Memecoins have once again captured market attention after a sharp rise in prices and trading activity pushed the sector’s total market capitalisation higher by roughly three billion dollars in a single day. Tokens such as PEPE, BONK and Dogecoin emerged among the strongest performers, raising questions about whether a new meme driven cycle is beginning as the broader crypto market looks ahead to 2026.

Friday’s rally marked one of the most notable short term recoveries for memecoins in recent weeks. While it does not yet resemble the explosive runs seen during previous meme cycles, the scale of the move and the surge in derivatives activity suggest renewed speculative interest. Traders appear to be positioning for further upside, encouraged by improving sentiment across the wider altcoin market.

Memecoin market cap jumps to two week high

The combined market value of memecoins climbed to around 39.45 billion dollars on Friday, representing an eight percent increase over the previous 24 hours. This level marked the highest valuation for the sector in roughly two weeks. The last time memecoins held a market capitalisation above 39 billion dollars was on December 20, highlighting how quickly sentiment has shifted after a subdued end to the year.

Market participants attributed part of the renewed enthusiasm to a symbolic moment in crypto culture after Ethereum cofounder Vitalik Buterin updated his profile picture to a meme themed non fungible token. While such actions do not alter fundamentals, they often act as catalysts for speculative assets that thrive on narrative and attention. In the memecoin market, perception and momentum can matter almost as much as liquidity.

The increase in market capitalisation was not evenly distributed. A handful of large tokens accounted for the majority of gains, while smaller meme assets saw more mixed performance. Still, the aggregate move suggested broad based demand rather than an isolated pump in a single token.

PEPE BONK and DOGE post strong daily gains

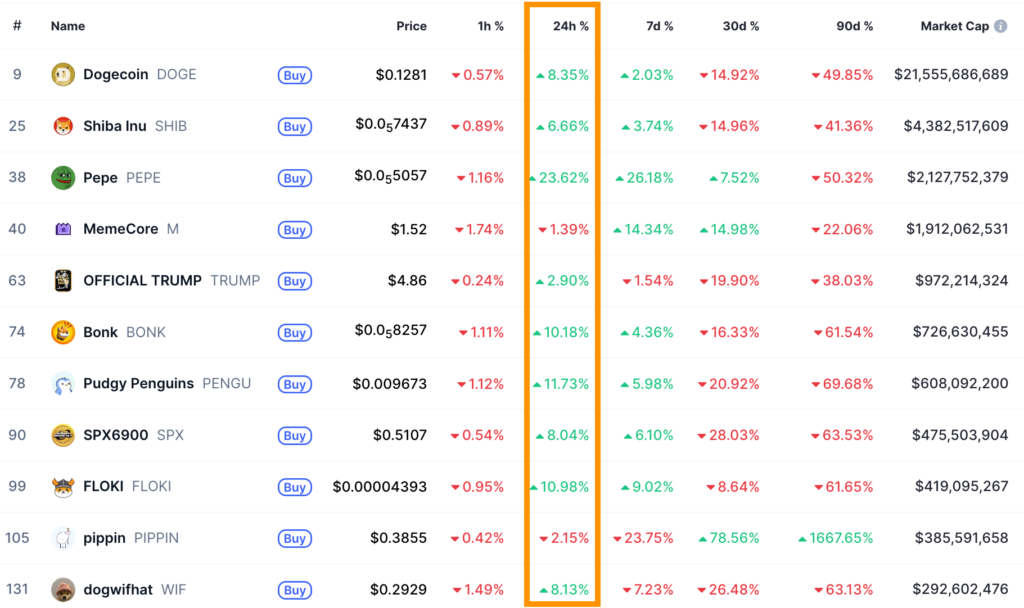

PEPE led the rally among major memecoins, recording a gain of approximately 23.6 percent over the course of the day. The Ethereum based token has remained a favourite among short term traders due to its deep liquidity and strong derivatives presence. Friday’s move placed PEPE firmly at the top of the memecoin leaderboard for daily performance.

On the Solana network, BONK also delivered solid returns, climbing around ten percent within the same period. BONK has often been viewed as Solana’s answer to PEPE, benefiting from lower transaction costs and an active on chain trading culture. Its performance suggested that interest in memecoins is not limited to a single blockchain ecosystem.

Dogecoin, the largest memecoin by market capitalisation, rose by roughly eight percent. While its move was more modest in percentage terms, Dogecoin’s size means that even single digit gains can have a meaningful impact on the overall market. Its recovery also carried symbolic weight, as DOGE is often seen as a bellwether for sentiment in the meme segment.

Influencer commentary and bold price forecasts for 2026 contributed to the upbeat mood. Social media platforms saw a noticeable increase in discussion around memecoins, with traders sharing charts and speculative scenarios. Although such narratives can fade quickly, they often play a key role in reigniting interest after periods of consolidation.

Meme focused trading platforms add to the buzz

Beyond price action, attention has also centred on new infrastructure tailored specifically for memecoin traders. One platform drawing interest is MemeMax Fi, a decentralised perpetual exchange designed for meme assets. The platform allows users to trade memecoins with leverage of up to one hundred times, significantly amplifying both potential gains and risks.

Supporters argue that MemeMax Fi taps into the core dynamics of meme trading by treating attention as a form of capital. According to traders promoting the platform, memes function not just as cultural artefacts but as vehicles for liquidity, momentum and collective energy. This framing resonates with a segment of the market that views memecoins as social assets rather than traditional investments.

The availability of high leverage products can accelerate price movements in both directions. In the current context, it appears to have encouraged bullish positioning as traders seek to maximise exposure during the early stages of a potential rally. However, such conditions also raise the risk of sharp liquidations if sentiment reverses.

Open interest and derivatives volume signal bullish bets

One of the clearest indicators of renewed enthusiasm came from the derivatives market. Open interest across major memecoins rose sharply in the 24 hours preceding Friday’s price gains. Open interest represents the total value of outstanding futures contracts that remain unsettled, providing insight into how much capital is committed to leveraged positions.

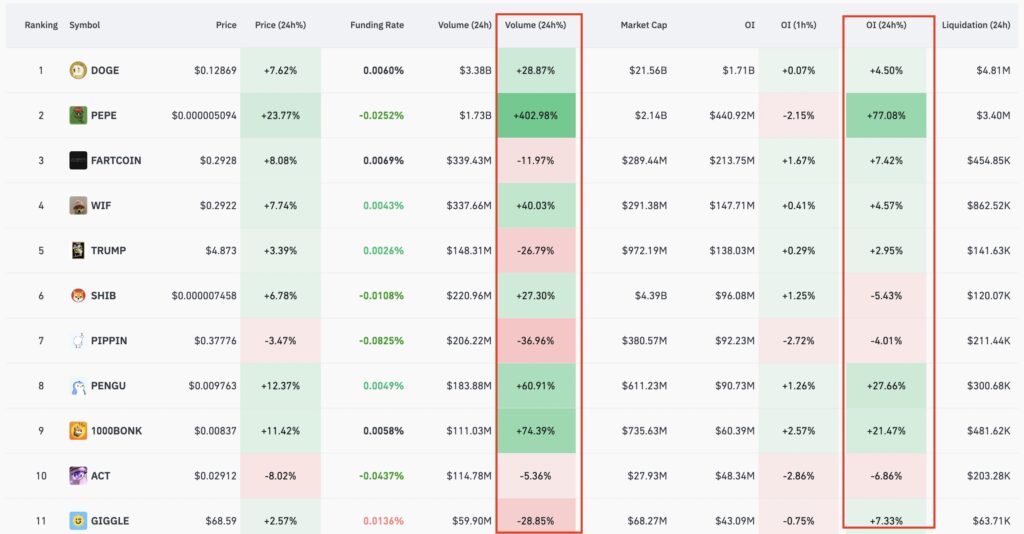

PEPE saw the most dramatic change, with open interest jumping by roughly 77 percent to around 441 million dollars. This surge suggested that traders were aggressively opening new positions in anticipation of further upside. When open interest rises alongside price, it often indicates that fresh capital is entering the market rather than positions merely being closed.

Other memecoins also recorded notable increases. PENGU experienced an open interest rise of more than 27 percent to approximately 90.73 million dollars. Dogecoin’s open interest stood at about 1.71 billion dollars, reflecting a daily increase of around 4.5 percent. While smaller in relative terms, DOGE’s open interest remains the largest in the sector, underlining its importance to the broader derivatives landscape.

Trading volume in memecoin derivatives expanded significantly as well. PEPE led the surge, with daily derivatives volume increasing by more than 400 percent. Across the memecoin sector, total daily derivatives volume climbed by roughly 35 percent to reach around 4.75 billion dollars. Such spikes typically occur when traders anticipate sustained volatility and directional movement.

Historically, rising open interest combined with higher trading volume has been associated with bullish momentum. It indicates that leveraged traders are willing to commit capital to long positions, expecting prices to continue climbing. However, it also increases the market’s sensitivity to sudden reversals, as crowded trades can unwind rapidly.

Broader altcoin structure supports memecoin recovery

The memecoin rebound did not occur in isolation. It coincided with improving technical conditions across the wider altcoin market, as measured by TOTAL3. This metric tracks the combined market capitalisation of all cryptocurrencies excluding Bitcoin and Ether, offering a view of pure altcoin performance.

Over the last two days, TOTAL3 rose by around 22 percent to reach an intraday high near 848 billion dollars on Friday. The move took place within an ascending parallel channel on the four hour chart, suggesting a structured recovery rather than a random spike. Traders appeared to buy aggressively during pullbacks earlier in December when momentum indicators reached oversold levels.

The relative strength index for TOTAL3 had dropped to around 25 in mid December, signalling deeply oversold conditions. Since then, it has recovered to approximately 65, indicating strengthening momentum and growing interest in altcoins. Such shifts often precede rotations into higher risk segments of the market, including memecoins.

A key technical level now lies around the 848 billion dollar mark, which aligns with both the upper boundary of a triangular pattern and the 200 period simple moving average. A decisive break above this resistance could open the path towards a measured target near 900 billion dollars. If that scenario plays out, altcoins and major memecoins could see further gains over the coming weeks.

Improving sentiment indicators add to this cautiously optimistic outlook. Market mood has moved out of the extreme fear zone, suggesting that traders are becoming more willing to take risk after a prolonged period of caution. While confidence remains fragile, the shift creates a more supportive environment for speculative assets.

Are memecoins truly back

Despite the impressive figures, it is still too early to declare the start of a full scale meme season. Previous cycles were characterised by sustained rallies lasting weeks or months, often accompanied by explosive growth in retail participation. The current move, while significant, has so far unfolded over a relatively short time frame.

Nevertheless, the combination of rising prices, expanding derivatives activity and improving technical structure across altcoins points to a meaningful change in market behaviour. Memecoins thrive when liquidity is abundant and traders are willing to embrace risk. Recent developments suggest that both conditions may be returning.

As the market heads into 2026, memecoins are once again positioning themselves at the intersection of culture, speculation and technology. Whether this resurgence develops into a prolonged rally will depend on broader macro conditions, regulatory clarity and the sustainability of trader interest. For now, PEPE, BONK and Dogecoin have reminded the market that memes remain a powerful force in crypto.

Leave a Reply