Solana-based memecoin launchpad Pump.fun has recorded its strongest week of revenue in 2025, signalling a sharp rebound in the memecoin market. Despite facing a multi-billion-dollar lawsuit, the platform has regained its leading position among Solana launchpads while the broader memecoin sector recovers from recent losses.

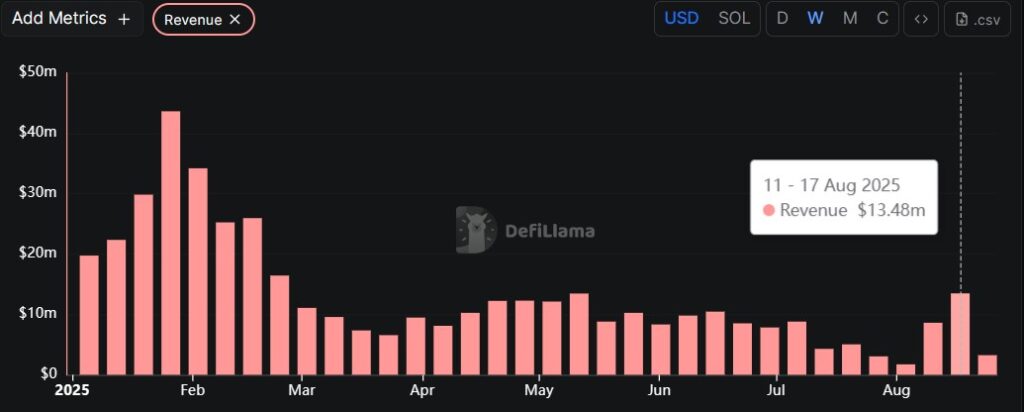

Strongest Revenue Week Since February

Pump.fun generated $13.48 million in revenue between 11–17 August, according to decentralised finance tracker DefiLlama. This marked the platform’s best weekly performance since February and a sharp recovery from earlier in the month.

From 28 July to 3 August, Pump.fun revenue had plunged to just $1.72 million, the lowest level since March 2024. The slump coincided with a wider decline in the memecoin market, which lost nearly $16 billion in value in just one week. CoinMarketCap data shows the sector dropped from a $77.73 billion market cap on 28 July to $62.11 billion by 3 August.

The rebound has been swift. By 11 August, memecoins recovered close to $75 billion in total market cap before cooling to around $70 billion a week later. At the time of writing, the figure stands at approximately $66 billion, still well above the month’s lows.

Pump.fun Regains Top Spot in Solana Rankings

The revenue surge has also helped Pump.fun reassert its dominance in Solana’s memecoin launchpad ecosystem. According to data from decentralised exchange aggregator Jupiter, the platform now commands a 73.6% market share and recorded $4.68 billion in trading volume over the past seven days.

In addition, Pump.fun saw 1.37 million traders and more than 162,000 token mints during the week. This activity dwarfed that of its closest rival, LetsBonk, which managed a 15.3% market share, $974 million in volume, 511,000 traders, and just over 6,000 token mints.

The rivalry between Pump.fun and LetsBonk has been intense. On 7 July, LetsBonk briefly overtook Pump.fun in 24-hour revenue, sparking speculation of a potential power shift. For much of July, LetsBonk continued to chip away at Pump.fun’s dominance. However, the latest figures confirm that Pump.fun has reclaimed its leading role in the market.

Lawsuit Clouds the Platform’s Success

While Pump.fun has enjoyed a strong August, it continues to grapple with legal challenges. A class-action lawsuit filed on 30 January accuses the platform of using “guerrilla marketing” tactics to hype volatile tokens and create artificial urgency.

On 23 July, the lawsuit was amended to describe Pump.fun as an “unlicensed casino,” alleging that its structure operates like a “rigged slot machine.” According to the filing, only the earliest participants profit, while later buyers are left with heavy losses. The lawsuit estimates that investors have already lost $5.5 billion through the platform.

Despite these allegations, Pump.fun has continued to grow. Data from Dune Analytics indicates that the platform’s lifetime revenue has already surpassed $800 million, underscoring its scale and user base.

Industry Voices and Future Potential

Industry leaders have taken note of Pump.fun’s trajectory. Solana Labs co-founder Anatoly Yakovenko recently commented on the platform’s long-term potential. Speaking last week, Yakovenko suggested that Pump.fun could even evolve into a global streaming platform, highlighting the broader possibilities for decentralised, community-driven financial products.

For now, the focus remains on Pump.fun’s ability to maintain momentum while addressing its legal troubles. Its recent surge in revenue and market share shows strong user appetite for Solana-based memecoin projects, even as regulators and courts scrutinise its business model.

Pump.fun’s comeback in August highlights the resilience of the memecoin sector. The platform has not only bounced back from its weakest revenue month of 2025 but has also reaffirmed its dominance in the Solana ecosystem. However, the shadow of a $5.5 billion lawsuit raises questions about the sustainability of its growth.

Whether Pump.fun can balance booming demand with regulatory and legal challenges will be key in determining if it remains the leading memecoin launchpad—or becomes an example of unchecked hype in the volatile world of decentralised finance.

Leave a Reply