Ripple has appointed the Bank of New York Mellon Corporation (BNY Mellon), a financial titan with over $43 trillion in assets under custody, as the primary custodian for its US dollar-backed stablecoin, RLUSD. The partnership was finalised on July 1 and publicly revealed on July 9, marking a major step in Ripple’s strategy to merge traditional finance (TradFi) with blockchain infrastructure.

Under the agreement, BNY Mellon will not only safeguard RLUSD reserves but also provide Ripple with transaction banking services to help support and scale its operations. Ripple’s stablecoin, issued under the New York Department of Financial Services (NYDFS) Trust Charter, is designed as a compliant, enterprise-grade asset backed 1:1 by highly liquid assets, such as cash, equivalents, and US treasuries.

Jack McDonald, Ripple’s Senior Vice President of Stablecoins, praised BNY’s reputation and innovation in financial services:

“BNY brings together demonstrable custody expertise and a strong commitment to financial innovation in this rapidly changing landscape. Their forward-thinking approach makes them the ideal partner for Ripple and RLUSD.”

Built for Institutions, Not Speculation

Unlike many stablecoins that focus on retail users or trading volume, RLUSD is positioned as a tokenised financial asset built with utility, transparency, and regulatory compliance at its core. Ripple’s announcement highlighted the shared vision with BNY Mellon to build “the infrastructure for the future of finance.”

RLUSD’s design reflects strict institutional standards, with independent audits, full asset segregation, and clear redemption rights. These features are intended to satisfy the rigorous demands of regulators and institutional investors.

Ripple has also applied for a national banking licence through the US Office of the Comptroller of the Currency (OCC), underscoring its ambitions to deepen its regulatory footprint within the United States.

Additionally, Swiss-based AMINA Bank has partnered with Ripple to offer custody and trading of RLUSD, expanding its institutional presence across borders.

RLUSD Supply Surges Past $500 Million

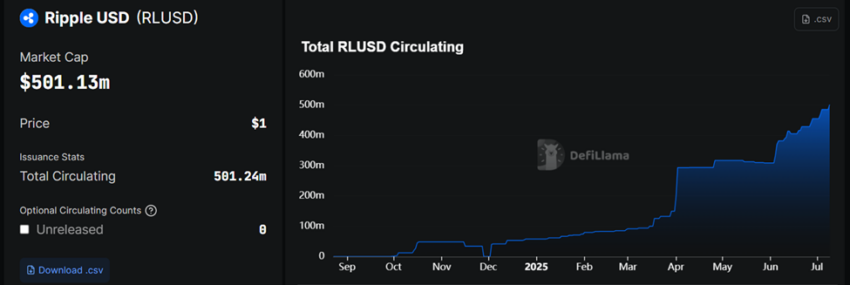

Ripple’s decision to enlist a Wall Street custodian comes at a time of explosive growth for RLUSD. Launched in December 2024, the stablecoin has already surpassed $500 million in circulating supply, becoming one of the top 20 stablecoins globally. According to DefiLlama, RLUSD currently holds the 16th position among all dollar-pegged tokens.

BeInCrypto recently named RLUSD the fastest-growing stablecoin in June 2025 after a 47% month-on-month increase in supply. Its issuance across both the XRP Ledger and Ethereum networks has allowed RLUSD to capture a diverse user base and facilitate efficient cross-border transactions.

CoinGecko reports that RLUSD now averages over $26 million in daily trading volume, with current volumes nearing $32 million driven by increased institutional interest and broader adoption in payment infrastructure.

Enterprise Stablecoins Gaining Momentum

Ripple’s RLUSD expansion mirrors a wider industry trend: the stablecoin market has ballooned to over $255 billion, with US dollar-pegged assets accounting for over 95% of the total market share. As traditional institutions increasingly explore blockchain-based financial services, enterprise-grade, fully regulated stablecoins like RLUSD are gaining traction.

Notably, the use of US treasuries to back stablecoins has drawn attention from crypto figures such as Max Keiser, who believes this shift signals the deepening integration of digital assets with the global financial system.

As Ripple continues to position RLUSD as a serious contender in the regulated stablecoin arena, the partnership with BNY Mellon may act as a blueprint for future collaborations between legacy banks and blockchain innovators.

Ripple’s alliance with BNY Mellon is more than just a custody arrangement. With compliance, scalability, and institutional utility at the core, RLUSD is rapidly becoming one of the leading examples of how traditional finance can meet blockchain in a secure, regulated, and enterprise-ready format.

Leave a Reply