The cryptocurrency market saw major developments today, from record-breaking fund inflows to a potential shake-up in traditional banking, and a delisting controversy in the DeFi space. Here’s a look at the top stories shaping the digital asset landscape.

Crypto Funds Record Historic $5.95 Billion Inflows

Cryptocurrency investment products have seen their biggest-ever weekly inflows, reaching $5.95 billion amid growing concerns over a possible US government shutdown. According to CoinShares, the week ending Friday marked the strongest period for global crypto exchange-traded products (ETPs) since records began.

James Butterfill, head of research at CoinShares, said the surge was “a delayed reaction to the Federal Open Market Committee’s recent rate cut, compounded by weak employment data and instability fears surrounding the government shutdown.”

The rally pushed Bitcoin (BTC) to a new historic high of $125,000 on Saturday. This inflow surpassed the previous record of $4.4 billion from July by 35 percent.

Bitcoin dominated the week’s activity, attracting $3.6 billion of inflows, while Ether (ETH) funds brought in $1.48 billion. The latter pushed total year-to-date inflows for Ether to $13.7 billion, nearly triple last year’s figure.

Solana (SOL) also gained momentum with $706.5 million, followed by XRP (XRP) at $219.4 million, both setting new records. Butterfill added that despite the surge in prices, investors showed little interest in short products, suggesting strong long-term confidence.

GENIUS Act May Redefine Traditional Banking

The recently enacted stablecoin-focused GENIUS Act could mark a turning point for traditional banks, according to Tushar Jain, co-founder and managing partner at Multicoin Capital.

“The GENIUS Bill signals the beginning of the end for banks’ ability to profit from low-yield deposits,” Jain wrote on X. He predicted that major technology firms such as Meta, Google and Apple will soon compete directly with banks by offering stablecoin-based accounts with higher yields and seamless user experiences.

Jain argued that the GENIUS Act would push deposits away from traditional institutions into stablecoins offering better returns and faster settlement. He added that banks had already appealed to regulators to close a perceived “loophole” allowing stablecoin issuers to offer interest-bearing products through affiliates.

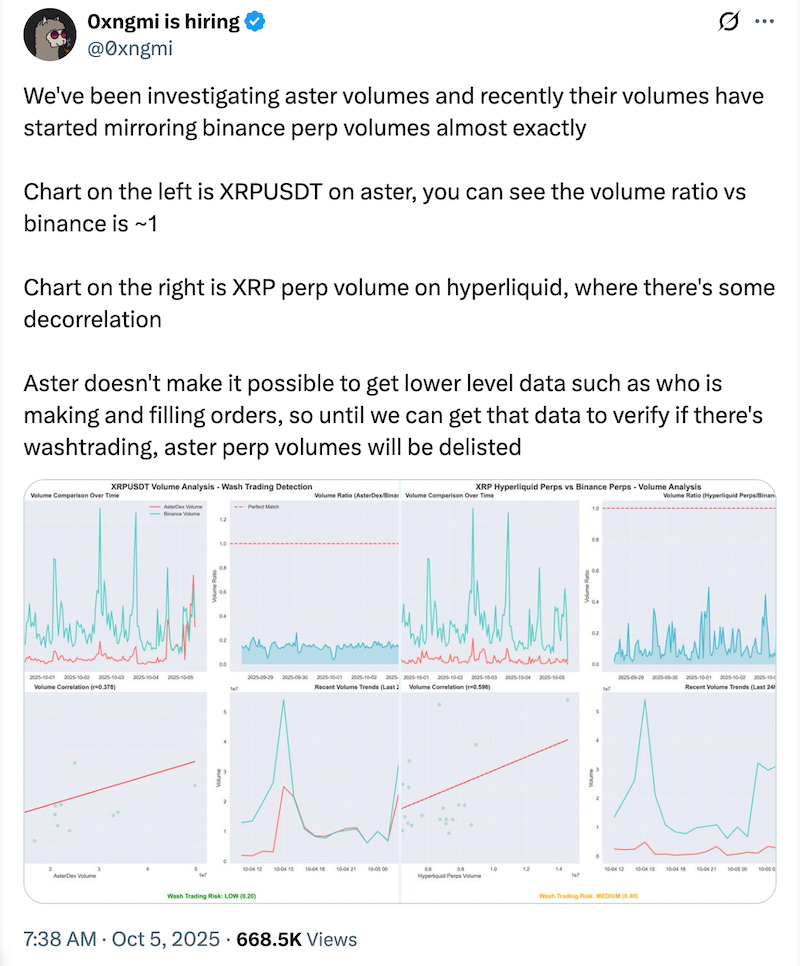

DefiLlama Delists Aster Trading Data Over Accuracy Concerns

In the world of decentralised finance, DefiLlama announced the delisting of perpetual futures trading volume data for Aster DEX due to integrity concerns.

The pseudonymous co-founder of DefiLlama, 0xngmi, stated that Aster’s reported trading volume appeared suspiciously close to that of Binance’s perpetual futures market, with a near-perfect correlation between the two. “Aster does not provide granular trade data, such as who is placing or filling orders, so until that information is available, we will delist their perpetual volumes,” 0xngmi explained.

The decision sparked debate within the DeFi community, as Aster has been gaining attention as a potential rival to Hyperliquid, one of the leading perpetual futures platforms. Aster’s association with Binance co-founder CZ has further fuelled speculation about its rapid rise in trading volumes.

Bitcoin Maintains Market Leadership

Bitcoin remains the clear leader among digital assets, accounting for the majority of recent fund inflows. Analysts say that the renewed investor interest reflects growing belief in Bitcoin as a hedge against economic uncertainty and government instability.

With its market dominance reinforced by the latest figures, Bitcoin continues to set the tone for the broader cryptocurrency ecosystem.

Outlook: Optimism Amid Regulatory Shifts

The past week’s developments highlight both the resilience and volatility of the crypto market. Record-breaking inflows point to sustained institutional interest, while the GENIUS Act could reshape the relationship between banks and blockchain-based finance.

Meanwhile, the scrutiny of Aster’s trading data underscores the ongoing challenges of transparency in decentralised platforms. As regulation and technology continue to evolve, investors and analysts alike are watching closely to see how these forces shape the next phase of digital finance.

Leave a Reply