NVIDIA and OpenAI have announced what may well be the most consequential corporate partnership in modern technology: a $100 billion strategic collaboration to build 10 gigawatts of AI data centres. The agreement ties NVIDIA’s funding directly to the deployment of its systems, making it not only OpenAI’s supplier but also an investor with equity upside.

The sheer scale is jaw-dropping. Ten gigawatts of power dedicated solely to AI computing dwarfs existing infrastructure. For comparison, a single gigawatt powers around 750,000 homes. Allocating ten times that to one company’s AI operations signals a shift in industrial priorities, where compute capacity now rivals energy in strategic importance.

From an investment standpoint, this is not a speculative gamble. Rather, it is a carefully engineered self-reinforcing loop: NVIDIA supplies the hardware, profits from sales and simultaneously gains equity in OpenAI, whose value increases as its compute capacity scales. This structure is both bold and brilliant, almost vendor financing on steroids, but with potentially limitless upside.

Beyond a Vendor Relationship

What sets this apart from typical partnerships is the deep technical integration. The agreement mentions co-optimisation of OpenAI’s software and NVIDIA’s hardware roadmaps. That is not vendor language, it’s joint engineering. In practice, this means OpenAI may shape future chip design, while NVIDIA could influence AI model architecture.

Such entanglement creates enormous switching costs. Once OpenAI’s models are optimised for NVIDIA’s full stack GPUs, networking, software and even custom silicon pivoting to AMD, Intel, or a startup becomes near-impossible. This is less a deal and more a strategic lock-in that ensures NVIDIA remains the beating heart of OpenAI’s infrastructure for years, if not decades.

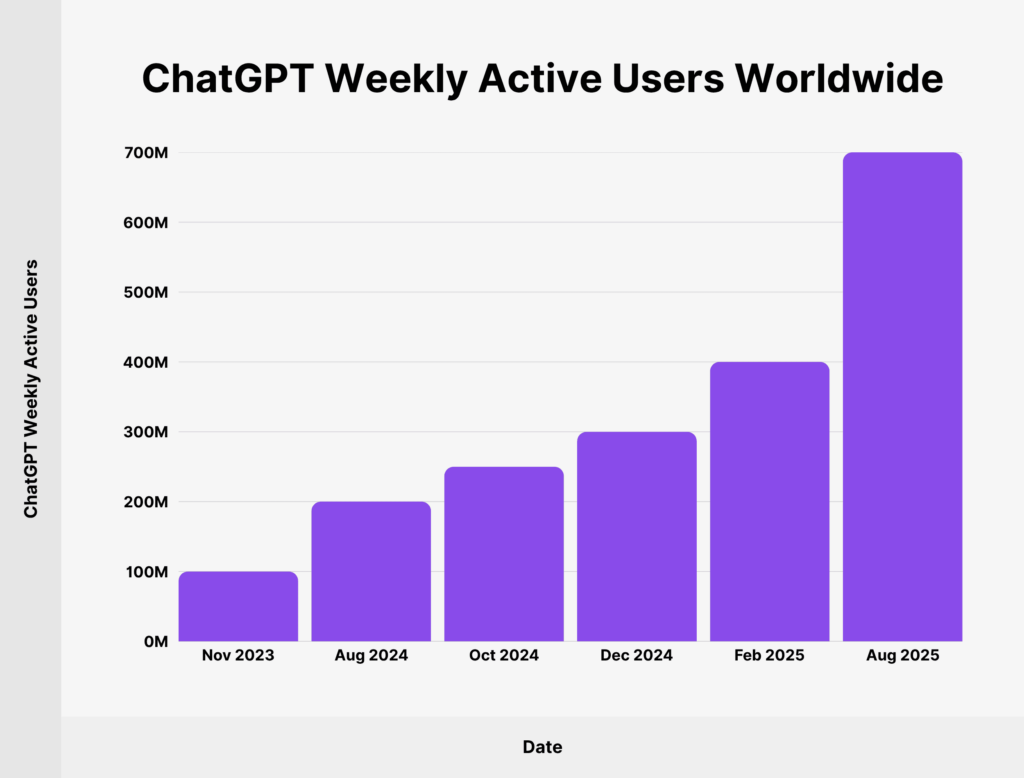

For OpenAI, the upside is equally significant. The company currently serves 700 million weekly active users and its ambitions for artificial general intelligence (AGI) demand compute at a scale far beyond what today’s clusters can provide. With 10 gigawatts in play, OpenAI gains a potential insurmountable advantage in training capability. The biggest bottleneck in AI today is not talent or ideas, it is raw computing power. NVIDIA’s commitment directly addresses that.

A Timely Strategic Signal

The timeline is worth noting. The first deployment is scheduled for the second half of 2026, using NVIDIA’s forthcoming Vera Rubin platform. That is still years away, but the announcement is strategic. By locking in OpenAI’s roadmap to NVIDIA’s unreleased architecture, Jensen Huang’s company has effectively frozen the market. Rivals, whether AMD with its Instinct GPUs or cloud hyperscalers with in-house chips, are put on notice: the world’s most influential AI firm has already chosen its hardware partner.

This sends a chilling signal to enterprise buyers and investors. Why risk capital on alternative platforms if OpenAI itself, widely seen as the tip of the AI spear, is committed to NVIDIA through 2030 and beyond? It is a clever form of competitive signalling, designed to cement NVIDIA’s dominance long before its rivals can scale their own offerings.

Risks and Rewards

Of course, the numbers are staggering. A $100 billion outlay is not a small bet, even for a company with NVIDIA’s balance sheet and market capitalisation. But crucially, this is not a lump-sum investment, it is tied to deployment milestones. Each gigawatt deployed justifies its own tranche of funding, ensuring that NVIDIA’s risk is matched by tangible infrastructure growth.

Still, risks remain. Regulation could bite, especially given rising scrutiny over AI energy consumption and concentration of power. Ten gigawatts of energy use will not go unnoticed by policymakers worried about grids already under strain. There is also the competitive dynamic: Alphabet’s DeepMind, Anthropic (with Amazon backing) and Meta are unlikely to sit still. A compute arms race could spiral into unsustainable capital burn, echoing the cloud wars of the 2010s.

Yet, the reward profile may outweigh these concerns. If OpenAI achieves AGI or even continues its current trajectory, NVIDIA stands to benefit not just as a supplier but as a shareholder in what could become the most valuable AI company of all time. It is a dual revenue stream that few companies in history have managed to secure.

Implications for Crypto and Digital Economies

Interestingly, this deal also has knock-on effects beyond AI. In crypto markets, the symbolism of energy allocation cannot be ignored. Ten gigawatts devoted to AI training dwarfs the energy consumption of most proof-of-work blockchains. Investors may read this as a signal that capital and power will increasingly flow to AI compute rather than crypto mining, shifting the balance of digital infrastructure.

For crypto-linked AI projects, the message is clear: scale wins. Niche tokens promising AI integration will find it difficult to compete when industrial giants are building nation-sized compute facilities. NVIDIA’s alignment with OpenAI reinforces the view that AI dominance will consolidate around a handful of players, much like Bitcoin mining consolidated around large-scale farms.

A Defining Moment

This partnership is more than just a supply contract, it is a defining moment in the AI race. NVIDIA has positioned itself not merely as a chipmaker but as a strategic co-architect of the AI future. OpenAI, in turn, secures the lifeblood of its ambitions: compute at an unprecedented scale.

For investors, policymakers and rivals, the message is blunt. The future of AI is being built not in abstract research labs but in gigawatt-scale industrial deployments. The $100 billion figure is less a number and more a declaration: the era of small experiments is over. AI has entered its infrastructure age and NVIDIA and OpenAI intend to lead it.

Whether this becomes the most lucrative corporate partnership in history or a cautionary tale of overreach remains to be seen. But one thing is certain: the ripple effects will shape technology, markets, and energy economics for decades to come.