Somnia (SOMI) has been capturing market attention as its bullish momentum strengthens. The altcoin has shown resilience, attracting renewed investor interest and consolidating recent gains. With improving market sentiment and growing capital inflows, the question now is whether Somnia can achieve a 40% rally and revisit its all-time high (ATH) in the coming weeks.

Investors Show Renewed Confidence

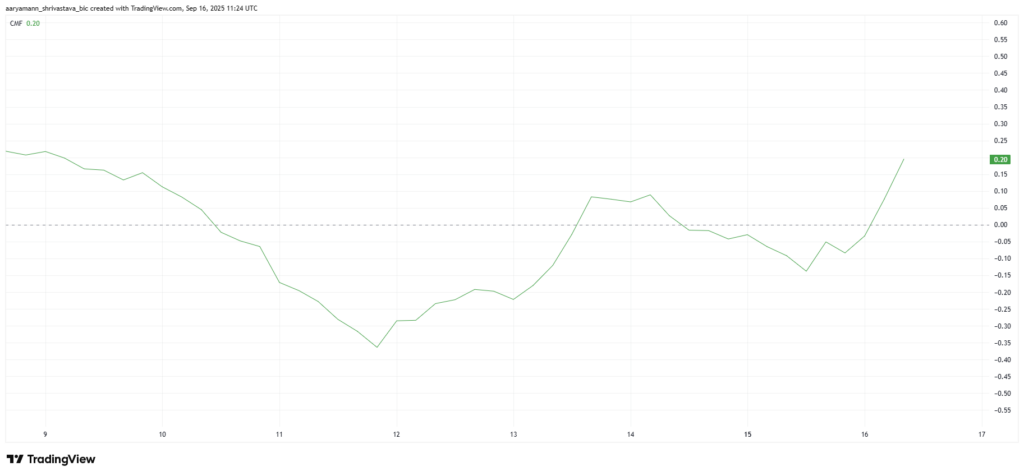

The Chaikin Money Flow (CMF) indicator, a metric that tracks capital inflows and outflows, highlights rising investor optimism toward Somnia. Recent data shows the CMF trending upwards, signalling that more funds are entering the token than leaving it.

This growing liquidity base reinforces confidence among market participants. Such inflows are often a precursor to sustained bullish moves, as they demonstrate that traders and long-term investors are positioning themselves for further upside. The steady build-up of buying pressure is setting the stage for SOMI to attempt a breakout and potentially reclaim its ATH.

Correlation With Bitcoin Strengthens

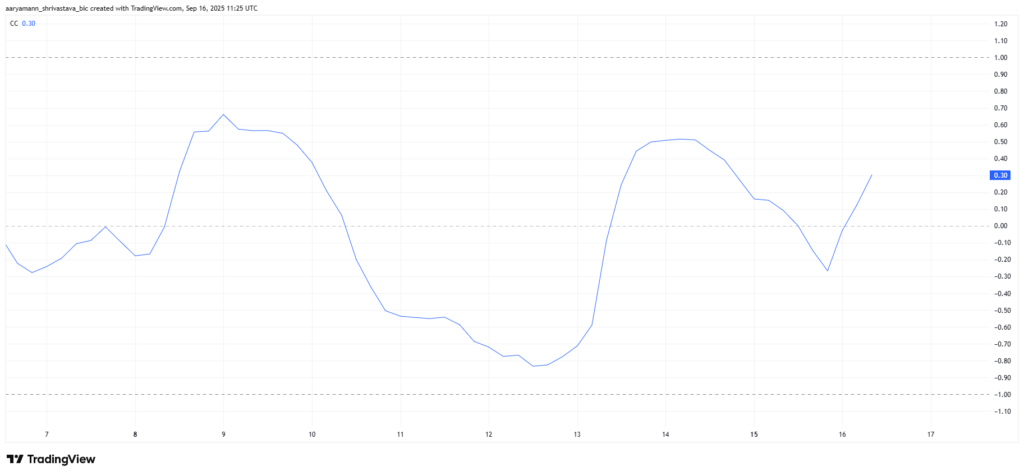

One of the notable shifts in Somnia’s recent performance is its evolving correlation with Bitcoin (BTC). Previously, the token displayed a negative correlation of -0.35, often moving in the opposite direction of the leading cryptocurrency. However, the correlation has now improved to 0.30, signalling that SOMI is beginning to align more closely with broader market trends.

While this figure still represents a moderate relationship, the shift is significant. Historically, when altcoins strengthen their correlation with Bitcoin during bullish phases, they tend to ride the momentum of the broader market. If Bitcoin continues its upward trajectory, Somnia could benefit from this spillover effect, further fuelling its price momentum and investor appeal.

Resistance and Support Levels in Play

At the time of writing, SOMI is trading at $1.32. The token has established strong support at $0.96, a level that has repeatedly cushioned it against downside pressure. However, the $1.44 resistance has proven to be a stubborn barrier in recent trading sessions.

For Somnia to confirm its bullish trajectory, it needs to decisively break above this resistance. Flipping $1.44 into support would clear the way for the token to make a run toward its ATH of $1.90. Such a move would represent nearly a 40% rally from current levels, a milestone that could draw even more attention from retail and institutional investors.

However, should selling pressure mount, a drop below $0.96 could signal a breakdown. In that scenario, SOMI risks sliding toward $0.57, undermining its bullish outlook and dampening investor sentiment.

Outlook: A Rally on the Horizon?

With rising inflows, growing market optimism and improving alignment with Bitcoin, Somnia is in a promising position. A breakout above $1.44 would be a critical technical milestone, potentially setting the stage for a retest of the ATH.

Still, the market remains vulnerable to shifts in sentiment. Any unexpected surge in selling pressure could reverse gains and expose SOMI to deeper corrections. For now, the balance of signals favours the bulls, but the coming weeks will determine whether Somnia can transform its momentum into a historic rally.

Leave a Reply