Riot Platforms sold 1,818 Bitcoin in December, generating about $161.6 million as the company reshapes its long term strategy. The Bitcoin miner said the sale was executed at an average net price of $88,870 per coin. Despite producing 460 Bitcoin during the month, Riot’s total holdings declined as it chose to monetize part of its treasury rather than continue holding all newly mined assets.

By the end of December, Riot held 18,005 Bitcoin, including 3,977 restricted BTC. This marked a drop from 19,368 Bitcoin at the end of November. Restricted Bitcoin refers to assets pledged as collateral under debt agreements and held separately, according to the company’s regulatory filings.

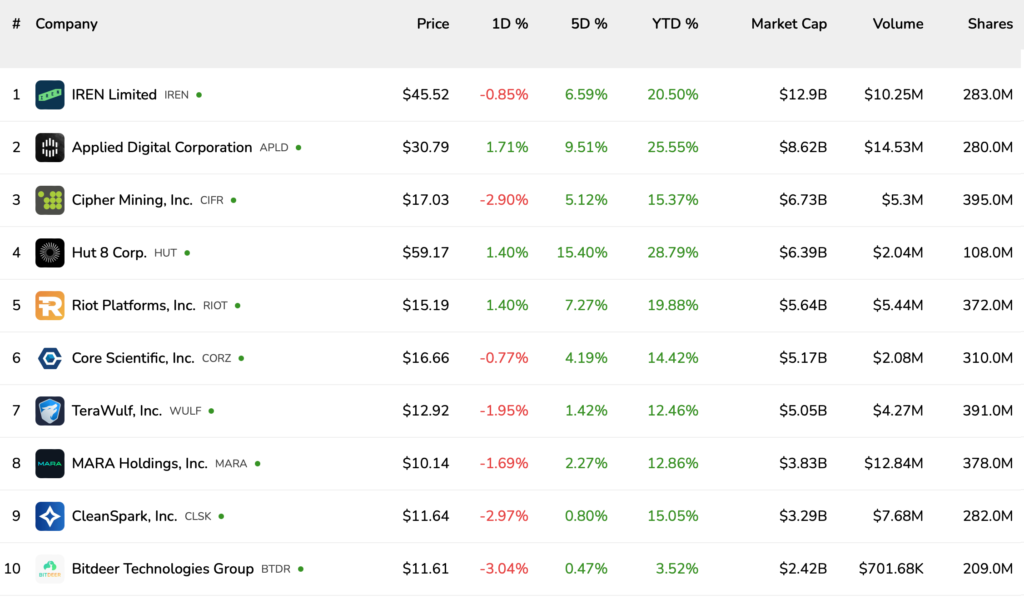

The company continues to rank among the largest public Bitcoin holders, standing seventh globally based on data from Bitcointreasuries.net.

Shift From Monthly Mining Updates to Broader Business Focus

Riot also confirmed that its December production report will be its final monthly update. Going forward, the company will move to quarterly disclosures that focus on overall business performance rather than just mining output. These reports will cover progress in data center development, infrastructure expansion, and the role of Bitcoin mining within the broader strategy.

The decision reflects a clear change in priorities. Riot stated that while Bitcoin mining remains part of its operations, it is no longer the central objective. Instead, the company is positioning itself as a provider of large scale power and data center infrastructure that can serve multiple industries.

Bitcoin Mining No Longer the End Goal

The strategic shift became clear in October when Riot said Bitcoin mining was no longer its final destination. The company outlined plans to repurpose its extensive power assets to support a proposed 1 gigawatt data center campus designed to meet growing demand for high performance computing.

This infrastructure could be used for artificial intelligence workloads, cloud computing, and other energy intensive applications. Riot believes its access to power and experience running energy dense facilities give it an advantage as demand for computing capacity accelerates.

Rising Mining Costs Push Miners Toward AI and Data Centers

The move comes as Bitcoin miners face rising operational pressure. The April 2024 halving cut block rewards in half, increasing the cost of producing each Bitcoin. As margins tightened, many miners began exploring new revenue streams beyond crypto mining.

Artificial intelligence has emerged as one of the most attractive opportunities. AI workloads require massive computing power and reliable electricity, two areas where Bitcoin miners already operate at scale. This overlap has encouraged partnerships between miners and major technology firms.

Tech Giants Expand Partnerships With Bitcoin Miners

Several high profile deals over the past year highlight this growing connection. In August, Google became the largest shareholder of TeraWulf, acquiring roughly 14 percent of its outstanding shares. The move followed an expansion of a financial backstop linked to a 10 year colocation agreement with Fluidstack. Under the deal, TeraWulf supplies data center capacity for artificial intelligence operations.

In September, Google also acquired a 5.4 percent stake in Cipher Mining. This investment was part of a broader $3 billion, multi year data center arrangement involving Fluidstack. Google guaranteed $1.4 billion of Fluidstack’s obligations under a 10 year agreement to lease computing capacity from Cipher.

The trend continued in November when IREN signed a five year, $9.7 billion agreement with Microsoft to provide GPU cloud services. Under the deal, IREN will host Nvidia GB300 GPUs at its data centers. During the same month, the largest Bitcoin miner by market value announced a $5.8 billion agreement with Dell Technologies to purchase GPUs and related equipment for AI focused deployments.

Riot’s Position in a Changing Industry

Riot’s December Bitcoin sale and reporting changes signal that the company intends to compete in this evolving landscape. By reducing reliance on Bitcoin price cycles and focusing on infrastructure monetization, Riot aims to build more stable and diversified revenue streams.

While Bitcoin mining remains part of the business, the company’s future appears increasingly tied to data centers, power management, and supporting next generation computing needs. As AI demand continues to surge, miners with strong infrastructure may find new relevance well beyond the blockchain.

Leave a Reply