Switzerland has officially taken a major step toward crypto transparency on the global stage. On June 6, 2025, the Swiss Federal Council announced the adoption of a bill enabling the automatic exchange of crypto asset information with 74 partner countries. This ambitious regulation is set to come into effect in January 2026, with the first data exchange scheduled for 2027.

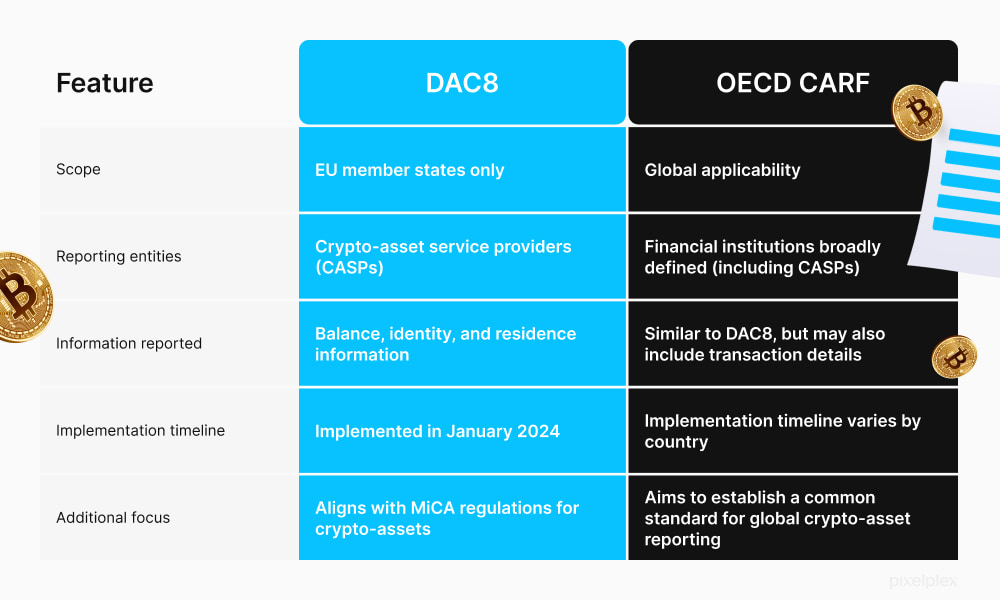

This move marks Switzerland’s alignment with the OECD’s Crypto-Asset Reporting Framework (CARF), a global standard designed to tackle cross-border tax evasion and ensure consistent reporting of crypto transactions.

A New Chapter in Global Crypto Transparency

The newly approved bill brings crypto-assets under the same international scrutiny as traditional financial assets. Once implemented, Switzerland will share crypto-related data automatically with selected international partners, provided they also agree to reciprocate and comply with the CARF framework.

The Crypto-Asset Reporting Framework, developed by the Organisation for Economic Co-operation and Development (OECD), requires Crypto-Asset Service Providers (CASPs)—such as exchanges and wallet operators—to collect and report users’ tax residency data, including taxpayer identification numbers (TINs).

These providers will need to file annual reports covering:

- Conversions between crypto and fiat currencies

- Exchanges between different crypto-assets

- Transfers of crypto-assets between accounts or wallets

Who’s In, Who’s Out

While Switzerland has not revealed the complete list of participating countries, the Council confirmed that all EU member states, the United Kingdom, and most G20 nations are included.

However, some notable absentees are drawing attention. The United States, China, and Saudi Arabia will not be part of the agreement, at least initially. A post from the official Swiss government account on X (formerly Twitter) made it clear that these jurisdictions will not receive crypto asset data from Switzerland.

This exclusion is significant, particularly given the size and influence of the U.S. and China in global crypto markets. It may reflect broader geopolitical tensions or a lack of reciprocal agreements on crypto transparency.

Conditional Sharing: A Two-Way Street

A crucial detail of the bill is that information sharing is not unconditional. Switzerland will only exchange data with countries that:

- Agree to reciprocate by sharing their own crypto data.

- Comply with the OECD’s CARF standards.

- Maintain compliance with reporting obligations over time.

The Swiss Federal Council has also committed to reviewing partner countries periodically to ensure continued adherence to the agreed standards before any actual data exchange occurs. This adds an additional layer of regulatory assurance to the automatic exchange system.

Implications for the Global Crypto Ecosystem

Switzerland, traditionally known for its strong privacy laws and status as a global financial hub, is now positioning itself at the forefront of regulated crypto transparency. The decision reflects growing international pressure on jurisdictions to close loopholes that allow crypto to be used for tax evasion and illicit finance.

This move is likely to have ripple effects across other crypto-friendly nations, especially those still assessing their positions on the OECD’s framework. It also sends a strong signal to Crypto-Asset Service Providers operating in Switzerland: compliance and transparency will become non-negotiable starting 2026.

Switzerland’s latest crypto bill signals a paradigm shift in how crypto assets are treated in international finance. By agreeing to share data with 74 countries under the OECD’s framework, Switzerland is not only complying with global transparency standards but also reinforcing its commitment to fair and regulated crypto usage. The exclusion of countries like the U.S. and China may raise eyebrows, but the move sets a precedent that could shape the future of global crypto regulation.

Leave a Reply