The United States Securities and Exchange Commission (SEC) has officially acknowledged the application submitted by Trump Media & Technology Group for a new Bitcoin and Ethereum exchange-traded fund (ETF). This move triggers the SEC’s review clock, giving the regulator a limited time to approve or reject the proposal.

The ETF, if approved, will trade on NYSE Arca and offer combined exposure to the two leading cryptocurrencies: 75% allocated to Bitcoin and 25% to Ethereum. The announcement positions Truth Social in the growing race to launch next-generation crypto investment vehicles, adding political weight to the push for broader digital asset adoption in the US financial system.

Fund Structure and Key Partners

According to the filing, the ETF’s digital assets will be securely managed by Foris DAX Trust Company, which will serve as the fund’s custodian. Yorkville America Digital, an asset management firm, is the official sponsor.

The ETF’s net asset value (NAV) will be evaluated daily using benchmark indexes provided by CME CF. The Bitcoin portion will rely on the CME CF Bitcoin Reference Rate, while Ether valuations will be based on the CME CF Ether Reference Rate, unless the sponsor chooses an alternative method at its discretion.

Custodial practices are outlined clearly in the filing. Both Bitcoin and Ether will be stored in separate accounts, isolated from other customer assets. Additionally, private keys will be stored in cold wallets, a preferred security measure to minimise the risk of digital theft.

The S-1 registration form for this dual crypto ETF was first submitted on June 16, indicating a relatively swift acknowledgment by the SEC.

Spot Solana ETF Faces Another Delay

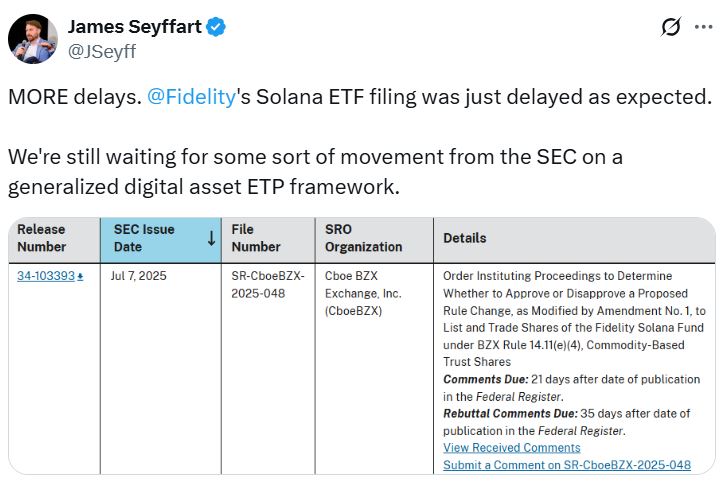

While Trump’s Bitcoin-Ether ETF sees forward motion, Fidelity’s application for a Solana-based spot ETF has hit another regulatory roadblock. The SEC has delayed making a decision, instead opening a new public comment period.

Filed by Cboe BZX Exchange on March 25, the Fidelity Solana ETF proposal is now subject to a 21-day window for public responses and a 35-day period for rebuttals. The delay, while unsurprising to analysts, signals the SEC’s cautious approach to expanding spot crypto ETF offerings beyond Bitcoin and Ethereum.

Bloomberg ETF analyst James Seyffart remarked on X (formerly Twitter) that the delay was “expected,” but added that any regulatory engagement should be viewed as a step in the right direction.

SEC Hints at Broader ETF Framework

The SEC is reportedly considering a streamlined framework to handle the growing number of crypto ETF applications. This would include automating parts of the approval process for digital asset products, reducing bureaucratic hurdles while maintaining regulatory oversight.

In a separate post, Seyffart also noted that the SEC has asked issuers of Solana ETFs to refile updated applications by the end of the month. While this does not guarantee approval, the continued dialogue between regulators and applicants may indicate a softening stance toward digital asset-based financial products.

Importantly, Seyffart cautioned that amendments and application resubmissions “are not approvals,” but rather necessary steps in the ongoing negotiation process between exchanges, issuers, and regulators.

Market Implications and Outlook

Truth Social’s foray into the ETF space adds a new layer of political visibility to crypto adoption in traditional finance. If approved, the Bitcoin-Ether ETF could attract a wide base of investors, ranging from institutional traders to retail holders seeking regulated exposure to digital assets.

At the same time, the delay of Solana’s ETF highlights the SEC’s hesitance to fully embrace the broader altcoin market without first establishing a consistent regulatory framework. Until such guidelines are finalised, applications will continue to face scrutiny and delays.

Nonetheless, the SEC’s acknowledgment of multiple filings and its willingness to engage in dialogue, could signal a more open stance in the near future. For investors, this mix of momentum and caution defines the current landscape for crypto ETFs in the US.

Leave a Reply