XRP, the native token of the Ripple network, is gaining fresh momentum in July 2025 as bullish signals line up across both technical charts and onchain data. The cryptocurrency has posted its strongest weekly gain since November 2024, drawing the attention of traders and analysts alike.

Veteran chartist Peter Brandt believes that XRP could be setting up for a sharp 60% rally, potentially pushing its price beyond $4.47 in the coming weeks. His analysis is supported by rising confidence among large investors and strengthening market sentiment.

Rare “Compound Fulcrum” Pattern Signals Breakout

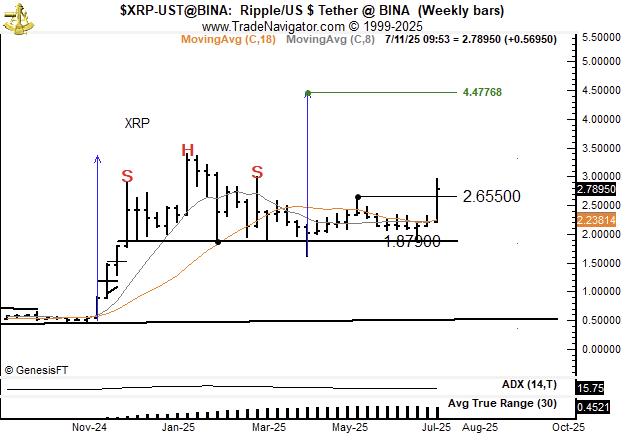

According to Peter Brandt, XRP is forming what he describes as a “highly rare continuation compound fulcrum” on its weekly chart against USDT. This complex chart pattern consists of multiple smaller structures, such as minor ranges, failed breakdowns, and wedge formations.

These mini patterns contribute to market uncertainty, often shaking out weak hands and allowing stronger investors to accumulate at lower levels. Once this fulcrum pattern resolves, the breakout is usually explosive and follows the prevailing trend, which, in this case, is upward.

Brandt suggests that if the setup holds, XRP could climb to around $4.47, representing a 60% gain from current levels. However, he also warns that a break below the $1.80 support level could invalidate the bullish thesis.

Whale Wallets Hit Record High

One of the clearest signs of rising confidence in XRP is the surge in whale wallet holdings. Onchain data shows that the number of wallets holding at least 1 million XRP has hit an all-time high.

This increase in whale activity usually reflects the accumulation phase of large investors, who are positioning themselves ahead of an expected price move. Their actions are often seen as early signals of broader market sentiment.

The recent 25% rise in XRP’s price during the week ending July 13, the strongest since November aligns with this pattern of quiet accumulation followed by a sharp upward move.

XRP Enters Belief Phase, Avoids Greed Zone

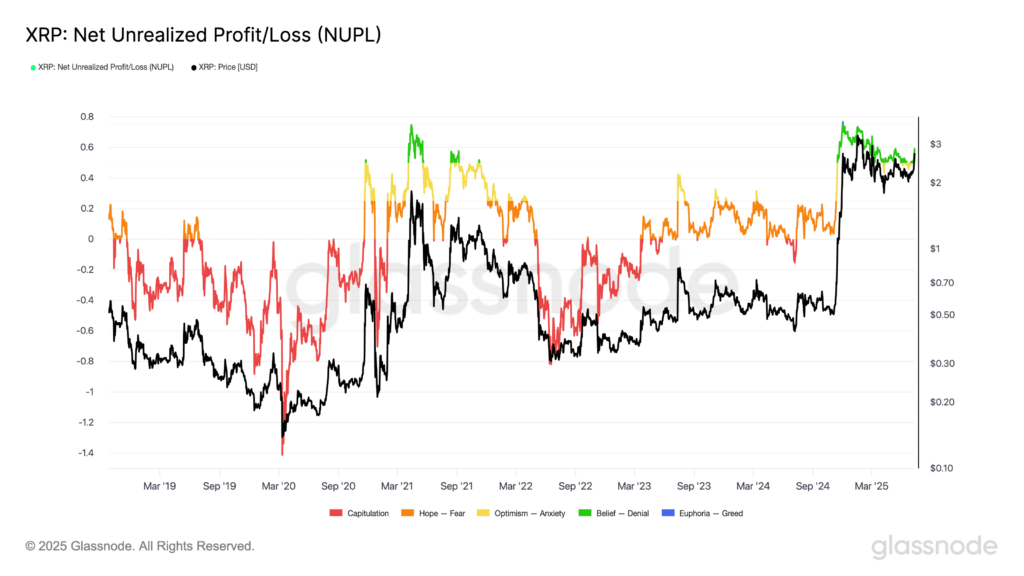

According to Glassnode’s Net Unrealized Profit-Loss (NUPL) metric, XRP has entered the “belief–denial” phase of the market sentiment cycle. This stage typically appears after a period of optimism and suggests further upside may be possible.

In previous bull cycles, such as in 2021 and late 2020, XRP entered the “euphoria–greed” zone before experiencing major corrections. As of now, however, there is no sign of excessive hype or panic selling. This makes the current rally look healthier and more sustainable than those in the past.

The absence of capitulation or investor fear suggests a solid foundation is being built for the next upward leg.

Altcoin Season and Bitcoin’s Support Add Fuel

XRP’s bullish potential is further enhanced by what many analysts describe as an ongoing altcoin season. Data from Santiment highlights that traders are increasingly moving profits from Bitcoin into high-potential altcoins like XRP.

This rotation is likely to continue as long as Bitcoin holds above its key psychological support level of $110,000. When Bitcoin is stable, investors tend to diversify into altcoins to seek higher returns, giving XRP a chance to shine.

XRP is currently in one of its most promising technical and fundamental positions in recent years. A rare chart pattern, rising whale accumulation, improving onchain sentiment, and supportive market conditions are all contributing to a growing sense of optimism.

While risks remain, particularly if support around $1.80 fails, the current setup points to a possible rally toward $4.47, which would mark a major milestone for the digital asset.

Investors and traders will be watching closely as XRP attempts to break out of its long-standing consolidation and reclaim its place among the top-performing cryptocurrencies of 2025.

Leave a Reply