MicroStrategy is facing a high-profile class action lawsuit following a staggering $5.9 billion unrealised Bitcoin loss. The legal complaint, filed in the Eastern District of Virginia (Docket No. 25-cv-00861), accuses the company and its executives of deceiving shareholders and manipulating crypto-related stock valuations.

At the heart of the lawsuit is Michael Saylor, co-founder and Executive Chairman of Strategy, whose bold Bitcoin investment strategy has now turned into a legal liability. Investors allege that Strategy downplayed significant crypto risks, misled markets, and violated federal securities laws.

Unrealised Losses Spark Lawsuit

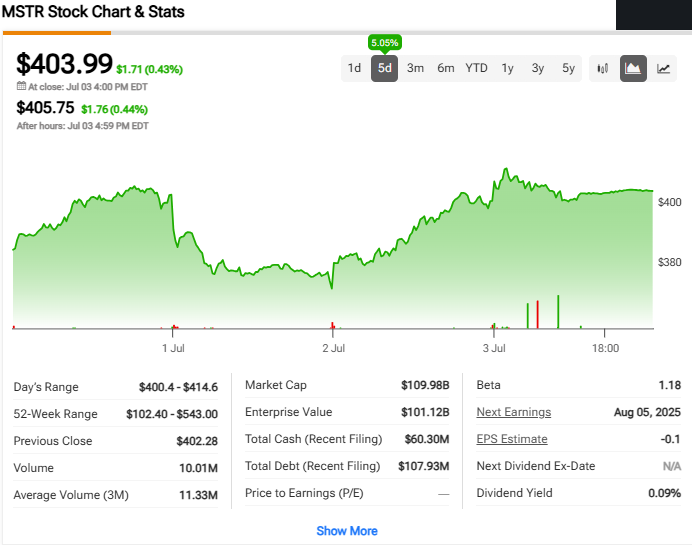

On April 7, 2025, Strategy disclosed an eye-watering $5.91 billion unrealised Bitcoin loss under new accounting standards (ASU 2023-08). This shock announcement sent Strategy’s stock (MSTR) plunging by $25.47, or 8.67%, to $268.14, triggering immediate concern among shareholders.

The loss stemmed from updated rules requiring fair value reporting of digital assets, including unrealised gains and losses, in quarterly earnings. Effective from January 1, 2025, the new standards forced Strategy to disclose volatile crypto fluctuations more transparently, exposing how damaging Bitcoin’s price swings could be to its bottom line.

Strategy admitted the challenge, stating:

“We may not be able to regain profitability in future periods, particularly if we incur significant unrealised losses related to our digital assets.”

This marked one of the most significant corporate Bitcoin-related losses in recent memory and sparked investor outrage.

Stock Fraud & Crypto Manipulation Allegations

The lawsuit alleges that Strategy misled investors by overstating its profitability and underplaying the risks tied to its Bitcoin holdings. According to the complaint, the company focused on selective metrics such as “BTC Yield” and “BTC Gain,” promoting a narrative of continuous crypto-driven growth while omitting critical risk disclosures.

These omissions, the plaintiffs argue, constituted material misrepresentations. Investors who purchased securities between 30 April 2024 and 4 April 2025 claim they were unaware of the extent to which Bitcoin volatility and new accounting rules could impact financial performance.

Furthermore, the complaint accuses Strategy of crypto stock manipulation, highlighting that executives issued optimistic assessments without addressing how the fair value accounting standard could result in substantial losses.

This pattern of selective disclosure, the lawsuit suggests, misled shareholders into believing Strategy’s Bitcoin-centric strategy was safer and more profitable than it actually was.

Investor Deadline & Regulatory Implications

Investors have until 15 July 2025 to apply as lead plaintiffs in the Strategy class action lawsuit. Legal experts suggest this case could set a major precedent in how crypto-exposed companies are required to communicate financial risks to shareholders.

With regulatory and accounting frameworks around digital assets still evolving, this lawsuit arrives at a pivotal moment. The fair value accounting rule (ASU 2023-08) now forces firms to present a more realistic and often more volatile, picture of crypto asset holdings.

Should the plaintiffs prevail, the outcome may reshape the way publicly traded companies report digital assets and influence how the SEC monitors corporate crypto disclosures.

A Cautionary Tale for Corporate Crypto Exposure

Michael Saylor has long championed Bitcoin as a corporate treasury asset. While that strategy brought short-term headlines and hype, Strategy’s recent $5.9 billion loss and now this lawsuit underscores the dangers of riding the crypto rollercoaster without transparent risk management.

For investors, regulators, and crypto companies alike, the Strategy case serves as a powerful reminder: as crypto moves deeper into traditional finance, accountability and full disclosure aren’t optional.

Leave a Reply