Spot Bitcoin exchange-traded funds (ETFs) faced a significant setback on Friday, registering the second-largest single-day outflow in their history. Meanwhile, Ethereum ETFs ended their longest-ever inflow streak, marking a turbulent moment in the crypto investment landscape.

Bitcoin ETFs Record Major Outflow

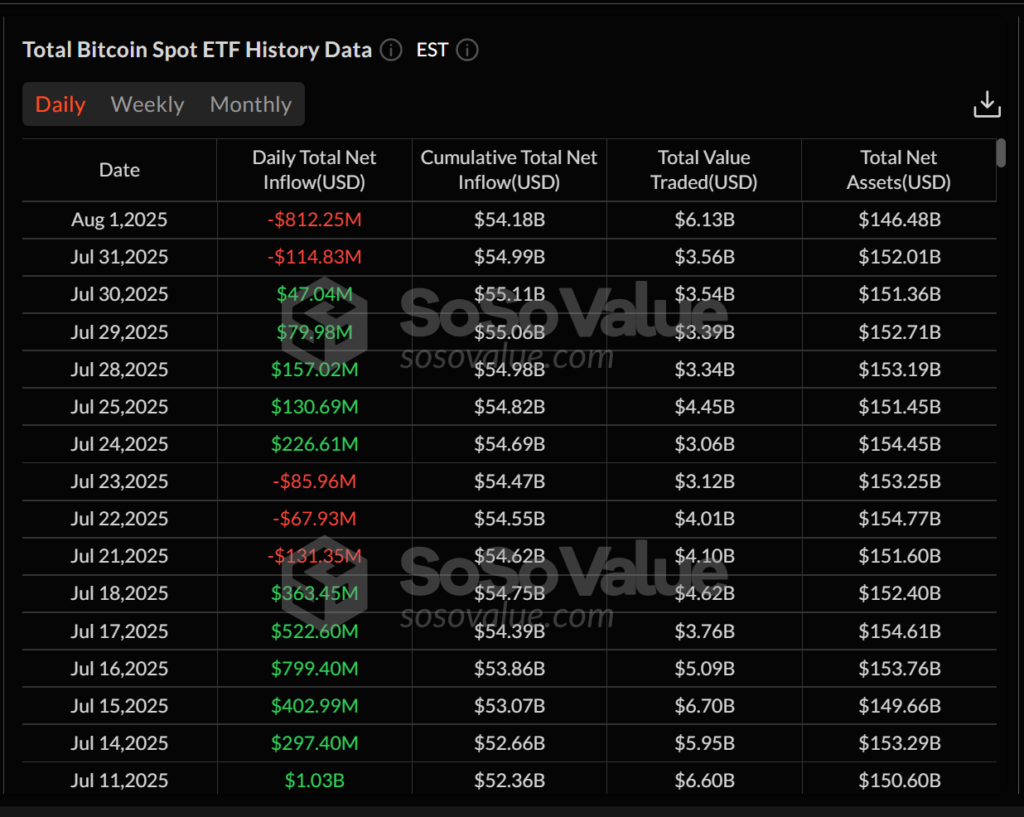

Spot Bitcoin ETFs saw a combined net outflow of $812.25 million, wiping out a week of steady gains. The total net inflows dropped to $54.18 billion, while assets under management (AUM) fell to $146.48 billion. This figure now represents 6.46 percent of Bitcoin’s total market capitalisation, according to SoSoValue.

Fidelity’s FBTC led the downturn with $331.42 million in redemptions, closely followed by ARK Invest’s ARKB, which reported outflows of $327.93 million. Grayscale’s GBTC lost $66.79 million, and BlackRock’s IBIT saw relatively minor redemptions of $2.58 million.

Despite the heavy outflows, trading volumes remained robust. Over $6.13 billion was traded across all Bitcoin ETFs, with BlackRock’s IBIT contributing $4.54 billion, suggesting sustained investor interest even amid losses.

Ethereum ETFs Break 20-Day Winning Streak

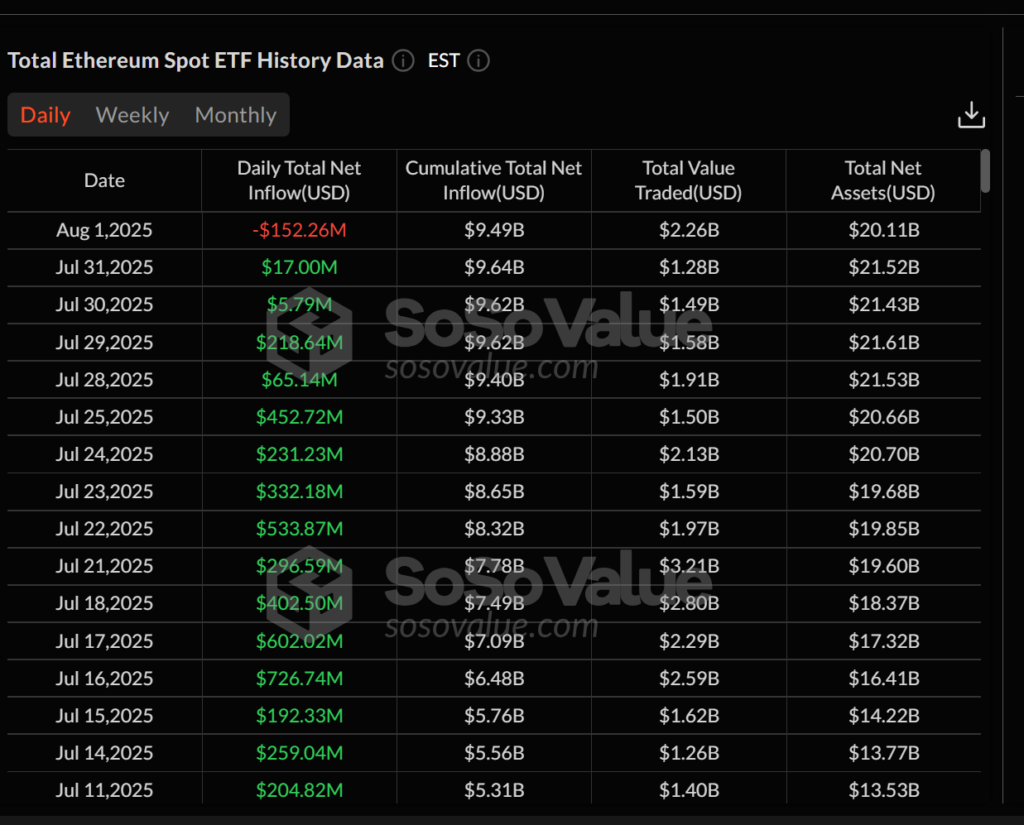

In contrast to Bitcoin’s dramatic one-day outflow, Ethereum ETFs saw the end of a 20-day inflow streak, the longest since their inception. On Friday, Ether-based funds recorded a net outflow of $152.26 million, bringing total AUM to $20.11 billion. This now accounts for 4.70 percent of Ethereum’s market cap.

Grayscale’s ETHE led the losses with $47.68 million in outflows. Bitwise’s ETHW followed with $40.30 million in redemptions, while Fidelity’s FETH reported $6.17 million in losses. BlackRock’s ETHA remained unchanged, holding its AUM steady at $10.71 billion.

Ethereum ETFs saw total daily trading volumes of $2.26 billion. Grayscale’s ETHE stood out with $288.96 million in trades, reflecting heightened volatility.

Record Inflows in July Fuelled Ether Momentum

The recent drawdown came after a historic surge in Ethereum ETF inflows earlier in July. On 16 July, Ethereum ETFs attracted a record $726.74 million in one day, followed by another $602.02 million on 17 July. These milestones underscored the growing institutional appetite for Ether products.

Corporates Turning to Ether Over Bitcoin

Standard Chartered has reported that corporate interest in Ether now exceeds that of Bitcoin, with companies acquiring Ether at twice the rate since early June. The report suggests that crypto treasury firms have collectively acquired about 1 percent of Ethereum’s circulating supply in just two months.

This accumulation trend, combined with sustained ETF inflows, has supported Ether’s recent rally. The bank projects that ETH could surpass $4,000 by year-end. It also forecasts that corporate holdings could eventually rise to 10 percent of Ethereum’s total supply, driven by benefits like staking and decentralised finance participation.

Market Outlook Remains Divided

While the sharp ETF outflows reflect short-term caution among investors, the continued high trading volumes and corporate accumulation of Ether point to longer-term confidence. Analysts are closely watching how the ETF market stabilises in the coming weeks, particularly ahead of anticipated regulatory updates and macroeconomic signals.

Leave a Reply