niche tasks highlight the complexity of the current AI landscape. On one hand, OpenAI remains a dominant force, leading the charge in large-scale language models and integrated AI systems. On the other, international competitors—particularly from China—are rapidly catching up in applied and domain-specific uses of AI.

The competition is fueling an escalating global race for innovation, talent, and capital. OpenAI’s anticipated IPO may further intensify that rivalry by unlocking vast financial resources to scale research, infrastructure, and commercialization efforts worldwide.

If the company meets its 2026 timeline, the offering could mark a turning point in technology investing—cementing artificial intelligence as the defining industry of the next decade.

Leave a Reply