Ethereum has faced selling pressure after failing to break past the $3,400 level, but market data continues to suggest that the broader trend remains constructive. Ether has slipped around 7 percent from last week’s highs and is now hovering near key support levels. Still, a combination of rising staking demand, renewed institutional interest and strong technical support indicates that ETH could be setting up for a sustained recovery in the weeks ahead, as long as buyers defend the $3,100 zone.

Staking demand hits multi year highs

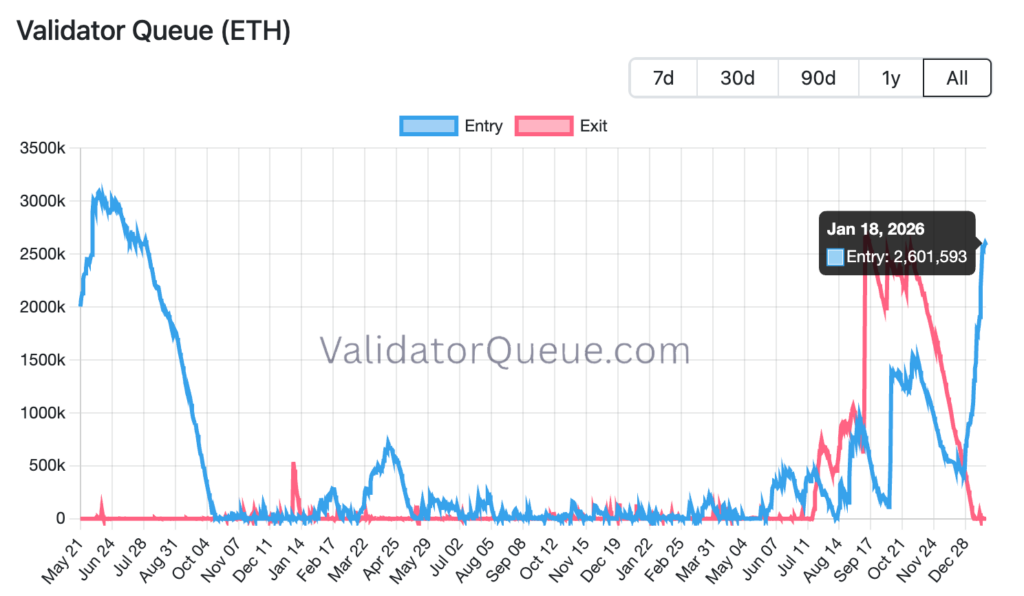

One of the strongest signals supporting Ethereum’s price outlook is the sharp rise in staking activity. The network’s validator entry queue has climbed above 2.6 million ETH, valued at roughly $8.3 billion at current prices. New validators now face an estimated wait time of 44 days before they can begin staking, the longest delay seen since mid 2023.

According to data from ValidatorQueue, Ethereum currently has close to 979,000 active validators. Around 29.76 percent of the total ETH supply, or approximately 36.1 million ETH, is now locked in staking. Market analysts have highlighted the scale of this trend, noting that the entry queue is at its highest level in over two and a half years.

The surge in staking is tightening liquid supply, which improves Ethereum’s supply demand balance. At the same time, the validator exit queue has dropped to zero, suggesting that very few stakers are choosing to leave the network. This reduction in potential selling pressure has reinforced confidence in Ethereum’s yield driven model.

Historically, similar conditions have preceded strong price moves. Analysts point out that the last time Ethereum’s exit queue was cleared, the asset went on to post a sharp rally in the following months, ultimately pushing prices to new highs.

Institutional accumulation regains momentum

Beyond retail participation, Ethereum is also seeing renewed interest from institutional investors and corporate treasury holders. Data from Capriole Investments shows that combined ETH holdings across strategic reserves and exchange traded funds have increased by about 10 percent since late November 2025. Total holdings now stand at over 12.2 million ETH, up from roughly 11.6 million ETH.

These entities collectively control nearly 9.72 percent of Ethereum’s total supply, valued at around $40 billion. The steady accumulation highlights a growing concentration of ETH in long term institutional hands. Many of these players actively stake their holdings to earn additional yield, which may partly explain the sharp expansion in the validator entry queue seen over recent weeks.

Among corporate holders, BitMine Immersion Technologies, chaired by Tom Lee, continues to stand out. The company added nearly 187,000 ETH to its staking address last week, worth about $625 million. This brings its total staked holdings to more than 1.53 million ETH, equivalent to roughly 4 percent of all ETH currently staked on the Beacon Chain.

Ethereum ETFs return to inflows

Spot Ethereum exchange traded funds have also shown signs of recovery after a brief period of outflows earlier this month. According to data from SoSoValue, ETH ETFs recorded inflows on every trading day last week, attracting a combined $479 million.

This followed a three day stretch between Jan. 7 and Jan. 9 when these products saw net outflows totaling $351 million. The return to consistent inflows suggests that investor confidence is stabilizing and that demand for regulated Ethereum exposure remains intact above the $3,000 level.

ETF buying plays a key role in absorbing market supply, particularly during periods of price consolidation. When combined with rising staking activity, it strengthens the argument that a significant portion of ETH is being taken off the market and held for longer term strategies.

The $3,100 support remains the line in the sand

From a technical perspective, Ethereum’s ability to hold above $3,100 is critical. Onchain cost basis data shows that investors accumulated around 3.27 million ETH in the $3,100 to $3,170 range. This creates a dense support zone where many holders are likely to defend their positions.

Analysts also point to the 21 day simple moving average, currently aligned near $3,170, as an important level for maintaining bullish structure. Recent price action shows that ETH has respected this moving average, reinforcing its role as near term support.

Market commentators argue that as long as Ethereum stays above the broader $3,050 to $3,170 demand zone, the path remains open for a renewed push higher. A sustained hold in this area could provide the base needed for a move back toward $3,400 and potentially beyond $4,000 if momentum builds.

Outlook remains constructive despite volatility

While short term volatility cannot be ruled out, the broader data continues to favor Ethereum bulls. Strong staking demand is reducing available supply, institutional and ETF accumulation is picking up again, and technical support around $3,100 remains intact.

If buyers continue to defend this level, Ethereum appears well positioned to resume its uptrend in the coming weeks. For now, the $3,000 mark stands as a key psychological and technical floor that keeps the bullish case firmly in play.

Leave a Reply