Solana’s TVL Falls $5 Billion in 30 Days

The Solana blockchain has seen a significant decline in total value locked (TVL), plunging by 39.2% in the past month. This marks the largest monthly drop since November 2022, when the collapse of the FTX exchange sent shockwaves through the crypto market.

Solana’s TVL, which peaked at $12.1 billion on 24 January, now stands at $7.4 billion. TVL measures the total value of assets deposited in decentralised finance (DeFi) protocols, serving as a key indicator of network activity and investor sentiment. A rising TVL reflects confidence in the ecosystem, while a sharp decline suggests capital outflows, reduced liquidity, and waning interest from investors.

According to data from DefiLlama, the most significant decrease came from Raydium, which saw a 53% drop in the past month. Other major decentralised applications (DApps) such as Jupiter DEX, Jito liquid staking, and Save Lending also reported declines of 25%, 41%, and 42%, respectively.

This downturn has had a direct impact on Solana’s on-chain volumes, which have fallen drastically from $97 billion in weekly transactions in mid-January to just $11 billion this week.

Memecoin Market Cap Plummets 70%

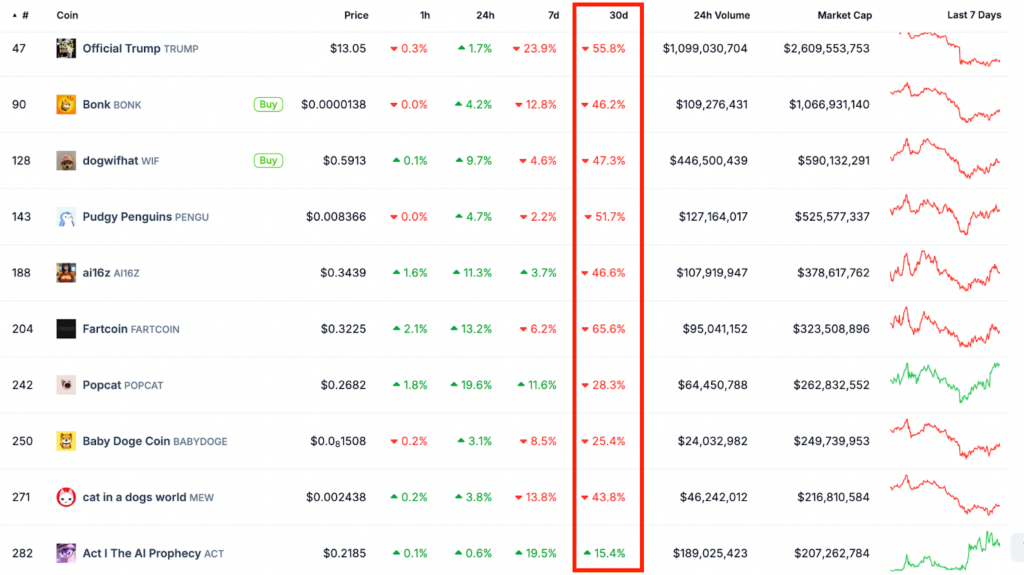

The decline in Solana’s TVL mirrors a steep drop in the market capitalisation of Solana-based memecoins, which have suffered heavy losses over the past few months. Many of these tokens have experienced double-digit percentage declines daily, with some trading at 80% to 90% below their all-time highs.

At its peak in December 2024, Solana’s memecoin market cap stood at $25 billion. However, it has since dropped to $8.3 billion, representing a 68% collapse in under three months.

This decline has been accompanied by falling activity on decentralised exchanges (DEXs) that facilitate memecoin trading. Data shows that daily DEX trading volume for Solana-based memecoins—including those launched on Pump.fun—plunged from $22.1 billion on 19 January to just $1.6 billion by 26 February.

This reduced trading activity signals diminishing interest in the network, negatively impacting demand for SOL, the blockchain’s native cryptocurrency.

SOL Price Risks Further Decline

Solana’s native token, SOL, is currently trading at $137.17, marking a 41% decline over the past 30 days. The cryptocurrency is now 52% below its all-time high of $295, recorded on 19 January.

From a technical standpoint, SOL has formed a bearish double-top pattern, suggesting further downside risk. The token is hovering around crucial support at $135, but if this level fails, a further drop to the $120-$110 range is likely, representing a potential 22% decline from its current price.

However, there are signs of possible support at this level. The Relative Strength Index (RSI) has dropped to 28, indicating that SOL is in oversold territory. If demand picks up at this level, it could trigger a recovery in the coming days.

Popular crypto analyst Gum suggests that the lowest SOL might go is “around 10% higher than the last price Galaxy and other funds bought the FTX-locked SOL,” estimating a potential bottom at $110 before a bounce.

While Solana’s recent struggles paint a bleak picture, the coming weeks will determine whether the network can regain investor confidence or continue its downward trajectory.

Leave a Reply