Rising use for salaries and everyday payments

Stablecoins are moving beyond trading desks and into daily financial life, according to a new global survey commissioned by BVNK and conducted by YouGov. The study found that 39 percent of crypto users and those planning to enter the market already receive some form of income in stablecoins, while 27 percent use them for everyday payments.

The online survey covered 4,658 respondents across 15 countries during September and October 2025. Participants were adults who either currently hold cryptocurrency or expect to acquire it. Lower transaction fees and faster cross-border transfers emerged as the main reasons for choosing stablecoins over traditional banking options.

Wallet balances and spending habits

On average, stablecoin users worldwide keep about 200 dollars worth of tokens in their wallets. In higher-income economies, that figure rises sharply to around 1,000 dollars, reflecting greater disposable income and more frequent use for savings or payments.

The survey also revealed strong interest in closer integration with mainstream finance. Around 77 percent of respondents said they would open a stablecoin wallet with their primary bank or fintech provider if the option were available. Another 71 percent expressed interest in using a debit card linked directly to stablecoin balances, allowing them to spend digital dollars or euros as easily as cash.

For those already paid in stablecoins, the assets make up roughly 35 percent of their annual income on average. Respondents who use stablecoins for international transfers reported saving about 40 percent on fees compared with traditional remittance services.

Stronger adoption in emerging markets

Adoption levels were notably higher in middle- and lower-income economies. About 60 percent of respondents in these regions said they hold stablecoins, compared with 45 percent in high-income countries. Africa recorded the highest ownership rate at 79 percent and also showed the strongest growth in holdings over the past year.

Spending behavior followed a similar pattern. More than half of all crypto holders said they had made a purchase specifically because a merchant accepted stablecoins. In emerging markets, that share climbed to 60 percent. While 28 percent of respondents currently use stablecoins for major or lifestyle purchases, 42 percent said they want to do so in the future, pointing to room for further growth as acceptance expands.

Multiple tokens and preferred platforms

A BVNK spokesperson said the research was designed to understand how existing and prospective crypto users behave, rather than to measure adoption across the general population. One key finding was that users rarely rely on a single issuer. Instead, many hold a mix of dollar- and euro-pegged stablecoins, spreading balances across multiple tokens.

When asked where they prefer to manage their stablecoins, 46 percent chose crypto exchanges. Payment apps with built-in crypto features, such as PayPal or Venmo, followed at 40 percent, while 39 percent preferred mobile crypto wallet apps. Only 13 percent said they would rather store stablecoins in a hardware wallet, suggesting convenience still outweighs maximum self-custody for most users.

Payroll integration gathers pace

Regulatory clarity is helping push stablecoins into formal payroll systems. In the United States, the passage of the GENIUS Act, alongside Europe’s Markets in Crypto-Assets Regulation, has encouraged companies to explore digital asset settlement for wages and cross-border payouts.

On Feb. 11, global payroll platform Deel announced plans to offer stablecoin salary payouts through a partnership with MoonPay. The service is set to launch next month for workers in the United Kingdom and European Union, with expansion to the United States planned later. Employees will be able to receive part or all of their wages in stablecoins to non-custodial wallets, while MoonPay handles conversion and onchain settlement and Deel continues to oversee payroll and compliance.

Enterprise activity in the sector is also accelerating. Paystand recently acquired Bitwage, strengthening its cross-border stablecoin payout and foreign exchange capabilities. Paystand said its network has processed more than 20 billion dollars in payment volume to date.

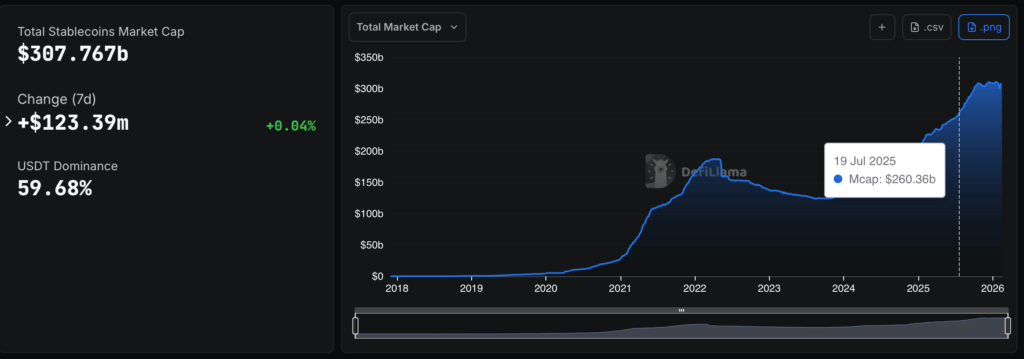

Market growth supports everyday use

Stablecoins are typically pegged one-to-one with fiat currencies such as the US dollar or euro, which makes them more suitable for payments than more volatile cryptocurrencies. That stability is reflected in the market’s rapid expansion. Data from DefiLlama shows the global stablecoin market now stands at 307.8 billion dollars, up from 260.4 billion dollars in mid-July, around the time the US GENIUS Act was signed into law.

As regulation, infrastructure, and consumer familiarity continue to improve, the survey suggests stablecoins are steadily becoming a practical option for salaries, shopping, and cross-border payments rather than just a niche crypto product.

Leave a Reply