Spot Bitcoin exchange traded funds in the United States faced a sharp wave of withdrawals during the Christmas holiday week, shedding a combined 782 million dollars as investors trimmed exposure amid seasonal slowdowns. Market analysts say the pullback reflects year end positioning and lighter trading activity rather than a meaningful drop in institutional confidence toward Bitcoin.

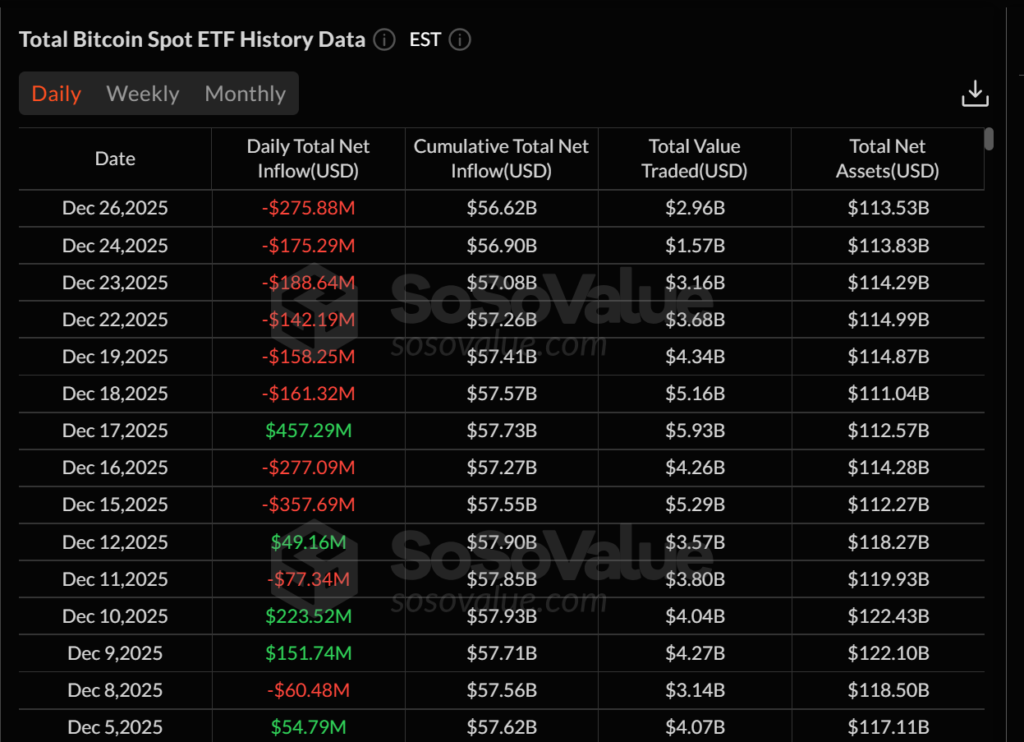

Data from SoSoValue shows that the selling pressure stretched across several major products, extending a multi day trend that has become the longest ETF outflow streak since early autumn.

Christmas Week Sees Heavy Redemptions

Spot Bitcoin ETFs recorded their largest weekly outflows in over a month, with investors pulling money steadily over six consecutive trading days. The heaviest single day withdrawal came on Friday, when net outflows reached 276 million dollars.

BlackRock’s iShares Bitcoin Trust led the decline, losing nearly 193 million dollars in one day. Fidelity’s Wise Origin Bitcoin Fund followed with 74 million dollars in outflows, while Grayscale’s GBTC continued to post smaller but persistent redemptions.

Over the six day stretch, total outflows crossed 1.1 billion dollars, marking the longest run of withdrawals since September. Despite the selling pressure in ETFs, Bitcoin prices remained relatively stable, trading close to the 87,000 dollar level throughout the period.

ETF Assets Dip Despite Stable Bitcoin Price

As a result of the sustained outflows, total net assets held by US listed spot Bitcoin ETFs fell to approximately 113.5 billion dollars by the end of the week. This was down from highs above 120 billion dollars earlier in December.

The decline in ETF assets came even as Bitcoin avoided major price swings, suggesting that the selling was driven more by portfolio adjustments than by bearish sentiment on the asset itself. Market participants noted that reduced liquidity and limited desk activity during the holidays often amplify short term flow trends.

Analysts Point to Holiday Positioning

Industry experts have played down concerns that the withdrawals signal weakening institutional demand. Vincent Liu, chief investment officer at Kronos Research, said ETF outflows around Christmas are common as traders close books, manage risk, and prepare for the new year.

According to Liu, thinner liquidity during the holiday period can exaggerate the appearance of outflows, even when long term interest remains intact. He added that institutional participation typically resumes once desks return in early January and normal trading volumes pick up.

Liu also highlighted broader macro factors that could support ETF demand in the coming months. He pointed to expectations of monetary easing further down the line, with rate markets already pricing in between 75 and 100 basis points of cuts. Lower rates, combined with expanding bank led crypto infrastructure, could make Bitcoin exposure more attractive to large allocators.

Glassnode Flags Broader ETF Cooling

While some analysts see the Christmas week outflows as temporary, on chain data firm Glassnode has noted a broader cooling trend across crypto ETFs. In a recent report, Glassnode said both Bitcoin and Ether ETFs have entered a sustained outflow phase since early November.

The 30 day moving average of net flows into US spot Bitcoin and Ether ETFs has remained negative, indicating subdued institutional participation as global liquidity conditions tighten. Ether ETFs, which were expected to attract fresh inflows after their launch, have also struggled to maintain consistent demand.

Because ETFs are often viewed as a proxy for institutional sentiment, prolonged outflows suggest that some large investors are reducing crypto exposure after playing a major role in driving markets earlier in the year.

Institutional Interest Faces Short Term Pause

The recent ETF withdrawals highlight a pause in institutional momentum rather than a full reversal. Many investors appear to be taking profits, managing balance sheets, or waiting for clearer signals on interest rates and macro policy before increasing exposure again.

With Bitcoin holding firm near recent highs and infrastructure around regulated crypto products continuing to mature, analysts expect flows to stabilize once the holiday lull ends. Early January could provide clearer insight into whether institutions return to the market or remain cautious as 2026 approaches.

Leave a Reply