Stablecoins are emerging as a serious risk to traditional banking deposits across the United States and globally according to a new report by Standard Chartered. The bank’s digital assets research team warns that the rapid growth of dollar backed cryptocurrencies could significantly weaken banks’ funding bases particularly at regional institutions.

The analysis comes amid ongoing debate in Washington over the proposed CLARITY Act which would restrict stablecoin issuers from paying interest. The delay in passing the legislation has renewed concerns within the banking sector about potential deposit losses.

One Third of Stablecoin Growth Could Drain US Deposits

Geoff Kendrick Global Head of Digital Assets Research at Standard Chartered said stablecoins now represent a direct challenge to conventional banking models.

The report estimates that for every dollar added to the stablecoin market roughly one third may be diverted from US bank deposits. With dollar pegged stablecoins currently valued at about 301 billion dollars this represents a substantial risk.

Kendrick noted that stablecoins offer users fast digital transactions global accessibility and perceived safety which makes them attractive alternatives to traditional deposit accounts. As adoption increases more customers may choose to hold funds in crypto based instruments rather than in banks.

The delayed progress of the CLARITY Act was described as a reminder that regulators still face difficulties in managing this emerging risk.

Regional Banks Face Higher Exposure

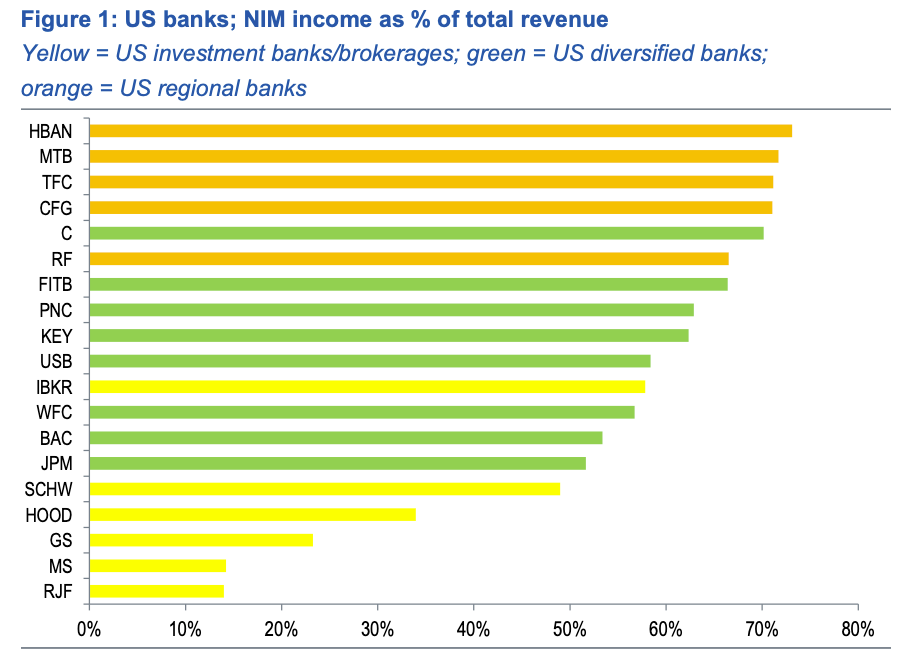

The report highlights net interest margin income as the key measure of vulnerability. This metric reflects how much profit banks earn from the difference between lending rates and deposit costs.

Since deposits are central to this income stream any large outflow could weaken profitability.

According to Kendrick regional US banks are most exposed to this threat. These institutions depend more heavily on retail deposits than diversified or investment banks.

Huntington Bancshares M T Bank Truist Financial and CFG Bank were identified as among the most vulnerable based on their reliance on deposit driven income.

By contrast large diversified banks with stronger investment operations are less dependent on deposit margins and therefore better positioned to absorb potential losses.

Stablecoin Reserves Offer Limited Support to Banks

One factor that could reduce the risk of deposit erosion is where stablecoin issuers store their reserves. If issuers kept most funds in traditional banks deposit losses could be offset.

However the report finds that this is not happening at scale.

Tether the issuer of USDT holds only around 0.02 percent of its reserves in bank deposits. Circle which issues USDC holds about 14.5 percent in bank accounts.

Most reserves are instead placed in short term government securities and money market instruments.

This means that when users move funds from banks into stablecoins the money rarely flows back into the banking system. As a result there is little natural redepositing to balance the outflow.

Kendrick concluded that current reserve practices provide minimal protection for banks against deposit drain.

Global Demand Patterns Shape the Impact

The scale of deposit losses also depends on where stablecoins are being used. Domestic demand directly reduces local bank deposits while foreign demand has little immediate effect on domestic systems.

Standard Chartered estimates that around two thirds of stablecoin demand currently comes from emerging markets. Only about one third originates in developed economies.

If the stablecoin market reaches a projected value of two trillion dollars by 2028 the consequences could be significant.

The report suggests that about 500 billion dollars could leave banks in developed markets. Meanwhile around one trillion dollars may exit banking systems in emerging economies.

These shifts could reshape financial landscapes particularly in countries where banking systems are already fragile or underdeveloped.

Regulation and Future Risks

Despite current delays Standard Chartered expects the CLARITY Act to be passed by the end of the first quarter of 2026. The legislation aims to create a regulatory framework for stablecoins including restrictions on interest payments.

Supporters argue that this could reduce competition with bank deposits. Critics say it may limit innovation in digital finance.

Some industry leaders have dismissed fears of stablecoin driven bank runs. Circle chief executive Jeremy Allaire recently described such concerns as exaggerated.

However Kendrick maintains that risks remain substantial. He also warned that stablecoins are not the only source of pressure. The expansion of tokenised real world assets and other blockchain based financial products could further weaken traditional banking models.

The report concludes that banks regulators and policymakers must prepare for structural changes in how people store and move money. Without effective oversight stablecoins could accelerate the shift away from conventional deposits and challenge financial stability in the coming years.

Leave a Reply