Speculation about a potential Tether IPO has resurfaced following comments by BitMEX co-founder Arthur Hayes and reports of a private fundraising effort that could value the stablecoin issuer at half a trillion dollars. If confirmed, the deal would place Tether among the world’s most valuable private companies, alongside the likes of OpenAI, SpaceX and Coca-Cola.

Hayes Fans the IPO Flames

Arthur Hayes, the outspoken former CEO of BitMEX, sparked fresh debate by suggesting that a Tether public offering could mark the end for Circle, the issuer of rival stablecoin USDC. In a post responding to Circle’s oversubscribed IPO, Hayes quipped:

“Next up a US IPO. Bye bye Circle.”

His comments coincided with reports that Tether is in discussions with investors to raise as much as $20 billion at a valuation of around $500 billion. If realised, this would put the company well ahead of Circle, which currently sits at a market capitalisation of about $35 billion.

The scale of the proposed valuation has raised eyebrows. Market analysts noted earlier this year that such a figure would make Tether the 19th most valuable company globally, outpacing many household names.

Tether’s Record-Breaking Profitability

While Tether lacks the mainstream profile of OpenAI or SpaceX, its financial results speak for themselves. The company generated $4.9 billion in profit in the second quarter of 2025 alone, bringing year-to-date earnings to $5.7 billion. Of this, $3.1 billion was recurring income derived from yields on reserve assets.

This profitability makes Tether one of the most lucrative companies globally on a per-employee basis. In contrast, Circle’s reliance on a revenue-sharing agreement with Coinbase significantly reduces its margins, making it far less profitable despite USDC’s sizeable market share.

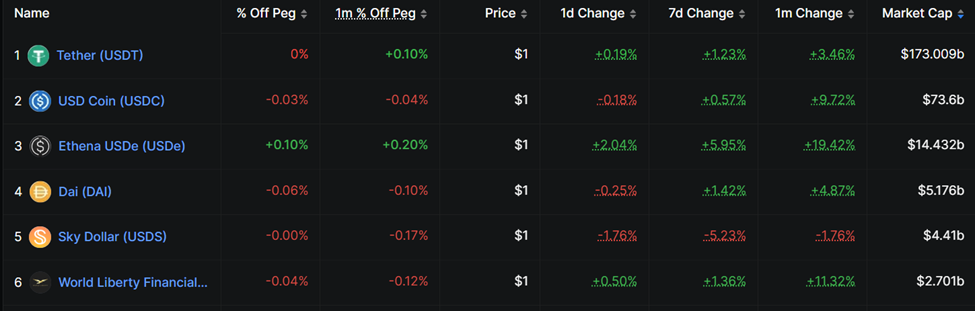

Tether’s USDT currently dominates the stablecoin market with a circulating value of $172.8 billion, more than double USDC’s $73.6 billion, giving it around 56% of global market share.

IPO or Opportunistic Raise?

Despite the IPO speculation, Tether’s leadership has sent mixed signals. CEO Paolo Ardoino recently confirmed that the company is exploring raising capital from high-profile investors, but he previously dismissed any intention to go public, stating confidence in its private structure.

Bloomberg reported that Tether may look to raise between $15 billion and $20 billion via a private placement, with Cantor Fitzgerald advising on the deal. The raise could involve selling a 3% stake, though sources cautioned that the final figure could be far lower, given that talks remain preliminary.

Some analysts view the fundraising as opportunistic, timed to leverage Tether’s record profits and market dominance while interest rates remain high. Global macro investor Raoul Pal posed the question:

“…what happens if yields fall back to 2%?”

This highlights a key risk for Tether, which derives a significant portion of its profits from interest income on reserves.

Comparing Tether and Circle

The contrast between Tether and Circle underscores why Hayes believes a Tether IPO could overshadow its rival. Circle’s IPO was highly anticipated and oversubscribed, but its $33 billion market value is dwarfed by Tether’s projected $500 billion.

Circle also depends heavily on Coinbase for distributing USDC at scale, which reduces its profitability. By comparison, Tether distributes USDT directly across global markets, retaining all associated profits.

According to Hayes, any investment in a stablecoin issuer must be evaluated on distribution capabilities, an area where Tether’s independence gives it a decisive edge.

The Bigger Picture: Stablecoins in Global Finance

Beyond corporate rivalries, the broader stablecoin market continues to expand rapidly. Stablecoins now represent a $307 billion sector, serving as a low-cost, efficient tool for transferring value and accessing blockchain applications.

Regulatory momentum is also building. In the US, the recently passed GENIUS stablecoin bill aims to strengthen the dollar’s role in the digital economy by setting clear rules for issuers. Against this backdrop, both Tether and Circle are well positioned to benefit from rising adoption.

Yet, questions remain about transparency and trust. While Tether’s profitability is undisputed, critics continue to demand clearer disclosures about its reserves and investments. For now, the company’s staggering profits and dominant market share may outweigh these concerns for investors.

Outlook

Whether Tether pursues an IPO or opts for a large-scale private raise, its potential $500 billion valuation signals just how central stablecoins have become in global finance. A successful raise could rank Tether among the most valuable companies worldwide, further cementing its dominance over Circle.

Still, uncertainties linger. Profitability tied to high yields may not last indefinitely and the company faces persistent scrutiny over transparency. But if Tether does move towards a listing or even a partial spin-off into a regulated US entity, as some suggest, it could mark one of the most significant milestones yet in the convergence of traditional markets and digital assets.

Leave a Reply