Institutional Interest in Crypto Drives Market Rally

Shares of major South Korean banks have surged following a wave of stablecoin-related trademark filings, highlighting growing institutional interest in the digital asset space. According to data from Google Finance, the stock prices of Kakao Bank, Kookmin Bank, and the Industrial Bank of Korea rose between 10 and 19 percent after they filed applications for Korean won-pegged stablecoin trademarks.

The rise in share prices comes in the wake of the inauguration of South Korea’s 21st president, Lee Jae-myung, on 4 June. His campaign included several crypto-friendly promises, including the development of a national stablecoin linked to the Korean won. These developments appear to have boosted investor confidence and generated excitement across the banking sector.

Kakao Bank Leads the Surge

Kakao Bank saw one of the most significant increases following its trademark applications. On 23 June, the bank filed for at least 12 crypto-related trademarks, according to South Korean media outlet Industry News. The day after the filing, the bank’s stock price jumped from $22.60 to $27, marking a 19.3 percent gain.

Data from the World Intellectual Property Organization confirmed the filings, further solidifying the bank’s commitment to entering the digital asset space. Despite the market enthusiasm, Kakao Bank has not yet issued a formal statement outlining its stablecoin plans.

Kookmin and Industrial Bank Follow Suit

Kookmin Bank, a subsidiary of KB Financial Group, also filed for stablecoin trademarks on 23 June. Although its stock initially experienced a modest 4.3 percent rise to $82 on 24 June, its value continued to climb over the following days. At the time of writing, Kookmin’s shares are trading at $89, representing a total increase of 13.38 percent since the filing.

The Industrial Bank of Korea followed on 27 June with its own set of stablecoin trademark applications. The move sparked an immediate market response, pushing its share price from $13.30 to $14.70 — a 10.1 percent rise. Like the other banks, the Industrial Bank of Korea has yet to release official details on its crypto-related ambitions.

Stablecoin Momentum Builds Despite Regulatory Gaps

As investor interest heats up, the broader South Korean banking sector appears increasingly eager to participate in the stablecoin race. Some banks have hinted at collaborative efforts to launch a national stablecoin, although no formal partnerships have been announced.

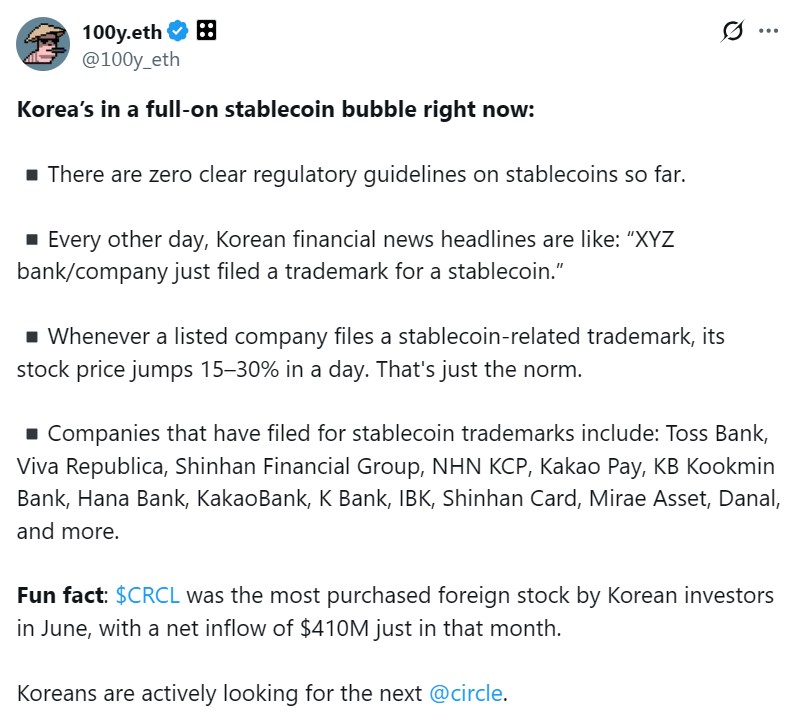

However, not everyone is convinced this enthusiasm is sustainable. A lead researcher at crypto think tank Four Pillars, known online as 100y, warned on social media platform X that the current scenario may represent a “stablecoin bubble.” The researcher noted that, while bank stocks have surged, South Korea still lacks comprehensive regulatory guidelines for stablecoins. This absence of clarity could raise long-term concerns about the viability and safety of these digital assets.

Unanswered Questions from Key Banks

Journalists attempted to contact Kakao Bank, Kookmin Bank, and the Industrial Bank of Korea for further insight into their stablecoin strategies, but none of the institutions responded before publication. As excitement continues to build, the industry awaits clearer communication from the banks involved and firmer regulatory direction from South Korean authorities.

The recent market performance underscores the growing role digital assets are playing in traditional finance. Yet the road ahead remains uncertain without a legal framework to govern stablecoin issuance and usage. For now, investor optimism appears to be driving the narrative — but whether it is justified remains to be seen.

Leave a Reply