Pump.fun (PUMP), the memecoin that many traders had written off just days ago, has staged a surprising comeback. After falling to an all-time low of $0.0023 just a week ago, the token has bounced back sharply, surging 43% and reigniting bullish sentiment among retail traders and short-term speculators.

This rebound comes as a potential shift in the market structure unfolds. For the first time in weeks, PUMP is now trading within an ascending channel, a bullish technical pattern marked by higher highs and higher lows. This indicates that the token may have finally found its floor, and buyers are slowly regaining control.

If this ascending channel holds, analysts believe PUMP could soon challenge nearby resistance zones, potentially setting the stage for an extended rally. But can the memecoin maintain this upward momentum?

Technical Indicators Flash Bullish Signals

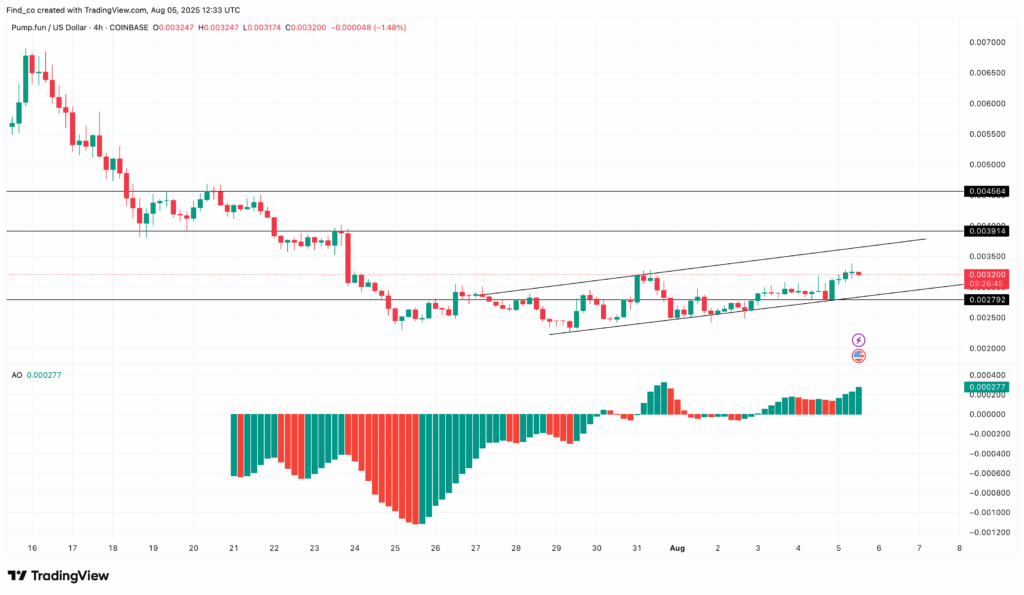

The technical setup across multiple timeframes supports the bullish case for PUMP. On the 4-hour chart, the Awesome Oscillator (AO) has crossed into positive territory, suggesting that bullish momentum is picking up. Historically, a sustained AO reading above zero is considered a key indicator of buying pressure overpowering selling activity.

Meanwhile, the token’s movement within the ascending channel has remained consistent, and traders are closely watching for a breakout above the channel’s upper boundary. If this breakout occurs, it could trigger a sharp move upwards, potentially challenging resistance levels at $0.039 and $0.046.

However, it’s important to note that any breakout must be supported by increased trading volume to confirm a legitimate shift in trend. Without it, the risk of a false breakout remains.

Lower Timeframes Mirror Bullish Setup

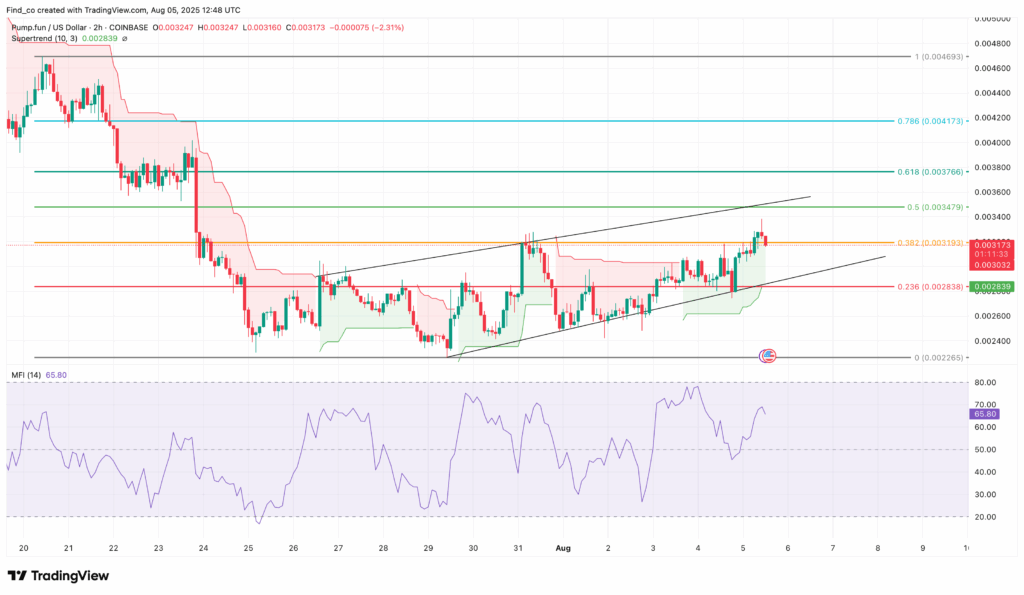

Zooming into the 2-hour chart, the bullish outlook continues. PUMP has continued to post higher lows, suggesting that accumulation is underway and investor confidence is slowly returning. This trend is reinforced by the Money Flow Index (MFI), which has now moved above the zero signal line. The MFI measures buying and selling pressure using volume and price, and a rise above zero typically indicates that capital inflows are outpacing outflows.

Additionally, the Supertrend indicator has flipped bullish. Its green line is now positioned below the current price of PUMP, placing the token firmly in a “buy zone”. This development adds further strength to the short-term bullish case, providing technical support for a potential run toward the key resistance at $0.038.

If bulls manage to break this level convincingly, the next upside target of $0.046 becomes a realistic scenario, especially if momentum and volume continue to support the move.

What Could Derail the Momentum?

While the technicals lean bullish for now, it’s crucial to keep an eye on support levels. If the ascending channel’s lower trendline fails, and PUMP dips below this level, it could spell trouble for the current recovery. In that scenario, PUMP risks re-entering bearish territory, with the potential of retesting or even breaching its previous low of $0.0023.

Given the volatile nature of memecoins and the emotional trading that often surrounds them, such shifts can happen quickly. Traders should remain cautious and monitor key support zones closely.

Cautious Optimism as Bulls Take the Lead

Pump.fun’s 43% rally from its all-time low is a significant technical development, but not yet a confirmation of a full trend reversal. The presence of bullish indicators like the ascending channel, AO, MFI, and Supertrend across the 2-hour and 4-hour timeframes suggest a real possibility of continuation, especially if resistance at $0.038 is broken.

That said, volume confirmation and trendline support will be critical. If bulls can hold the current structure and sustain momentum, the next leg up to $0.046 may not be far away.

For now, traders remain cautiously optimistic, watching for signals that this rebound is more than just a temporary bounce.

Leave a Reply