The global stablecoin market is undergoing a historic expansion in 2025 and Tether, the sector’s largest player, is positioning itself at the forefront. According to reports, Tether is exploring a funding round of up to $20 billion that could value the company at a staggering $500 billion. If successful, the valuation would place the stablecoin issuer alongside the world’s most valuable private firms, cementing its influence over the future of digital finance.

The company, whose flagship token USDT now boasts a circulating supply exceeding $170 billion, intends to use the fresh capital to diversify beyond its stablecoin business. Tether has already secured a reputation as one of the most profitable firms in the cryptocurrency industry, supported by its vast US Treasury holdings and expanding Bitcoin reserves. In the second quarter of 2025, Tether reported $4.9 billion in net income, up 277% compared with the same period last year.

The funding round is reportedly being advised by Cantor Fitzgerald, a current shareholder in Tether. Investor interest is also intensifying, with Japanese investment powerhouse SoftBank and Cathie Wood’s ARK Invest among the institutions said to be circling the deal. Their interest reflects a growing belief among institutional investors that stablecoins have moved beyond being niche crypto products to becoming essential infrastructure for global finance.

Stablecoin Adoption Surges Globally

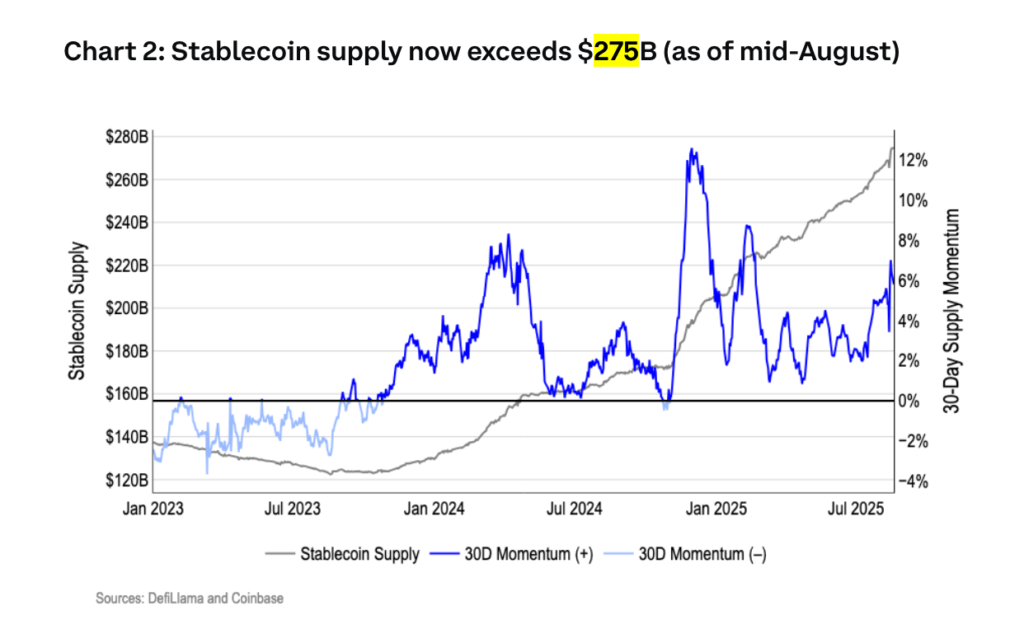

The appeal of stablecoins lies in their utility. In 2025, the sector has entered what many analysts call an “inflection point”, as institutions embrace dollar- and euro-backed tokens for purposes ranging from cross-border payments to treasury management. Coinbase’s August report highlights that the total capitalisation of the stablecoin market has soared past $275 billion, with projections suggesting it could reach $1 trillion by 2028.

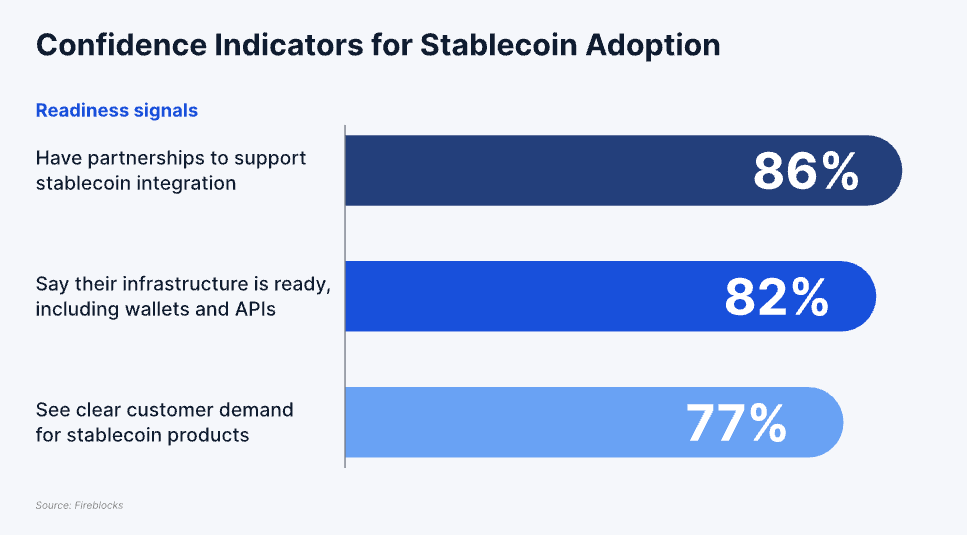

This growth is not only driven by crypto-native firms but also by global enterprises and banks. Stablecoins are now used in more than 43% of B2B transactions across Southeast Asia, providing faster and cheaper settlement than traditional systems. A survey by Fireblocks revealed that 90% of institutions are actively integrating stablecoins into their operations this year, demonstrating a clear shift in corporate adoption.

Europe is moving quickly to secure its position. Nine major banks, including ING, UniCredit and Danske Bank, have teamed up to launch a euro-denominated stablecoin compliant with the EU’s Markets in Crypto-Assets (MiCA) regulation. In parallel, fintech firm Finastra has partnered with Circle, the issuer of USDC, to weave stablecoin functionality into conventional bank payment flows.

Asia’s “Two-Track Strategy”

The trend is even more pronounced in Asia, where financial institutions are actively preparing for what some are calling the “stablecoin era.” South Korea, in particular, is taking a dual approach: building domestic digital currency products while simultaneously engaging with established global issuers.

At least eight major Korean banks, including KB Kookmin Bank and Shinhan Bank, are forming a consortium to co-issue a won-backed stablecoin. These banks are also establishing internal task forces to run proof-of-concept trials for real-world settlements using tokenised currencies. At the same time, they are holding direct discussions with foreign players such as Circle, laying the groundwork for interoperability between domestic and international stablecoin systems.

This dual approach ensures that Korean banks will not only be able to service local demand but also maintain competitiveness in cross-border payments, a market segment where stablecoins are proving particularly disruptive.

Financial Risks and Regulatory Challenges

Despite the bullish outlook, warnings are emerging about the risks that widespread stablecoin adoption could pose to financial stability. A new report from Moody’s Ratings highlights that the number of global cryptocurrency users surged to 562 million in 2024, up 33% year-on-year. Much of this growth has come from emerging markets in Southeast Asia, Africa and Latin America, where citizens use stablecoins for inflation hedging, remittances and financial inclusion.

However, analysts warn that as stablecoins take market share from traditional banking products, they could undermine central banks’ ability to control monetary policy. This phenomenon, often referred to as “cryptoisation,” raises the prospect of reduced central bank influence over interest rates and exchange rate stability. Banks may also face deposit erosion as savers move funds into stablecoin wallets, potentially leading to liquidity crises.

Regulatory frameworks remain inconsistent worldwide. Advanced economies are moving towards tighter rules, with Europe implementing MiCA, the US enacting the GENIUS Act and Singapore adopting a tiered approach to oversight. But fewer than one-third of countries have full-spectrum regulation in place, leaving many emerging economies vulnerable to risks associated with underregulated reserves and potential liquidity runs.

Outlook: Promise and Peril

The rise of Tether and the broader stablecoin market marks a turning point for global finance. Institutional money is flowing in at an unprecedented pace, transforming stablecoins from speculative instruments into mainstream financial tools. At the same time, regulatory clarity is beginning to catch up, albeit unevenly across jurisdictions.

For Tether, the proposed $500 billion valuation would represent a remarkable leap, reflecting both its dominance in the market and its ambition to expand beyond its core USDT business. Yet the sector’s rapid growth also highlights significant vulnerabilities, particularly for central banks and traditional lenders facing structural disruption.

As the world edges closer to a trillion-dollar stablecoin market, the balance between innovation and regulation will determine whether this transformation strengthens or destabilises the global financial system.

Leave a Reply