The market for real-world asset (RWA) tokens has reached new highs this week, as both institutional interest and tokenised products continue to expand rapidly across blockchain networks.

Market Cap Climbs to Record Levels

Cryptocurrencies tied to RWA tokenisation surged 11% over the past week, driving the sector’s market capitalisation from around $67 billion to just under $76 billion, according to CoinMarketCap data.

Leading projects in the space, including blockchain oracle provider Chainlink, layer-1 chain Avalanche and institutional RWA platform Ondo Finance, were among the top gainers. Ondo Finance alone saw a 9% rise in value in a single day, reflecting growing demand for its DeFi services built around tokenised assets.

The rally highlights growing investor confidence in RWA-focused projects, which sit at the intersection of decentralised finance (DeFi) and traditional markets.

Onchain Value Doubles in 2025

The surge in token values coincides with a sharp rise in the total onchain value of RWAs. Data from RWA.xyz shows that tokenised assets reached $29 billion for the first time this week, nearly doubling since the start of the year.

Private credit makes up more than half of the total, while around a quarter consists of tokenised US Treasurys. The remainder includes tokenised commodities, alternative funds, equities and bonds.

When stablecoins are included in the calculation, the combined tokenised market is now valued at a record $307 billion, with over three-quarters of that hosted on Ethereum and layer-2 networks.

Ryan Sean Adams, a well-known crypto investor, noted that tokenisation is being actively pushed by the US government as part of efforts to modernise financial markets. He added that Wall Street and fintech firms now have strong incentives to accelerate adoption.

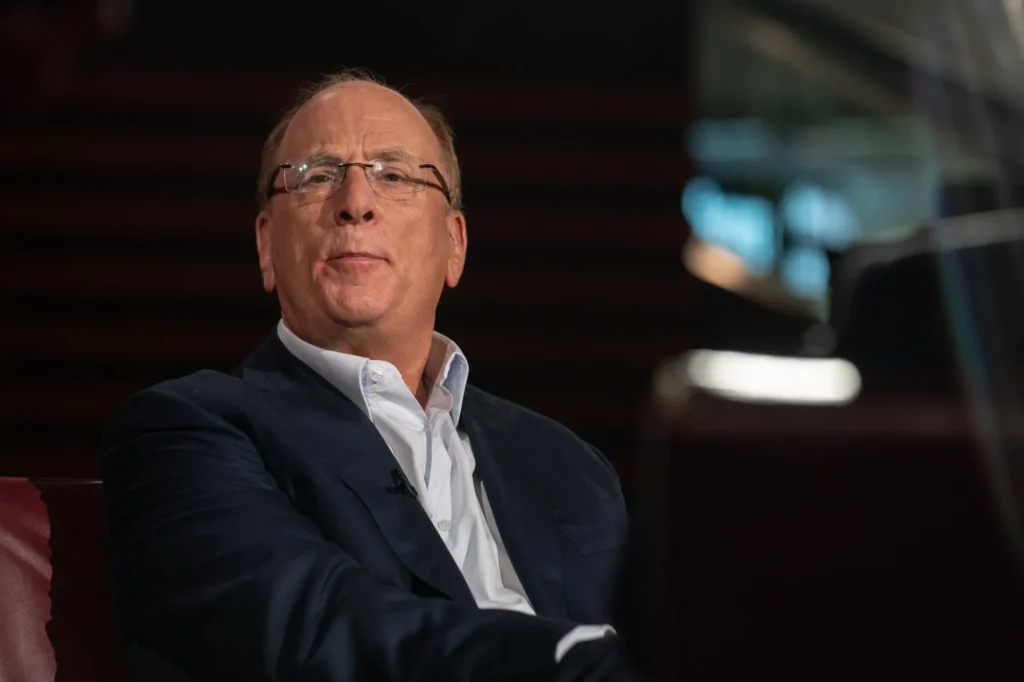

BlackRock Eyes Tokenised ETFs

Institutional momentum for tokenisation is underscored by moves from major asset managers. BlackRock, the world’s largest asset manager, is reportedly exploring the tokenisation of its exchange-traded funds (ETFs).

This would build on the company’s earlier success with its USD Institutional Digital Liquidity Fund (BUIDL), a tokenised money market fund launched on Ethereum in 2024. The fund has already grown to approximately $2.2 billion in assets under management.

BlackRock CEO Larry Fink has long argued that tokenisation can “democratise finance” and has suggested that every financial asset could eventually exist on blockchain rails.

Tokenisation at a Turning Point

The sharp rise in both token prices and onchain value signals a pivotal moment for tokenisation within global finance. By moving traditional assets like bonds, funds and equities onto public blockchains, issuers are unlocking greater transparency, faster settlement and more accessible global markets.

While the sector remains in its early stages, growing institutional backing and supportive regulatory signals suggest tokenisation is shifting from a niche experiment into mainstream adoption.

If current growth continues, RWAs could become one of the defining themes of the next cycle in digital assets bridging the gap between decentralised finance and traditional capital markets.

Leave a Reply