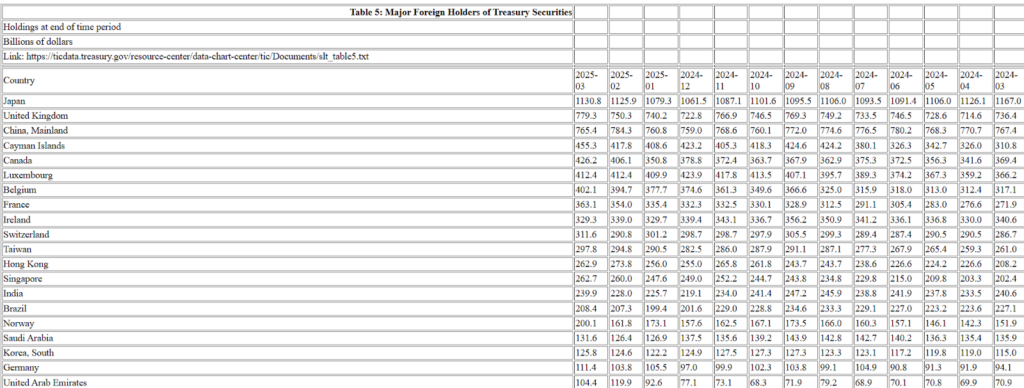

Tether, the issuer of the world’s largest stablecoin USDt (USDT), has surpassed Germany’s holdings of United States Treasury bills, marking a significant milestone in the company’s conservative reserve strategy. With over $120 billion in US Treasurys, Tether now ranks as the 19th largest holder globally—outpacing several major economies.

Tether Outpaces Germany with $120 Billion in Treasurys

According to Tether’s attestation report for Q1 2025, the stablecoin firm has surpassed $120 billion in US Treasury bill investments, eclipsing Germany’s $111.4 billion in holdings, as reported by the US Department of the Treasury. This development highlights Tether’s expanding influence not only in the cryptocurrency ecosystem but also in traditional financial markets.

“This milestone not only reinforces the company’s conservative reserve management strategy but also highlights Tether’s growing role in distributing dollar-denominated liquidity at scale,” the report stated.

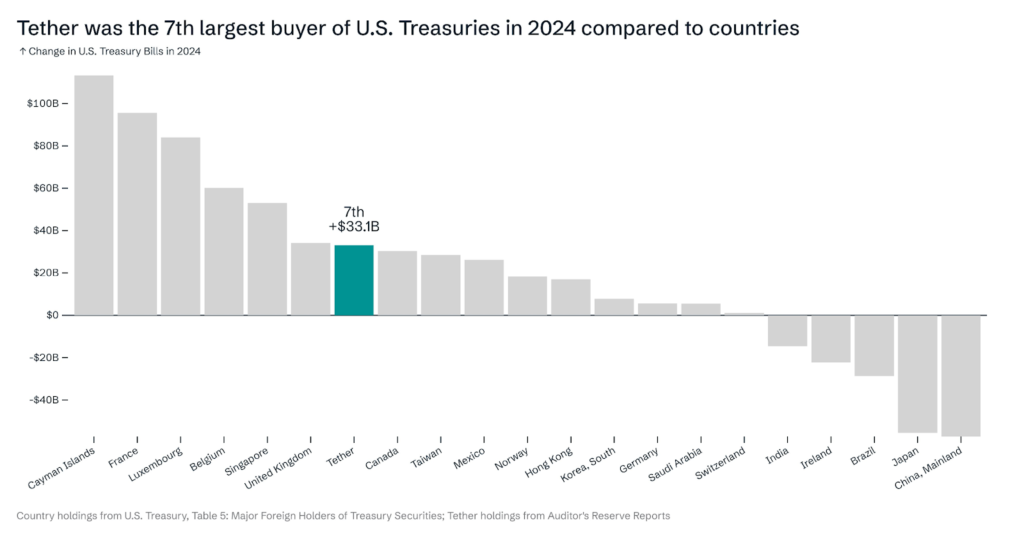

Tether has now entered the ranks of the world’s top 20 Treasury holders, just behind sovereign nations, showcasing the scale at which the stablecoin operates. In 2024, Tether was the seventh-largest buyer of US Treasurys globally, overtaking countries such as Canada, Taiwan, Mexico, Norway, and Hong Kong.

Reserves Strategy Shields Against Crypto Volatility

The first quarter of 2025 presented turbulent conditions for the crypto market, but Tether managed to weather the storm thanks to its diverse reserve portfolio. The company reported over $1 billion in operating profits from its traditional investments, driven primarily by the solid performance of its Treasury holdings.

Tether’s investment in gold also contributed to this stability. While crypto markets experienced volatility, gold returns helped offset potential losses, allowing the company to maintain financial strength and credibility among investors and users.

“Tether’s Treasury and gold portfolio almost offset the impact of crypto market downturns,” the firm noted, underlining the importance of diversification in its reserve strategy.

Stablecoin Regulations Take Centre Stage in the US

Tether’s growing dominance comes amid increasing regulatory focus on stablecoins in the United States. Two key legislative efforts are currently underway, which could further impact how firms like Tether operate and invest.

The Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act, aimed at enforcing stricter reserve and transparency requirements for stablecoin issuers, passed the House Financial Services Committee on April 2 by a 32–17 vote. The bill is now awaiting scheduling for a full debate and vote in the House of Representatives.

The second proposal, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, has faced setbacks. It failed to gain sufficient Democratic support and stalled on May 8, partly due to concerns over former President Donald Trump’s potential financial interests in the crypto sector, given his family’s involvement in digital assets.

Crypto Industry Mobilises for Regulation Clarity

Despite the setback for the GENIUS Act, the crypto industry continues to push for clear and supportive regulation. On May 14, at least 60 top crypto founders convened in Washington, DC, to advocate for the GENIUS Act, which aims to create robust collateralisation standards for stablecoins and enforce Anti-Money Laundering compliance.

Industry leaders argue that regulatory clarity will not only benefit innovation but also enhance consumer protection and financial stability. As US lawmakers continue to debate the future of stablecoin legislation, firms like Tether are closely monitoring developments that could influence investment strategies and market dynamics.

Tether’s Growing Role in Global Liquidity

With its massive US Treasury holdings, Tether is playing an increasingly significant role in distributing dollar-denominated liquidity across the global financial system. Its reserve diversification strategy, including exposure to gold and government securities, sets a benchmark for other stablecoin issuers navigating a volatile crypto landscape.

As regulation looms and markets evolve, Tether’s blend of traditional financial assets and digital innovation positions it as a pivotal player at the intersection of global finance and blockchain technology.

Leave a Reply