Fresh Bitcoin Buy Marks New Year Move

Strategy, the world’s largest corporate holder of Bitcoin, has kicked off 2026 with a fresh crypto purchase even as it disclosed a massive unrealized loss from the final quarter of last year. The company revealed in a Monday filing with the US Securities and Exchange Commission that it acquired 1,283 Bitcoin for approximately $116 million, marking its first buy of the new year.

With this addition, Strategy’s total Bitcoin holdings have climbed to 673,783 BTC. At current market prices, those holdings are valued at around $62.6 billion. The company’s average purchase price across all its Bitcoin now stands at roughly $75,026 per coin.

The latest acquisition was funded through the sale of MSTR shares under Strategy’s at-the-market offering program. The Bitcoin was bought at an average price of about $90,000 per coin, according to the filing.

Cash Reserves Strengthened Alongside BTC Holdings

Along with expanding its Bitcoin position, Strategy has also shored up its cash reserves. Michael Saylor, the company’s co-founder and executive chairman, said in a post on X that Strategy increased its US dollar reserves by $62 million, taking the total cash balance to $2.25 billion.

Saylor noted that these reserves are earmarked for meeting obligations such as dividend payments, servicing preferred stock, and covering interest on outstanding debt. The move suggests the company is focused on maintaining liquidity while continuing its long-term Bitcoin accumulation strategy.

The latest Bitcoin buy follows a significant boost to Strategy’s cash position late last year. On Dec. 22, the company reported adding nearly $747.8 million in net proceeds to its reserves through the sale of common stock.

Smaller Purchase Compared With 2025 Mega Buys

While the $116 million purchase is larger than the $108 million Bitcoin buy announced the previous week, it is modest when compared to some of Strategy’s major acquisitions in 2025.

Data from SaylorTracker.com shows that Strategy made its two largest Bitcoin purchases last year on March 31 and July 29. On March 31, the company acquired 22,049 BTC for $1.92 billion. This was followed by another major buy of 21,021 BTC for $2.46 billion in late July.

Those large-scale investments cemented Strategy’s position as the most aggressive corporate buyer of Bitcoin globally, a stance it continues to defend despite growing scrutiny and market volatility.

Q4 Paper Loss Highlights Bitcoin Price Swings

The upbeat start to 2026 comes against the backdrop of a challenging fourth quarter in 2025. Strategy reported an unrealized loss of $17.4 billion on its Bitcoin holdings during Q4, largely due to a sharp drop in Bitcoin prices toward the end of the year.

Market data shows that Bitcoin fell more than 23 percent during the quarter, dragging down the paper value of Strategy’s vast holdings. The loss is unrealized, meaning the company has not sold the Bitcoin and therefore has not locked in the decline.

The SEC filing also disclosed a related deferred tax benefit of about $5 billion. This reflects a potential future reduction in Strategy’s income tax liabilities tied to the unrealized losses.

Despite the headline figure, Strategy has consistently argued that short-term price fluctuations are less relevant to its long-term Bitcoin thesis, which treats the asset as a core treasury reserve rather than a trading position.

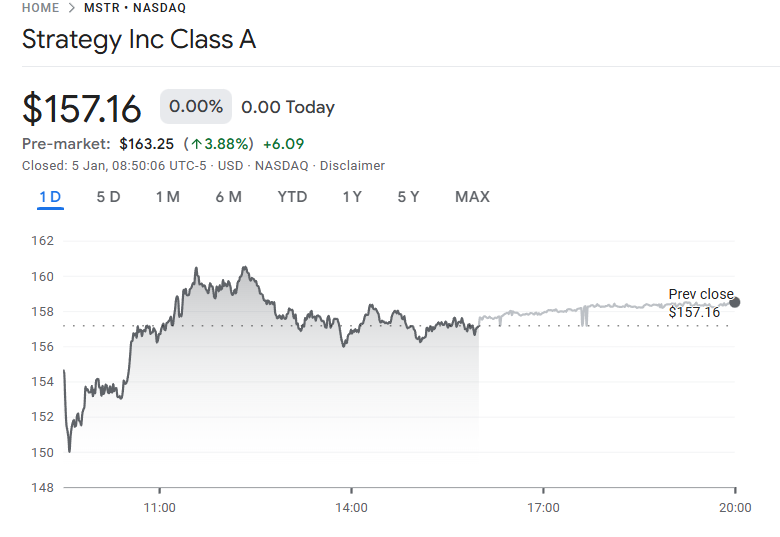

Market Reaction and Wider Corporate Influence

Investor reaction to the news was mixed. Strategy’s stock rose 3.88 percent in pre-market trading on Monday, climbing above $157. However, the shares remain under pressure overall, down more than 58 percent over the past year, according to Google Finance data.

Concerns around Strategy’s Bitcoin-heavy balance sheet continue to divide investors, particularly during periods of sharp crypto price corrections. Still, the company’s approach has had a visible impact across global markets.

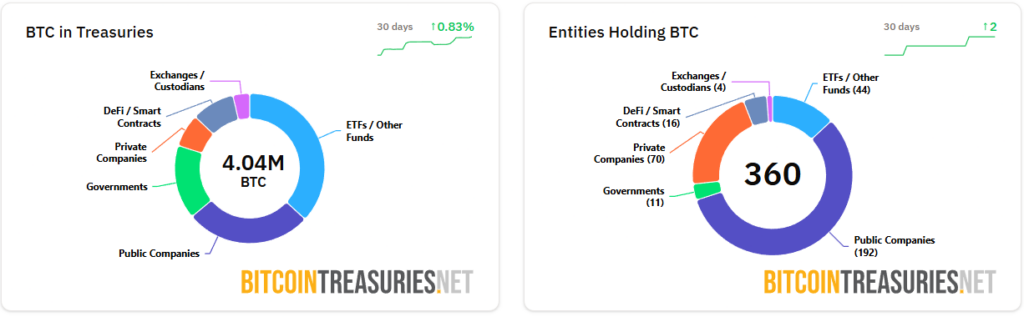

Inspired by Strategy’s model, several public companies have adopted Bitcoin-focused treasury strategies. One notable example is Japanese investment firm Metaplanet, which has grown into the fourth-largest public Bitcoin holder. Metaplanet now holds 35,102 BTC, valued at approximately $3.25 billion.

Collectively, public companies now hold about 1.09 million Bitcoin, representing roughly 5.21 percent of the total supply, according to data from Bitcointreasuries. Strategy alone accounts for a significant share of that total, underscoring its outsized influence on corporate Bitcoin adoption.

As 2026 begins, Strategy’s latest purchase signals that the company remains committed to its Bitcoin-first strategy, even in the face of large paper losses and ongoing market skepticism.

Leave a Reply