In a landmark move for UK capital markets, The Smarter Web Company has raised £15.8 million ($21 million) through a Bitcoin-denominated bond offering, becoming one of the first British firms to tap into cryptocurrency for structured corporate fundraising. The bond, named “Smarter Convert,” was fully subscribed and backed by the French asset management firm Tobam.

Innovative Fundraising Model with Tobam Backing

The Smarter Web Company, a UK-listed firm known for holding Bitcoin on its corporate balance sheet, partnered with Tobam to design the Bitcoin-denominated convertible bond. Tobam, which manages over $2 billion in assets, invested in the bond through three of its managed funds. The French firm has been active in the crypto space since 2017, when it launched the first Bitcoin mutual fund targeting institutional investors.

Tobam’s CEO, Yves Choueifaty, emphasised the company’s commitment to long-term strategic alignment and described the partnership as an extension of its belief in digital assets.

Convertible Bond with a Premium Structure

The bond is structured with a 12-month maturity period and is convertible into Smarter Web Company shares at a five per cent premium over the company’s stock price on the day before launch. With the share price at $2.60, the bond converts at $2.73 per share. If fully converted, the company will issue just over 7.7 million new shares.

The bond also includes a forced conversion clause. If the company’s share price increases by 50 per cent above the conversion rate for ten consecutive trading days, the company can require bondholders to convert their bonds into shares. If holders choose not to convert, the firm will repay 98 per cent of the bond principal in Bitcoin, adjusted for the cryptocurrency’s market price at the time of maturity.

Minimising Dilution While Growing Bitcoin Holdings

Unlike traditional equity raises, this bond structure allows The Smarter Web Company to increase its capital without immediate shareholder dilution. The company also benefits from a premium-based structure that reduces dilution by approximately five per cent compared to standard equity issuance.

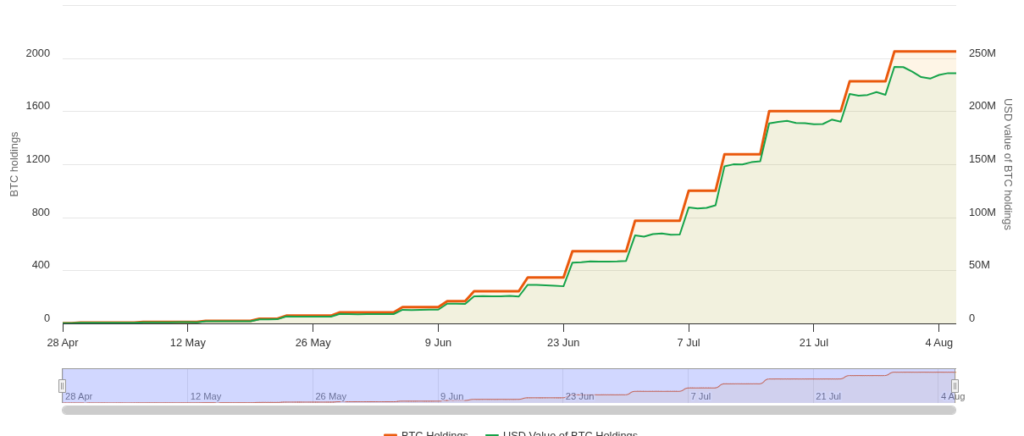

Moreover, the deal enables the firm to increase its Bitcoin reserves. As of the end of July, the company added 225 BTC to its holdings, bringing its total to 2,050 BTC, valued at approximately $234 million according to BitcoinTreasuries.NET.

UK Market First in Crypto-Backed Bonds

Andrew Webley, CEO of The Smarter Web Company, described the bond structure as a first for UK capital markets. He said the move opens a new segment of capital and enhances the firm’s funding strategy. Webley also highlighted the firm’s ambition to become one of the largest publicly listed companies in the UK.

This Bitcoin-denominated bond sets a precedent for crypto-aligned corporate finance in the UK, offering a model that combines blockchain-based assets with traditional financial instruments in a regulated environment.

Leave a Reply