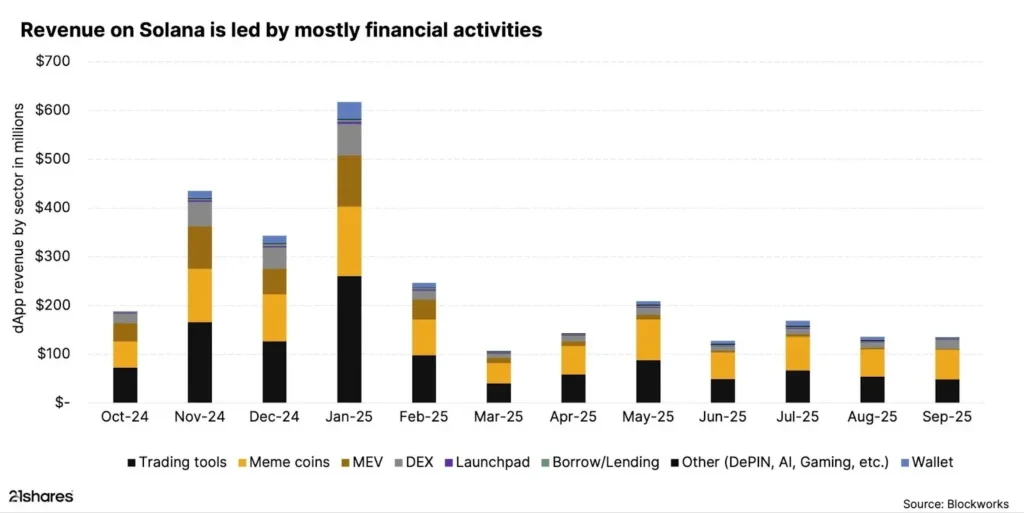

Solana has recorded a stunning financial year, generating approximately $2.85 billion in annual revenue, a milestone that positions the blockchain network ahead of Ethereum’s early growth trajectory. According to a new report by 21Shares, SOL averaged $240 million in monthly revenue between October 2024 and September 2025, with a peak of $616 million in January during the height of the memecoin trading frenzy.

The surge marks a monumental leap from the previous year’s $13 million in revenue, representing a 220-fold increase. This growth underscores a fundamental transformation in Solana’s network maturity, market adoption and ability to capture real economic value across its ecosystem.

Trading Platforms Lead Solana’s Revenue Boom

The 21Shares report highlights that decentralised trading platforms (DEXs) and related applications were the primary drivers of SOL’s revenue explosion. Trading-related protocols accounted for around 30% of total network income, equivalent to $1.12 billion.

Notably, platforms such as Photon and Axiom emerged as standout performers, generating over $260 million in a single month at the height of the memecoin frenzy in late 2024 and early 2025. Alongside trading tools, other contributors included launchpads, wallets, borrowing and lending protocols, AI-based dApps, and DePIN projects, reflecting the ecosystem’s increasing diversity.

Validators also contributed significantly, earning revenue from transaction fees, a testament to Solana’s high throughput and low-cost structure. The network’s ability to handle thousands of transactions per second at costs below $0.01 continues to attract developers and traders seeking scalability and affordability.

Solana Outpaces Ethereum’s Early Performance

21Shares’ analysis underscores Solana’s dominance relative to Ethereum’s early performance metrics. Ethereum, during its comparable lifecycle phase between 2019 and 2020, generated less than $10 million in monthly revenue, roughly 20 to 30 times lower than Solana’s current figures.

At its peak, SOL’s monthly revenue was over 50 times higher than Ethereum’s early averages. The report attributes this to Solana’s technical architecture, which allows for high transaction throughput and low fees, enabling rapid user adoption and network activity.

Solana’s daily active addresses now range between 1.2 million and 1.5 million, approximately three times more than Ethereum achieved at the same stage of development. This reflects a growing user base driven by both retail traders and emerging institutional participants.

From Post-FTX Skepticism to Institutional Adoption

Just a year ago, SOL was battling skepticism following a string of network outages, the collapse of FTX and regulatory scrutiny. However, the latest data indicates a decisive turnaround. The blockchain’s total DeFi total value locked (TVL) has reached nearly $13 billion, while stablecoin transaction volumes have surged sixfold year-on-year.

Moreover, the network now hosts over $500 million in tokenised real-world assets (RWAs), reinforcing its transition from speculative activity to genuine utility. This evolution has also caught the attention of institutions, with nearly $4 billion in SOL held on public company balance sheets.

Prominent holders include Pantera Capital, Forward Industries, and Brera Holdings, all signalling confidence in SOL’s long-term trajectory. According to 21Shares, this institutional engagement reflects a “reframing of Solana’s role” from a speculative asset to a credible infrastructure layer for decentralised applications and financial products.

ETF Approvals Could Fuel the Next Growth Phase

As Solana continues to gain momentum, attention now turns to the potential approval of U.S. spot SOL exchange-traded funds (ETFs). The Securities and Exchange Commission (SEC) is expected to issue decisions on multiple applications this month, including filings from Fidelity, VanEck, Grayscale, Canary, and Franklin Templeton, all with deadlines set for this Friday.

Applications from 21Shares and Bitwise are scheduled for review on 16 October. According to Polymarket data, there is a 99% probability of a Solana ETF being approved before the end of 2025, a development that could unlock a significant wave of institutional and retail capital into the ecosystem.

21Shares, which launched the world’s first Solana ETP in 2021, noted that ETF approval would “further unlock access and liquidity,” positioning Solana alongside Bitcoin and Ethereum as a top-tier investable crypto asset.

Upgrades Set the Stage for Continued Expansion

Solana’s future growth prospects remain strong, backed by upcoming technical upgrades aimed at improving scalability and speed. The Firedancer validator client, developed by Jump Crypto, is expected to increase the network’s capacity to 1 million transactions per second (TPS) by 2025.

Additionally, the recently approved Alpenglow update reduces finality times to under 200 milliseconds, enhancing the user experience for both traders and developers. These advancements could make SOL one of the fastest and most efficient blockchains in the market.

A Network Entering Maturity

With its $2.85 billion annual revenue, thriving ecosystem and imminent ETF catalysts, SOL is emerging as a powerhouse in the crypto economy. What was once seen as a high-risk “Ethereum killer” narrative has evolved into a story of network maturity, real-world adoption and institutional legitimacy.

As 21Shares concluded, Solana’s growth trajectory “signals a fundamental shift in how blockchain networks can capture and sustain value.” Whether this momentum can propel Solana into sustained dominance will depend on how effectively it scales, but for now, the numbers tell a clear story: Solana has arrived.

Leave a Reply