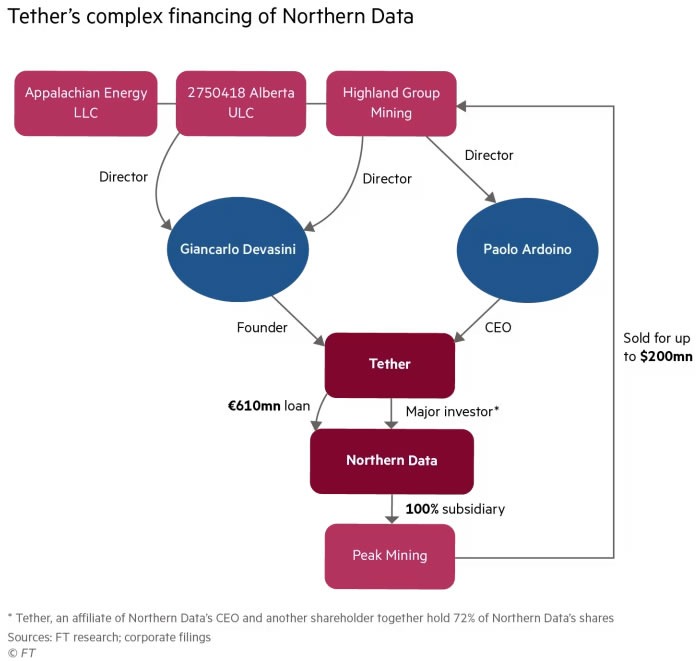

Northern Data, a data centre operator majority owned by stablecoin issuer Tether, has sold its Bitcoin mining business to companies controlled by senior Tether executives, according to a report by the Financial Times. The mining unit, known as Peak Mining, was sold for a price of up to $200 million.

The buyers are Highland Group Mining, Appalachian Energy and an Alberta based company. These entities are linked to Giancarlo Devasini, Tether co founder and chair, and Paolo Ardoino, the company’s chief executive. Corporate filings cited in the report indicate that Devasini and Ardoino serve as directors of Highland Group Mining, while Devasini is the sole director of the Alberta based firm. The ownership and management of Appalachian Energy, which is registered in Delaware, remain unclear.

Disclosure came months after initial announcement

Northern Data first announced the divestment of Peak Mining in November. At the time, the company did not disclose the identities of the buyers. German regulatory rules did not require the company to name them, which allowed the transaction to proceed without public detail.

The sale was completed shortly before video sharing platform Rumble agreed to acquire Northern Data. Tether holds close to a 50 percent stake in Rumble, adding another layer to the already complex financial relationship between the companies involved.

Second attempt after earlier deal collapsed

This transaction marks the second attempt by Northern Data to sell its Bitcoin mining arm to an entity linked to Devasini. In August, the company announced a $235 million sale of Peak Mining to Elektron Energy, a firm also controlled by Devasini. That agreement later collapsed following whistleblower allegations, according to the Financial Times.

Northern Data is currently under investigation by European prosecutors over suspected tax fraud. Its offices were reportedly raided in September as part of the inquiry. The company has not publicly commented in detail on the investigation.

Interlinked loans and Rumble acquisition

Financial ties between Tether, Northern Data and Rumble extend beyond ownership stakes. Northern Data has an outstanding loan of approximately 610 million euros, equivalent to about $715 million, provided by Tether.

As part of the Rumble acquisition, Tether is set to receive roughly half of the remaining loan balance in the form of Rumble shares. The remainder will be settled through a new loan from Tether to Rumble, which will be secured against Northern Data’s assets, according to the report.

Separately, Tether has agreed to a $100 million advertising deal with Rumble. It also plans to purchase $150 million worth of GPU services from the platform as it expands its activities in Bitcoin mining and artificial intelligence related infrastructure.

Tether expands beyond stablecoins

Tether continues to dominate the global stablecoin market, holding an estimated 60 percent share with around $187 billion worth of USDT in circulation. In recent years, the company has increasingly diversified its interests beyond digital tokens.

Alongside investments in Bitcoin mining, data centres and AI infrastructure, Tether has shown interest in media platforms and professional sports. On December 12, the company launched a $1.1 billion bid to acquire Italian football club Juventus. The offer was ultimately rejected by the club’s owners.

The sale of Peak Mining highlights the growing web of financial and corporate links surrounding Tether as it broadens its reach beyond its core stablecoin business.

Leave a Reply