The Sui network endured a turbulent Q1 2025, with its market capitalization plunging by 40.3% to $7.2 billion, a sharper decline compared to the broader crypto market’s 18.2% contraction. Despite this downturn, Sui climbed to 13th in market cap rankings, a testament to its underlying resilience amidst challenging conditions.

Fee Generation Declines Amid Market Pressure

Sui’s fee generation mirrored its price trends, with total fees dropping 33.3% quarter-on-quarter to $3.6 million. This decline was attributed to the reduced price of SUI tokens and diminished user activity, leading to a 44.4% decrease in fees denominated in SUI.

Despite these challenges, Sui upheld its hallmark of affordability, maintaining an average transaction fee of $0.0087. Sponsored transactions played a crucial role in usability and developer retention, accounting for over 23% of the network’s total.

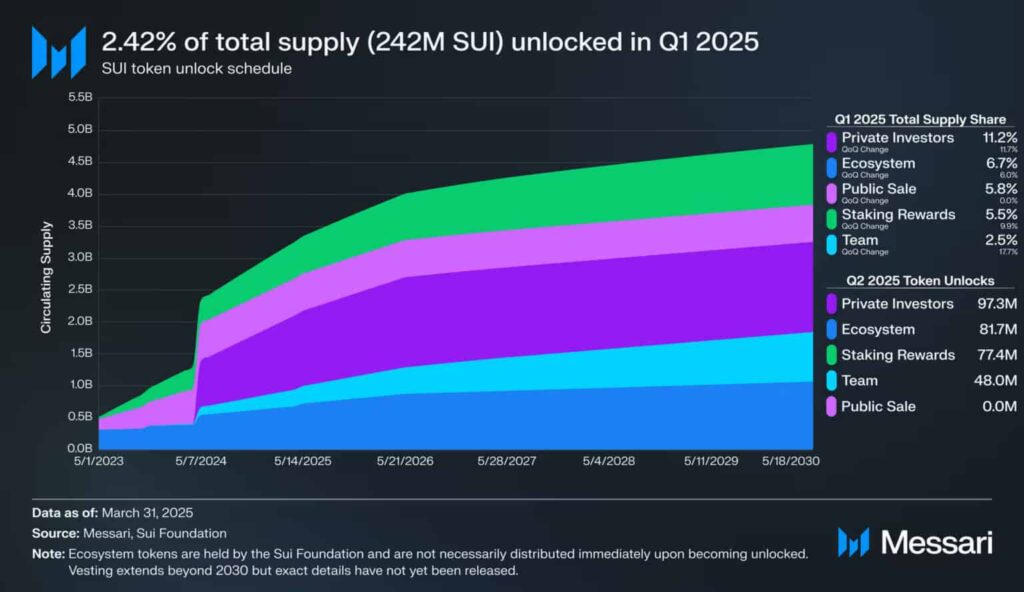

Token Unlocks Drive Inflation

One of the most significant contributors to Sui’s market struggles was its Q1 token unlocks, which released 242.5 million tokens into circulation. These distributions were allocated to early contributors, investors, and community reserves. While the unlocked tokens represented only 2.42% of the total supply, their $549.9 million valuation exerted tangible market pressure.

By quarter-end, 77.3% of the network’s eligible supply remained staked, showcasing strong community support. However, the introduction of liquid staking for locked tokens nudged annualized real yields into negative territory at -0.14%, reflecting inflationary trends and limited returns.

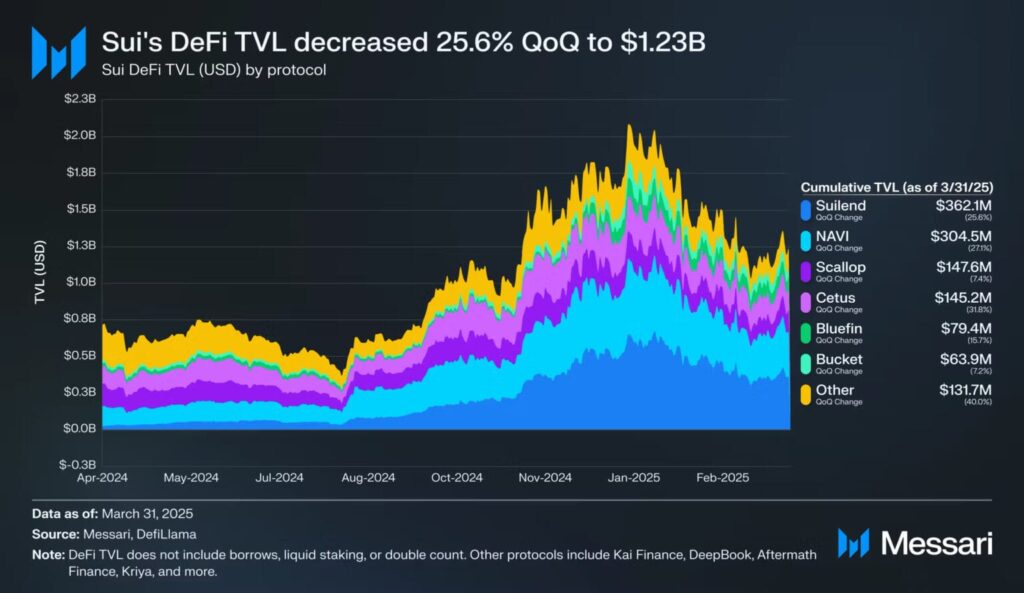

Sui’s DeFi Landscape: Challenges and Innovations

Sui’s DeFi ecosystem weathered significant contractions, yet its evolution continued unabated. Lending protocol Suilend retained its leadership position, closing the quarter with $362.1 million in total value locked (TVL), a 25.6% decline. Its market share stood at an impressive 29.3%, supported by the launch of STEAMM, a superfluid automated market maker (AMM) designed to optimize capital efficiency by utilizing LP assets across lending and swaps.

NAVI, another key DeFi player, recorded $304.5 million in TVL, maintaining a 24.7% market share. The protocol underwent rebranding to Astros and expanded swap functionalities via Mayan Finance. Meanwhile, Scallop bolstered its ecosystem with multicurrency support and major exchange listings, ending the quarter with $147.6 million in TVL and surpassing $300 million in swap volumes.

Record DEX Activity Drives Network Growth

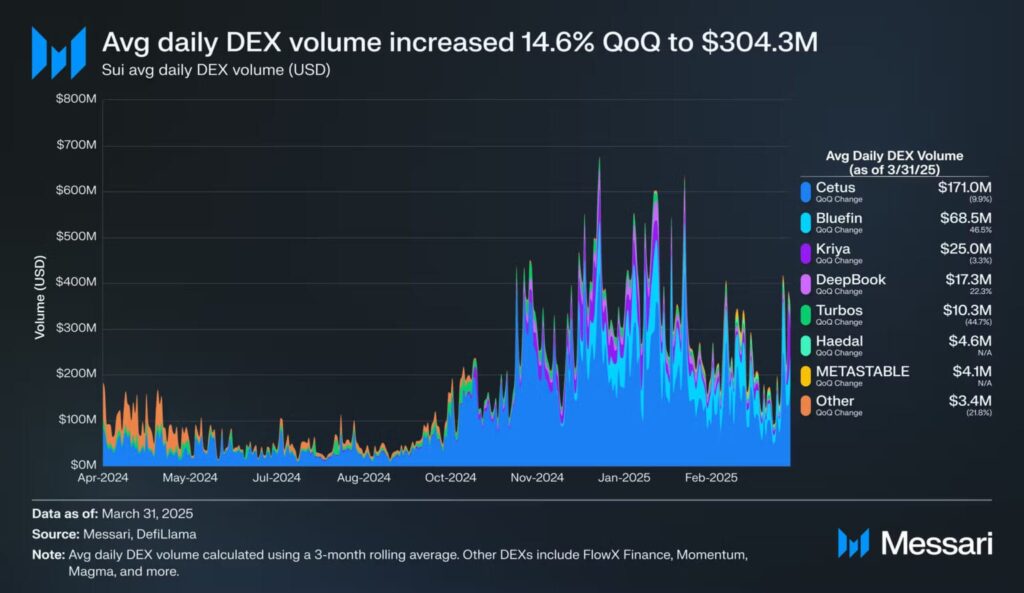

Decentralized exchange (DEX) activity was a standout highlight for Sui in Q1 2025, with daily average volumes reaching $304.3 million, a 14.6% increase from the previous quarter. Cetus and Bluefin led the surge, generating $171 million and $68.5 million in daily volumes, respectively. Other active DEXs like Kriya, DeepBook, and Turbos contributed to the network’s expanding trading infrastructure.

The robust DEX performance underscored Sui’s strong transaction throughput and its commitment to fostering a thriving DeFi ecosystem.

Leave a Reply