Robinhood is accelerating its tokenization efforts in Europe, bringing nearly 500 U.S. stock and ETF tokens to the Arbitrum blockchain. The expansion marks a major step in the company’s push into real-world asset (RWA) tokenization as it deepens its presence in the crypto ecosystem.

Nearly 500 Tokenized Assets on Arbitrum

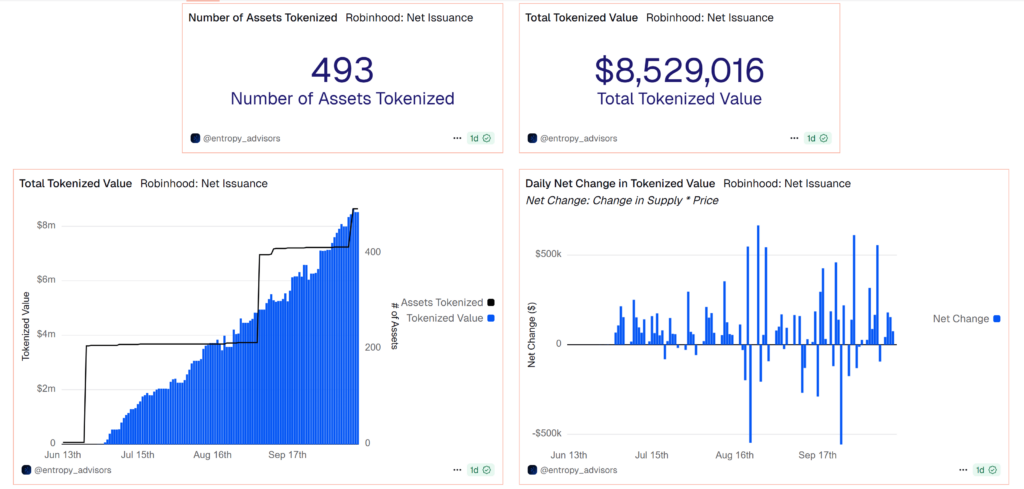

According to data from Dune Analytics, Robinhood has tokenized 493 assets worth more than $8.5 million. The cumulative mint volume has surpassed $19.3 million, offset by about $11.5 million in token burns, showing active trading and redemption across the platform.

Stocks make up around 70% of the total assets, while exchange-traded funds (ETFs) account for roughly 24%. The remainder includes commodities, crypto-linked ETFs, and U.S. Treasurys. In the past few days alone, Robinhood added 80 new stock tokens, including names like Galaxy (GLXY), Webull (BULL), and Synopsys (SNPS).

Research analyst Tom Wan noted that Robinhood’s EU users now have access to a broader mix of U.S. equities and ETFs through tokenization, expanding investment choices beyond traditional brokerage models.

Blockchain-Based Derivatives, Not Real Shares

Robinhood’s tokenized assets are designed to mirror the prices of publicly traded U.S. securities but do not represent actual share ownership. Instead, they function as blockchain-based derivatives, governed under the European Union’s Markets in Financial Instruments Directive II (MiFID II).

These digital assets are tradable around the clock, offering investors continuous market access without traditional exchange hours. The company says trades carry no hidden fees apart from a 0.1% foreign exchange charge, and investments can start from as little as one euro, making them accessible to small investors.

The tokenized structure allows users to gain exposure to U.S. markets in a decentralized format while maintaining regulatory compliance within the EU. However, this setup has raised regulatory questions about how such assets are classified and monitored.

Regulatory Scrutiny in the EU

In July, the Bank of Lithuania, Robinhood’s European regulator, requested detailed clarification on how the tokenized instruments are structured and whether they align with existing securities laws.

Robinhood CEO Vlad Tenev said the company welcomes the review, emphasizing that transparency and regulatory cooperation are central to the firm’s expansion strategy in Europe. The scrutiny underscores the growing attention financial watchdogs are giving to tokenized assets, particularly as they begin to blur the lines between traditional finance and blockchain-based instruments.

Strengthening Robinhood’s Crypto Strategy

Robinhood’s tokenization efforts follow several recent moves aimed at broadening its crypto and derivatives portfolio. Earlier this year, the brokerage introduced micro futures contracts for Bitcoin, XRP, and Solana, offering investors smaller-scale exposure to digital assets.

In May, Robinhood completed its $179 million acquisition of Canadian crypto platform WonderFi, a move that expanded its operations into new markets and added to its growing suite of blockchain-related products.

The company has also taken a proactive stance on policy, submitting a proposal to the U.S. Securities and Exchange Commission (SEC) advocating for a unified national framework governing real-world asset tokenization. The proposal seeks to provide clearer rules for firms exploring blockchain-based financial instruments in the United States.

A Step Toward the Future of Tokenized Finance

Robinhood’s growing footprint in tokenized assets highlights the convergence of traditional equities and blockchain technology. By enabling European users to trade fractionalized, blockchain-based versions of U.S. stocks and ETFs, the firm is positioning itself at the forefront of a financial transformation that merges accessibility, transparency, and digital innovation.

As regulators assess the implications of such offerings, Robinhood’s strategy could serve as a test case for how mainstream brokerage firms integrate tokenization into global financial markets.

Leave a Reply