Crypto Investment Products Face Heavy Outflows

Crypto investment products witnessed their largest weekly outflows since February, with CoinShares reporting a staggering two billion dollars leaving the market last week. This marks the third consecutive week of withdrawals, bringing total outflows to three point two billion dollars. James Butterfill, head of research at CoinShares, linked the trend to uncertainty around monetary policy combined with selling pressure from crypto-native whales.

Assets under management in crypto ETPs have now fallen to one hundred ninety one billion dollars, a notable decline from their peak of two hundred sixty four billion dollars in October. The United States contributed ninety seven percent of last week’s outflows at one point nine seven billion dollars. Germany stood out as the only major market with inflows, attracting thirteen point two million dollars.

Other regions followed the global retreat. Switzerland recorded thirty nine point nine million dollars in outflows. Sweden saw twenty one point three million dollars exit. Hong Kong, Canada and Australia experienced combined outflows of twenty three point nine million dollars. Bitcoin and Ether ETPs bore the brunt of this downturn, with Bitcoin products alone losing nearly one point four billion dollars, roughly two percent of their total AUM.

Bitcoin Slips to Year’s Lowest Level

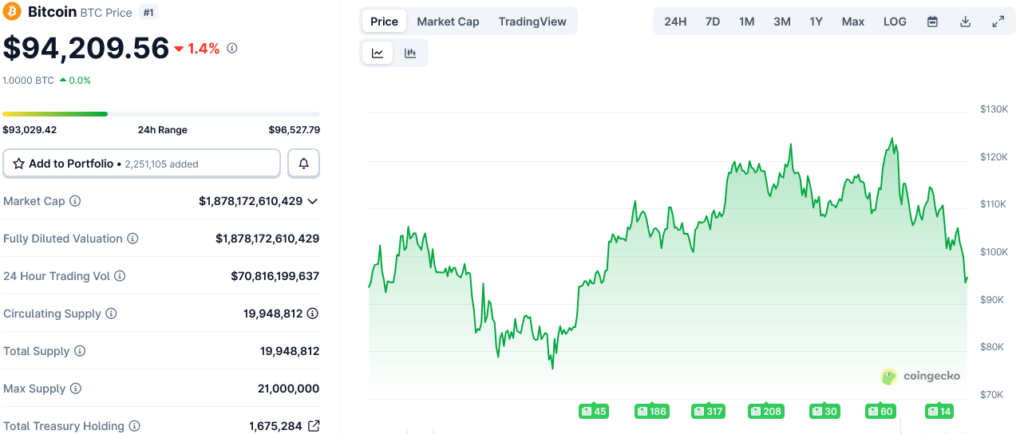

Bitcoin briefly erased all its gains for the year after a sharp weekend downturn. The flagship cryptocurrency fell to ninety three thousand and twenty nine dollars on Sunday, its lowest level of the year and twenty five percent below its October all-time high. Bitcoin opened the year at ninety three thousand five hundred and seven dollars. It has since recovered slightly to hover around ninety four thousand two hundred dollars according to CoinGecko.

Optimism had been strong earlier this year due to the formation of a pro-crypto administration under US President Donald Trump. Regulatory progress and a surge in corporate Bitcoin adoption as part of treasury strategies pushed markets upward through early 2025.

Yet Trump’s tariff battles and the prolonged US government shutdown, which only ended on Thursday after forty three days, triggered repeated market corrections. These factors contributed to a series of double-digit declines in Bitcoin’s price over recent months.

Zcash Rally Reignites Privacy Coin Debate

Zcash delivered one of the weekend’s more dramatic moves as it briefly surged above seven hundred dollars before retreating to the mid-six hundred range. The sharp rise, part of a rally that has seen ZEC climb more than one thousand percent in two months, fuelled a heated discussion between supporters of privacy coins and Bitcoin maximalists.

Bitwise CEO Hunter Horsley commented on X that the “Bitcoin only” community would struggle to dismiss Zcash, prompting swift pushback from Bitcoin advocates. Investor Dale Edward argued that although trading ZEC may be profitable, it does not rival Bitcoin’s legitimacy.

Zcash proponents countered strongly. Mert Mumtaz, CEO of Helius, argued that criticisms of the protocol often stem from exaggerated assumptions rather than technical shortcomings. The renewed attention on Zcash has revived broader conversations around privacy, decentralisation and the evolving role of alternative blockchains in a Bitcoin-dominant landscape.

Market Sentiment Remains Fragile

The combination of geopolitical uncertainty, policy turbulence and shifting investor sentiment continues to weigh on the crypto market. Heavy ETP outflows and Bitcoin’s pullback reflect a cautious stance among institutional participants. Meanwhile, dramatic price swings in alternative assets like Zcash highlight the contrasting levels of volatility across the sector.

As regulators, investors and industry participants navigate an unsettled macroeconomic environment, market direction in the coming weeks is likely to hinge on policy clarity and the sustainability of recent institutional interest in digital assets.

Leave a Reply