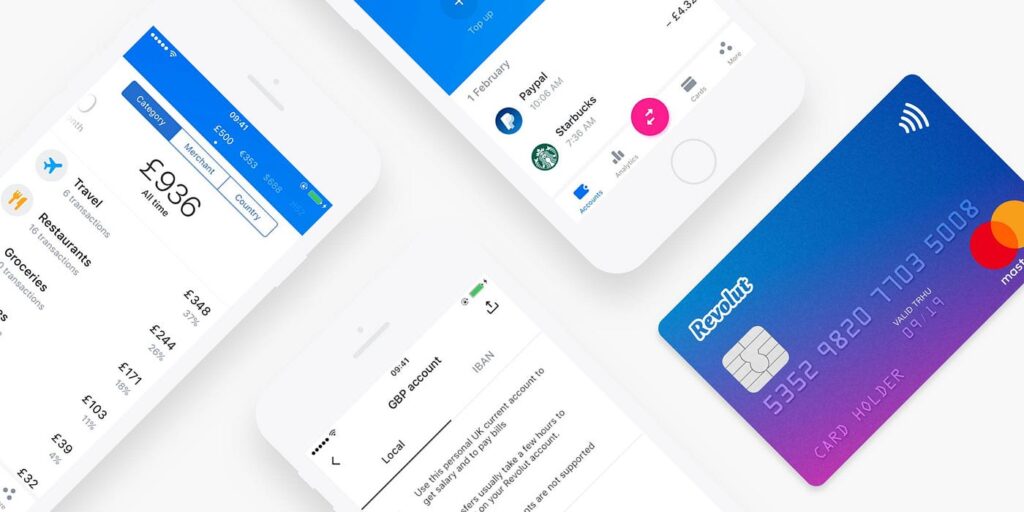

Fintech giant Revolut is set to launch enhanced fraud protection for crypto users with the rollout of Revolut Pay’s advanced security features in early 2025. This development promises a safer payment ecosystem for crypto transactions, reducing exposure to fraudulent attacks and scams.

Addressing Limited Protections in Crypto Payments

Currently, crypto users face heightened risks due to limited visibility in transactions made with exchanges, where existing card mechanisms lack sufficient anti-scam safeguards. Revolut’s solution addresses these gaps with a suite of features designed to boost security. A 12-month pilot of Revolut Pay’s advanced due diligence, including direct API integration and enhanced payment controls, revealed a significant reduction in fraud attempts—approximately 50% fewer than without the added protections.

Key Features of the Enhanced Security Suite

Revolut Pay offers multiple tools to combat crypto fraud:

- KYC Name Matching: Ensures the buyer’s identity matches between Revolut and the exchange, rejecting transactions with mismatched names—similar to blocking stolen card usage.

- Fraud Warning Screens: Alerts users about potential scams before completing transactions.

- Proof of Crypto Delivery: Confirms the legitimacy of crypto deliveries.

- Transaction Risk Scores: Provides merchants with detailed risk assessments, enhancing their ability to spot suspicious activities.

These features aim to strike a balance between user safety and a seamless transaction experience.

Fraud in the crypto space is evolving, with scams ranging from phishing attacks to AI-driven identity theft. One major challenge is investment scams, where users are tricked into making transactions to secure fake rewards. Revolut tackles these with a robust risk scoring system. Factors such as a user’s crypto trading history with Revolut or third parties help determine the likelihood of a scam. In high-risk cases, additional steps like customer service intervention may be introduced.

Balancing Safety and User Experience

According to Alex Codina, Revolut’s General Manager for Merchant Payments, ensuring security without overly disrupting user experience is crucial. Safety measures might involve simple queries or, for higher-risk scenarios, a brief conversation with customer support.

“Crypto fraud requires innovative solutions,” Codina said. “By integrating Revolut Pay, crypto exchanges and on-rampers can offer users a safer way to buy crypto directly at checkout.”

A Safer Future for Crypto Transactions

As crypto adoption grows, so does the need for robust fraud protection. Revolut’s commitment to safeguarding users with Revolut Pay’s advanced security features marks a pivotal step towards a more secure and trustworthy crypto ecosystem. This initiative underscores the importance of innovation in the fight against fraud, setting a new standard for security in fintech and cryptocurrency.

Leave a Reply