Sam Bankman-Fried, the jailed founder of the collapsed cryptocurrency exchange FTX, has claimed that his “single biggest mistake” during the company’s dramatic downfall was handing control of the firm to its new management. The decision, he said, destroyed his last chance to save the company before it declared bankruptcy.

The Decision That Changed Everything

In a recent interview with Mother Jones, Bankman-Fried said that transferring leadership of FTX to restructuring expert John J. Ray III on 11 November 2022 was a move he now deeply regrets.

“The single biggest mistake I made by far was handing the company over,” he said.

According to Bankman-Fried, just minutes after signing the documents, he received a call about a potential outside investment that might have rescued the exchange from financial collapse. However, it was too late to reverse his decision.

Shortly after taking charge, Ray filed for Chapter 11 bankruptcy in the United States and appointed the law firm Sullivan & Cromwell (S&C) to oversee legal matters.

From Billion-Dollar Empire to Bankruptcy

Once valued at $32 billion, FTX was among the world’s leading cryptocurrency exchanges. Its implosion in November 2022 wiped out around $8.9 billion of customer and investor funds. Bankman-Fried, widely known as “SBF,” was arrested a month later in the Bahamas after U.S. prosecutors charged him with seven felony counts, including fraud and conspiracy.

He was extradited to the United States in January 2023 and is now serving a 25-year prison sentence.

The root of the collapse was the misuse of customer funds. FTX transferred billions of dollars from user accounts to its sister trading firm, Alameda Research, to cover its trading losses. This shortfall, later dubbed the “Alameda gap,” became central to the case against Bankman-Fried.

The Role of Sullivan & Cromwell

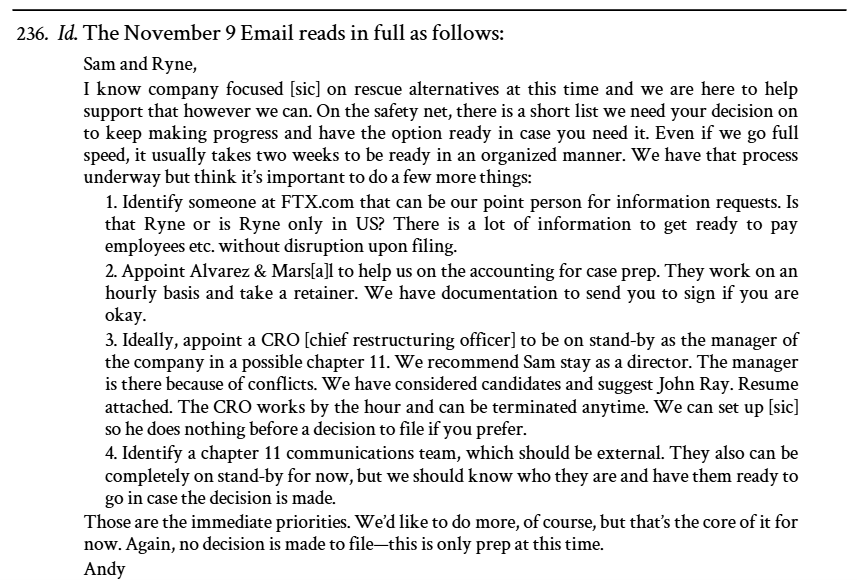

Two days before FTX declared bankruptcy, S&C attorney Andrew Dietderich emailed Bankman-Fried with a plan to bring in John Ray as chief restructuring officer “in a possible Chapter 11.” Ray would later assume full control of FTX’s management during the bankruptcy process.

In February 2024, a group of FTX creditors filed a lawsuit against S&C, accusing the law firm of aiding and abetting fraud and benefiting financially from its involvement with FTX. However, the case was voluntarily dismissed in October 2024.

By June 2024, S&C had earned more than $171.8 million in legal fees from the FTX bankruptcy proceedings, according to filings reviewed by Reuters.

Billions Still Awaiting Repayment

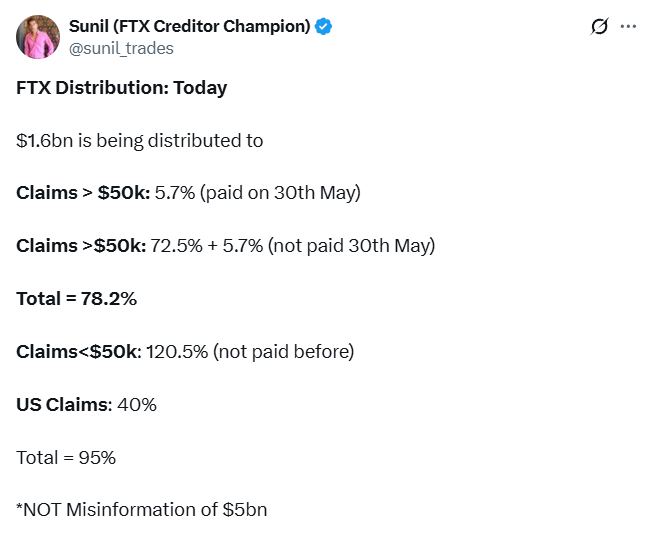

Nearly three years after the exchange’s collapse, many FTX users continue to wait for their full repayments. The FTX estate began distributing recovered funds in February 2024, starting with a $1.2 billion payout, followed by a $5 billion distribution in May. A third payment of $1.6 billion was issued in September, bringing total repayments to $7.8 billion.

According to recent estimates, FTX has recovered up to $16.5 billion in assets, meaning creditors could still receive a further $8.7 billion. The company aims to repay at least 98% of customers 118% of the value of their accounts as of November 2022.

FTX creditor and Customer Ad-Hoc Committee member Sunil confirmed on X (formerly Twitter) that the most recent $1.6 billion round of repayments had been successfully distributed at the end of September.

The Broader Impact on Crypto Markets

FTX’s collapse sent shockwaves throughout the global cryptocurrency industry, triggering a series of bankruptcies among other major players and marking the start of one of the longest bear markets in crypto history. Bitcoin, which had traded above $60,000 in 2021, plunged to nearly $16,000 in the aftermath of the scandal.

Despite the market’s gradual recovery, with Bitcoin now trading above $120,000, the damage inflicted by FTX’s implosion continues to shape investor sentiment and regulatory scrutiny across the sector.

As Bankman-Fried reflects from prison, his admission underscores how one decision, made under pressure, sealed the fate of one of crypto’s most powerful empires.

Leave a Reply