The U.S. Securities and Exchange Commission (SEC) has temporarily suspended trading of QMMM Holdings Ltd. after the Hong Kong-based advertising firm’s share price soared nearly 959% in less than three weeks. The extraordinary surge followed the company’s announcement of a $100 million cryptocurrency treasury, a dramatic strategic shift that attracted both investor enthusiasm and regulatory scrutiny.

The SEC’s intervention highlights the mounting tension between traditional financial oversight and the unpredictable, hype-driven nature of the cryptocurrency sector.

From Advertising to Digital Assets

QMMM Holdings Ltd. has long operated as a digital advertising business, offering marketing and campaign solutions. Until recently, the company’s focus was firmly on media services. That changed on 9 September 2025, when QMMM stunned markets with plans to establish a $100 million cryptocurrency treasury.

According to management, the new strategy aimed to diversify the firm’s assets by investing in Bitcoin, Ethereum and Solana. Executives touted the move as a way to strengthen financial resilience and capture growth opportunities in digital assets.

But the announcement marked a sharp departure from QMMM’s core expertise. Analysts quickly questioned whether the firm, with no history of managing volatile digital markets, was equipped to handle the complexities and risks of cryptocurrency investments.

The Surge: From $11 to $207

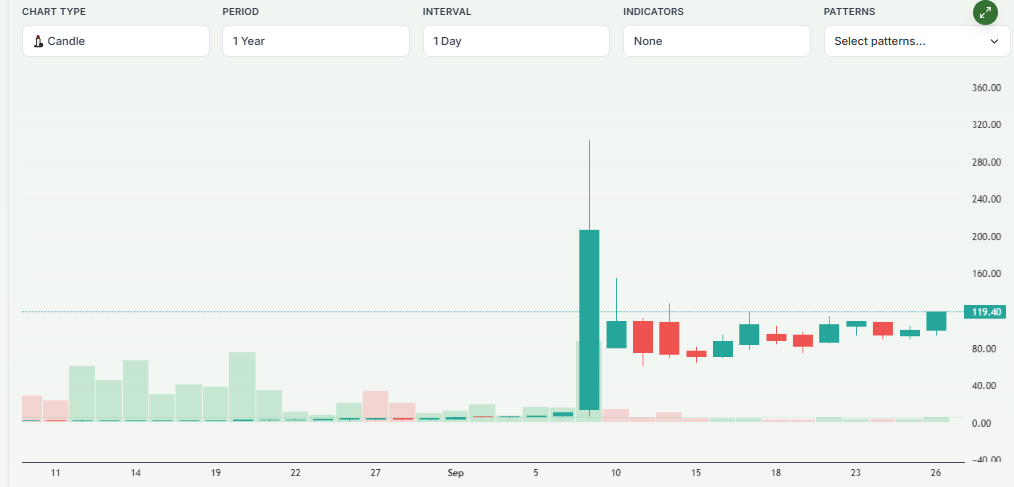

Despite concerns, investor reaction was immediate and dramatic. In just 14 trading sessions, QMMM’s stock price skyrocketed from $11 to $207, an increase of 959%.

Several forces fuelled this meteoric rise. The pivot into cryptocurrency positioned QMMM as part of a broader corporate trend of embracing blockchain and digital assets, generating widespread media coverage. Investor optimism around crypto, buoyed by rising institutional interest in Bitcoin and Ethereum, amplified the momentum.

Compounding the frenzy were reports of social media activity. According to the SEC, unknown individuals circulated online messages encouraging investors to buy QMMM shares. Such promotions further stoked demand, raising the risk of coordinated market manipulation.

SEC Steps In

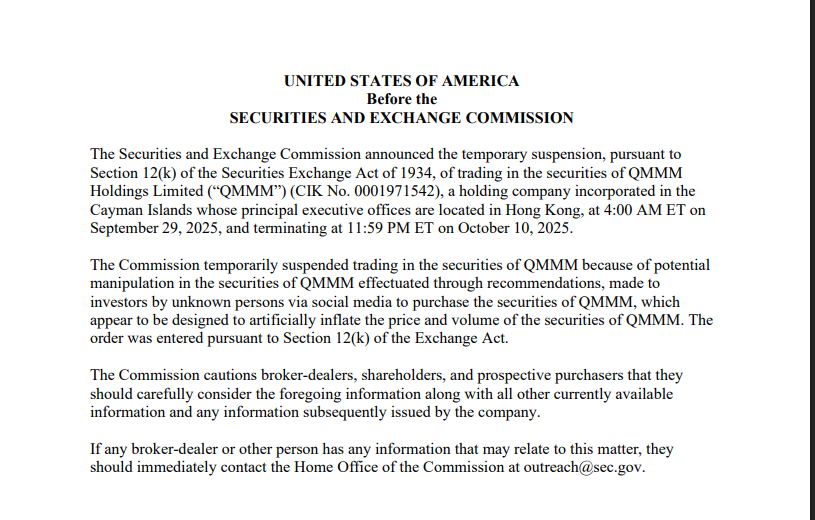

The scale and speed of QMMM’s rally quickly attracted regulatory attention. On 29 September 2025, the SEC ordered a temporary suspension of QMMM’s shares, effective until 10 October 2025.

The regulator cited “concerns regarding the accuracy and adequacy of publicly available information” and flagged “unusual trading activity linked to social media promotions”. The halt allows regulators to investigate whether market manipulation or securities law violations occurred.

By halting trading, the SEC signalled its intent to safeguard investors and preserve market integrity. The agency has taken similar actions in the past against little-known firms experiencing sudden speculative surges tied to crypto announcements.

What It Means for Investors

For QMMM shareholders, the suspension creates significant uncertainty. Investors who bought in at peak prices now face being locked into positions with no immediate ability to sell. The eventual outcome of the SEC’s investigation could result in resumed trading, additional restrictions, or further regulatory penalties.

Market analysts caution that even if QMMM’s stock is reinstated, volatility is likely to remain extreme. The lack of clarity around the company’s actual ability to manage a crypto treasury leaves investors exposed to both regulatory and operational risks.

“This is a classic case of hype running ahead of fundamentals,” noted one Hong Kong-based equity strategist. “The SEC had little choice but to step in.”

Wider Implications

The QMMM episode reflects a broader crossroads for global markets. On one hand, traditional firms are increasingly experimenting with cryptocurrencies, recognising both investor demand and the potential for digital assets to transform balance sheets. On the other, regulators remain vigilant about speculative excess, misinformation and manipulation risks.

The SEC’s decisive action underlines a global trend of tightening scrutiny on crypto-linked corporate moves. While some industry voices warn that aggressive oversight could slow mainstream adoption, regulators argue that unchecked speculation poses greater systemic dangers.

For companies, the lesson is clear: venturing into digital assets without robust governance, expertise and risk frameworks can trigger both market chaos and regulatory backlash.

Expert Analysis

Financial analysts are split on the long-term consequences. Some see the SEC’s suspension as a necessary safeguard to protect retail investors from speculative bubbles. Others caution that regulatory overreach could discourage legitimate firms from integrating digital assets into their operations.

What is certain is that the outcome of the SEC’s investigation into QMMM could establish an important precedent. How securities laws are applied in cases where companies pivot dramatically toward crypto will shape the contours of corporate adoption in the years ahead.

Outlook

QMMM’s meteoric rise and abrupt trading halt serve as a cautionary tale about the risks of combining cryptocurrency hype with traditional equity markets. While the promise of digital assets continues to attract companies and investors alike, the episode underscores the thin line between innovation and speculation.

For investors, the key takeaway is vigilance: when stock prices rise nearly tenfold on the back of untested strategies and online chatter, the risks often outweigh the rewards.

Leave a Reply